Executive Summary

Manappuram is India’s second-largest gold loan company. They have been lending for more than two decades and have earned the trust of their borrowers.

Gold loan business is a highly lucrative business as demonstrated by the following:

- Major gold loan companies enjoy high margins – NIM (Net Interest Margin) of 10%+

- Major gold loan companies enjoy high returns on capital as well as high returns on overall assets – they have an average ROA (Return on Assets) of 3%+ and ROE (Return on Equity) of 15%+.

Headwinds

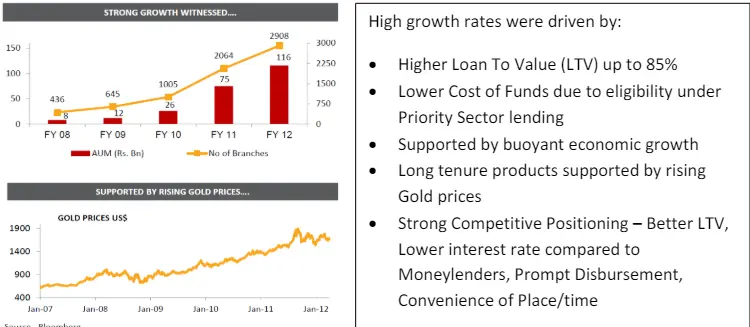

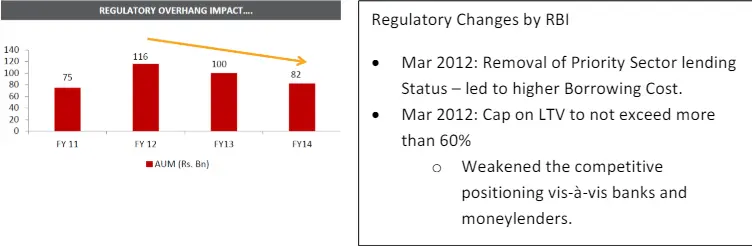

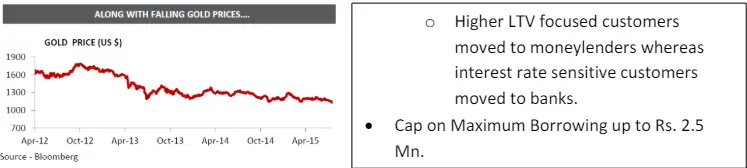

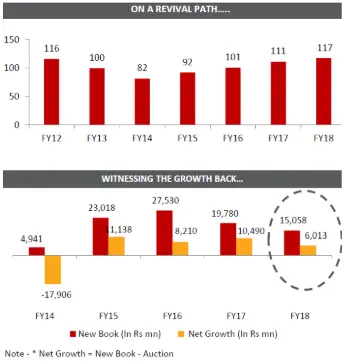

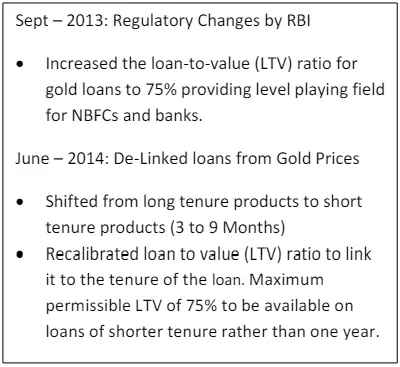

The two big Gold loan companies grew very well till FY 2012. A series of regulatory changes in CY 2012, distress in the rural economy, and a drop in gold prices impacted their growth between FY 2012 and FY 2015. As they were recovering from the setbacks, demonetization in CY 2016 created another setback.

The road ahead

The Indian government is focusing on doubling the rural income by 2022. The expected increase in buying power is expected to drive growth in the gold loan market for the foreseeable future.

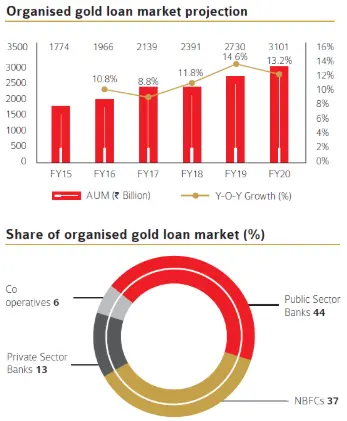

It is estimated that the organized (tax-paying) gold loan segment is only 30-40% of the total gold loan business. The remaining segment is dominated by local moneylenders and pawnbrokers who charge much higher interest rates. With digitization, better information availability, and broader coverage we expect that organized players will continue to take away market share from the unorganized players.

New growth engines

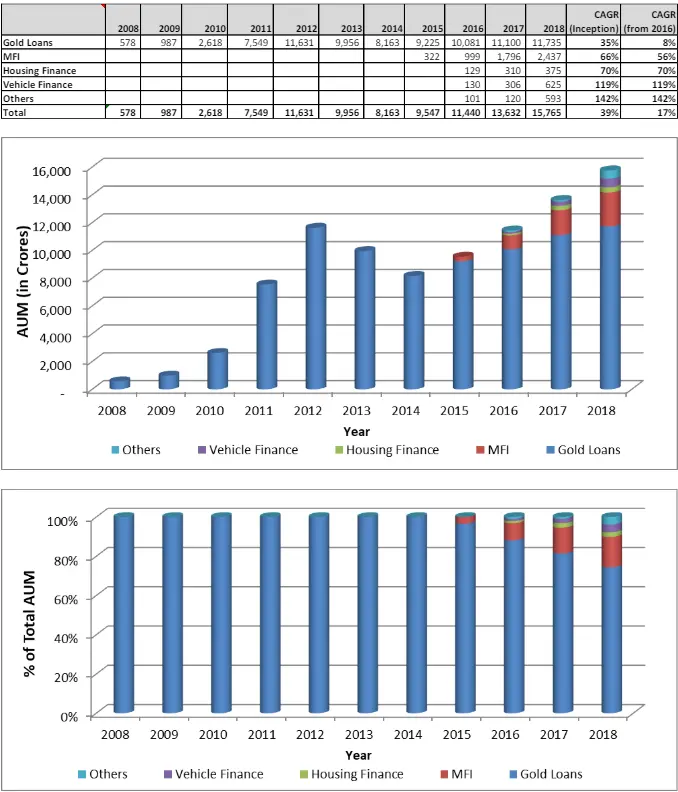

In FY 15 Manappuram started its journey of identifying additional businesses which can enable it to better leverage and expand its customer segment. the company has focused on the following additional businesses:

- Housing finance with customers in mid-to-low income group

- Vehicle Financing

- Microfinance using a collateral-free, joint liability model

These new businesses have scaled up well and now (FY 18) contribute as much as 26% of its total AUM.

It is expected that these businesses will continue to grow at a fast pace thus enabling Manappuram to grow its overall AUM and profitability at a CAGR of 15% over the foreseeable future.

Management

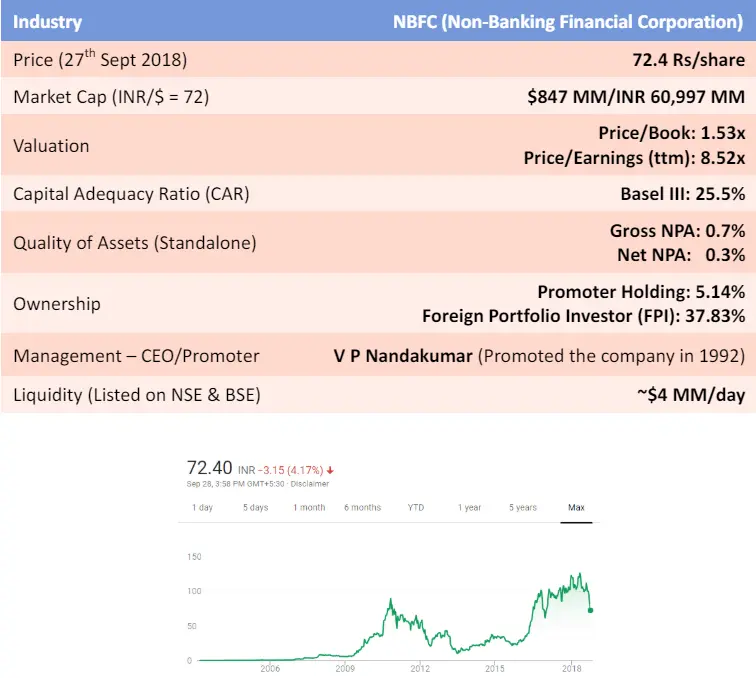

Manappuram is headed by V P Nandakumar – MD & CEO of the company. Mr. Nandakumar started the company in 1992 and the company was listed on the stock exchange in 1995. Over the last 23 years (since the company has been listed), it has delivered a CAGR of 27% to its investor v/s 11% provided by Sensex.

Read moreV P Nandakumar owns 35.14% (after recent buying) of the company. Over the last few weeks, he has buying shares in his account at an aggressive pace from the stock market.

Valuation

Manappuram trades at 7-8x expected FY 19 earnings and 1.53x book value (Q1 FY 19). This is for a business that has a good return on capital (ROE of 17.5% and ROA of 3.9% in FY 18) and is expected to grow at a CAGR of 15% over the foreseeable future.

Management seems to agree that it is cheap. In the last 6 months, the CEO and his relatives have bought 4.3 Million shares at different times from the market at around 88.7 Rs/share. In the last 6 months, a major financial institution – Quinag Acquisition has bought 27.3 Million shares at 105.3/share and increased its stake from 6.61% to 9.94%.

Basic Facts

Company Background

Manappuram’s origins go back to 1949 when it was founded by the late V.C. Padmanabhan, father of Mr. Nandakumar. In those days its activity was money lending carried out on a modest scale at Valapad. Mr. Nandakumar took over the reins of this one-branch business in 1986 after his father expired.

Subsequently, V P Nandakumar promoted Manappuram in 1992. Today it is a publicly-listed entity headquartered in Thrissur, Kerala, India. It now has a Pan India presence with branches across 28 states and 4 Union Territories of India.

The best way to understand Manappuram’s evolution is to break down its recent history into multiple phases.

Phase 1: FY 2008 – 2012

The company’s financial and operational metrics were completely transformed with:

- AUM CAGR of ~95% over FY08 – FY12.

- Branch Network grew by 7x over FY08 – FY12.

Phase 2: FY 2012 – 2015

Company’s financial and operational metrics were hurt with:

- Fall in Gold prices and peak LTV of 85% limiting the ability to lend to borrowers.

- Negative operating leverage resulted in a fall in return ratios and profitability.

Phase 3: FY 2015 onwards

The company’s financial and operational metrics are improving with:

- Risk of loss from gold price fluctuation brought down to close to nil

- Operational efficiency and digitization helping with the margins

- AUM growth picks up as the company enters into adjacent businesses (not shown in the above graphs) and they start providing meaningful contributions to the total AUM.

Business Segments

The company started entering new businesses in FY 15-16 to enhance its offering to the existing customer segment and grow into new segments. This effort has enabled the company to grow its AUM by 17% over the last two years even though the core business (Gold loan) growth has been muted at 8%.

Faster growth in alternative businesses has allowed the company to reduce dependence on the Gold loan business to 74% of the total AUM in FY 18. The company expects that new businesses will continue to grow at a fast pace over the next many years. This coupled with faster growth in the Gold loan business should enable the company to deliver 15%+ CAGR in total AUM over the foreseeable future.

Let us now look at these segments to understand the company’s operations better.

Gold Loan

Gold loan is the mainstay of the company. The company has scaled itself off the back of robust offerings in this segment.

As one of the oldest forms of secured lending, gold pawning has been prevalent in India for centuries. Given the liquidity it offers, gold helps both the borrower and lender to complete transactions faster than all other forms of financing.

The gold lending business has some unique characteristics:

- Unlike traditional lending, in the gold loan business, it is the borrower who needs to trust the lender. Thus brand (and trust) plays a big part in where the borrowers go for a loan.

- Most of the borrowers who use gold loans can’t borrow through formal channels because they don’t have regular income, proof of income, or credit history.

- It is a highly secure business. The company has estimated that in case a customer defaults, LGD (Loss Given Default) is only 0.63%.

- Gold loans have a quick turnaround time. A borrower gets a loan within 10 minutes of the time they walk into one of their branches.

There are two main categories of gold loan lenders in India:

- Formal (Organized) sector (banks, NBFCs, cooperatives) – regulated by RBI.

- Informal sector (pawnbrokers, local moneylenders) – unregulated.

As per WGC (World Gold Council) estimates informal sector accounts for 60-70% of the total gold loan market in India. We expect that the informal sector will continue to lose market share to the formal sector due to lower interest rates with better transparency and clear processes.

KPMG did a study of the gold loan market in December 2017. They expect that the organized gold loan market will have a three-year CAGR of 13.17% and will grow to INR 3,101 Bn by 2020.

Within the formal (organized) sector, banks provide gold loans at the lowest rates. However, banks are not able to compete with NBFC in terms of TAT (Turnaround Time).

In addition, many of the borrowers are borrowing small amounts which is operationally expensive for banks. For NBFC this is their core business and they have structured themselves accordingly.

manappuram’s Gold Loan Business

Gold loans are at the core of Manappuram’s operations. Manappuram identified this niche and has been able to ride it to scale up its operations

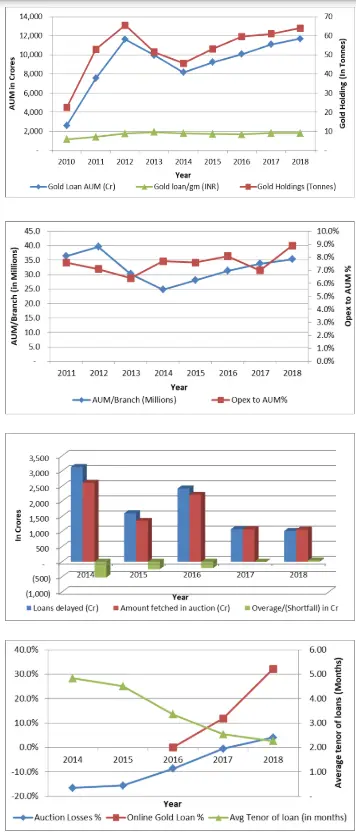

Company Gold loan AUM closely tracks the Gold jewelry deposited by its customers (tracked through Gold holdings in Tons).

The amount of loan that they are extending per gram of Gold has remained at a similar level over the last many years demonstrating a conservative approach.

The company has struggled to grow its AUM/Branch. It fell dramatically after regulatory restrictions in FY 14 and has since come back.

The company’s Opex to AUM has been stable. It went up in 2018 due to the need for higher security in its branches. The company expects to mitigate this cost by leveraging technology.

The company had to forego interest and principal for loans that were not repaid in 2014. This is reflected by the shortfall.

However, since then the company has moved to shorter tenor loans (up to 90 days). This has enabled the company to recover the amount due to them in auctions.

In 2014 average tenor of loans was close to 5 months. This impacted them as gold price fluctuated and LTV (Loan to value) was also high (85%).

The company has now moved to 3-month loans with a maximum LTV of 75%.

These initiatives are enabling the company to recover outstanding amounts due to them.

To improve operational efficiency company is moving to Online Gold loans – in these loans, customer deposits their jewelry with the company. Whenever they need money they can borrow up to a maximum pre-determined amount based on the jewelry that is kept with the company.

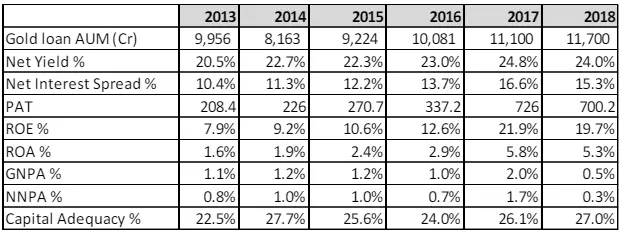

The below metrics demonstrate that Gold loans have been a great business for Manappuram with high returns on capital, low NPA, and high capital adequacy (RBI requires minimum capital adequacy of 15%). One obvious concern is that Gold loan AUM growth has been weak.

The company has initiated various new initiatives to grow the Gold loan business including:

- Providing loans directly to customer bank accounts.

- Mobile apps to enable withdrawal/payment of loans.

- Providing gold loans at customer’s doorstep

Apart from these, Online Gold loans, cross-selling across various businesses, and improvement in the rural economy are likely to drive the growth in the Gold loan business. We expect that the company can grow the Gold loan business at around 8-10% CAGR over the next many years (though the company has promised a higher growth rate).

The gold loan continues to be the crown jewel of Manappuram and is the cash cow that is enabling management to seed and grow new businesses.

Microfinance (MFI) – Asirvad

The company entered the MFI business by acquiring Asirvad Microfinance in Feb 2015 with an AUM of 322 Crs. As an established gold loan NBFC, the company had long dealt with the segment just above the bottom of the pyramid, i.e. those who possess some amount of gold. With this acquisition, they have entered an adjacent segment.

MFI caters to those at the bottom of the social pyramid by providing loans through a collateral-free, joint liability group (JLG) model. Thus, unlike gold loans, these are unsecured loans and hence have significantly higher risk.

In the MFI segment, the company gives loans with a tenor of up to 24 months for the following purposes:

- Income-generating program (IGP) loan

- Product loan

- Small and Medium enterprise (SME) loan

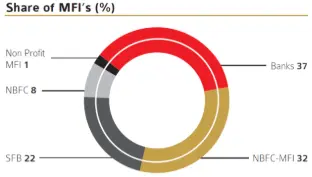

MFI industry in India is expected to be 6 Lakh Crore of which organized lenders account for 28%.

As of Dec 2017, among organized lenders, Banks hold the largest share of the portfolio in microcredit with a total loan outstanding of INR 45,649 crore.

NBFC-MFIs have a loan outstanding of INR 39,916 crore. SFBs have a total loan amount outstanding of INR 7,506 crore.

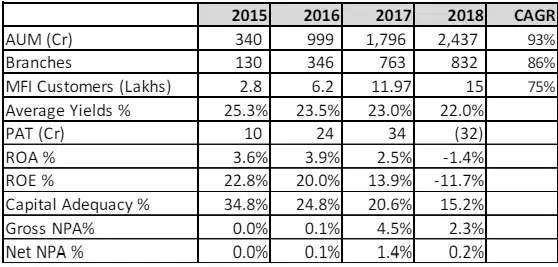

Asirvad continues to be run by its founding Managing Director, SV Raja Vaidyanathan. As a subsidiary of Manappuram, Asirvad has benefited by accessing lower-cost funds and an adequate amount of capital. This has enabled the MFI business to grow at a fast pace. It is now the 6th largest NBFC MFI in India.

In reviewing the key statistics we can conclude that:

- Asirvad has been able to grow its AUM by expanding its branches in additional states in India and reaching out to more customers in existing geographies.

- Average yields have come down as it has been able to leverage Manappuram’s parentage to borrow at a lower rate. Under MFI regulation, a company can have a maximum interest spread of 10%. Since the cost of borrowing has come down, average yields have come down as well.

- Asirvad made losses in FY 18 as the full financial impact of demonetization was reflected in the books. The company has taken higher provisions than mandated by RBI. While this action penalized their earnings in FY 18, it has helped them clean their books, and now (Q1 FY 19), Net NPA has come down to 0%.

MFI is a fast-growing industry with a long runway given the weak penetration of organized players. Besides, as new opportunities emerge many borrowers are keen to take loans and build out new businesses. Thus, the company expects to continue to grow at a fast pace for the foreseeable future. Management is expecting that the AUM of Asirvad will reach 3,500Cr by the end of FY 19.

Additional businesses

Besides MFI, the company initiated a few additional businesses in FY 15.

Vehicle Finance

The company had ventured into vehicle finance in the 2000s. However, given the fast growth of their gold loan finance, they decided to focus on gold financing. As Gold loan growth came down, the company once again started focusing on vehicle finance in FY 2015. In vehicle finance company is focusing on the following:

- Loans for new/preowned commercial vehicles and refinancing

- Financing customers who are largely from the unorganized sector and who are underserved by formal banking channels

- Minimum loans starting from INR 1 lakh

- 60-month maximum tenure

- The company is leveraging its existing gold loan branches to expand this business and hence will have to incur little expenditure in growing this business.

- The company has been able to grow its AUM very aggressively over the last few years. This is due to a combination of new branches, serving more customers from existing branches, funding more expensive vehicles, and expanding the types of vehicles on which the company is providing loans.

- In FY 17, the company commenced the financing of two-wheelers. Two-wheeler loan book has now scaled to INR 64.6 crore in FY18. The company will continue to grow the two-wheeler financing business by leveraging its existing customers in other adjacent businesses.

- As the loan book has scaled, GNPA has also grown. The company is taking active steps to ensure that the seasoning of the loan book doesn’t cause a significant deterioration in the asset quality of the book.

Housing Finance

The company provides home loans through its subsidiary – Manappuram Home Finance (MHF). MHF started its operation in January 2015. It focuses on affordable housing loans for mid-income to low-income groups mainly in tier-II, tier-III, and outskirts of metropolitan cities. The company’s primary focus is in South and West India.

The aggregate AUM of all AHFCs (Affordable Housing Finance Companies) is estimated to be INR 120,000 crore. Within this segment, large HFCs dominate the market, catering to borrowers in the formal sector who can produce documented proof of income. Excluding the top three, who collectively account for more than 90% of the market share, all other AHFCs manage less than INR 500 crore of assets, individually.

The growth rate of the housing finance industry over the last 7 years shows a CAGR of 18%. Affordable housing finance, albeit a recent entrant, promises to grow at a much higher rate.

- The company has grown its AUM quite aggressively since its start. This has also translated into high revenue growth.

- In the initial year’s company focused on expanding its branch footprint which led to higher costs and hence company has been making minor losses.

- The company has been earning reasonable yields given that it focuses on undocumented low to middle-income customers.

- Management mentioned that they slowed the growth in FY 18 to improve their processes and address the GNPA issue. Management expects GNPA to come down to 2% by the end of FY 19.

Other businesses

The company is also exploring a few new opportunities in the lending space. These include:

Corporate finance

The company is exploring lending to vendors and dealers of large, good-quality corporates. These segments are underbanked and have significant, unmet credit requirements. Many of the big lenders like PSU banks are not able to service these small companies. This is because PSU banks don’t have agile processes (they assess these companies only once a year) and they are dealing with significant NPA issues.

The company will tie up with large corporates and provide post-shipment and inventory finance products to their vendors. The company will capture the cash flows provided by these large corporations to their vendors and dealers through the escrow account. Given the comfort of the anchor corporate and other credit comforts like collaterals wherever required, these vendors and dealers would be extended finance facility by the company thus reducing risk to the company.

Micro, Small, and Medium Enterprises (MSME)

Introduce tailor-made products to meet the working capital demands of MSMEs. The average loan size for this funding will be INR 30 – 50 lakhs.

Project and Industrial finance

The company is looking to extend construction finance to ongoing projects in the affordable housing segment. Target clients will be local and mid-size developers. Exposure will be restricted to Real Estate Regulatory Authority (RERA) registered projects, which have started construction and launched sales.

The average ticket size of loans in this segment will be INR 5 – 10 crore. This offering will be launched in Maharashtra initially.

Overall

We believe that the company’s businesses can be broken into:

- Mature business: Gold loan business with low risk, high return on capital, and slow growth.

- New businesses: Microfinance, Housing, and Vehicle financing businesses. These businesses have high growth and as operating leverage kicks in, earnings growth will accelerate.

- Seed stage business: These are the businesses that are being conceptualized and tried out in the market. Based on the company’s experience in the next few years they can provide the next leg of growth.

Having looked at these businesses in-depth, we feel quite confident that the company will deliver earnings CAGR of 15%+ over the next many years.

Management

Management is a critical factor in the success of any investment. In an industry like finance, where leverage magnifies management actions, choosing the right management becomes critical.

V P Nandakumar (CEO & MD of Manappuram)

V P Nandakumar (VPN) is the CEO & MD of Manappuram. He promoted Manappuram in 1992. Before promoting Manappuram, VPN managed the money-lending business that his father started in Valapad.

Manappuram was listed on the stock exchange in 1995. Since then the company has provided a CAGR of 27% to its investors in IPO. Thus VPN has created enormous wealth for himself and his investors.

VPN currently owns 34.8% of the company. His significant ownership in Manappuram ensures that his incentives are consistent with those of his investors. More importantly, VPN has regularly bought shares from the market (and has not sold any shares). Over the last 6 months, VPN has bought 29 Lakh shares from the market at an average cost of 93.7/share.

S V Raja Vaidyanathan (MD of Asirvad – MFI)

Raja Vaidyanathan (RV) is an electrical engineer from IIT Chennai and an MBA from IIM Calcutta. RV has 30 years of experience in financial services. RV setup Asirvad in 2007. It was subsequently acquired by Manappuram in 2015.

RV is the driving force behind Asirvad – the 6th largest MFI in the country. RV has the aspiration to make Asirvad among the top three MFI in the next few years.

Overall

Management has been shareholder friendly, pays regular dividends, doesn’t reward themselves with options but rather buys from markets, and, is well grounded. They are passionate about their business and have enough skin in the game.

Valuation

We will value Manappuram using our forward return analysis framework. In this method, we will project earnings for a few years out and then apply reasonable multiples to come up with the expected forward return.

PAT projection

- The company had consolidated PAT of Rs 671 Cr in FY 18. PAT was subdued in FY 2018 since the company had taken higher provisions for bad debts in MFI to address issues due to demonetization. There was also a reduction in economic activity due to the introduction of GST.

- We expect that the company should grow PAT by 15% CAGR over the next few years (management has guided for faster growth). This will be driven by:

- Lower cost of provisions as Net NPA after Q1 FY 19 in MFI is 0%. Provisions in Gold loans are low because of low LGD.

- New businesses are growing at a much faster pace and they are becoming a meaningful amount of the total business (26% of FY 18 AUM).

- Pick-up in rural activity will drive growth in AUM.

- The company won’t need to dilute equity to support this fast growth. The company has a very high capital adequacy of 27% in FY 18 and 25.5% in Q1 FY 19. This coupled with the fact that the company generates an ROE of 17% will allow it to continue growing at 15% without any need for outside capital.

- Assuming PAT grows at 15% CAGR, we expect PAT in FY 21 to be 1,020Cr. Applying a multiple of 13x, we expect the company to be worth 13,260Cr by June 2021.

- In our mind 13x multiple is very reasonable for the following reasons:

- The company is expected to have a reasonable earnings CAGR of 15%.

- The company has a good ROE of 17%.

- The company is owner-operated and management is very passionate about the business.

- The company has a long runway ahead of it given the huge need for finance and the trend of business moving from an unorganized to an organized sector.

Expected Return

- The company’s current market cap is 6,100Cr.

- The company’s outstanding ESOP is 1.25% of the current share count. To be conservative we assume that there will be a share dilution of 2% till June 2021 due to the exercise of ESOP.

- Thus market cap of 6,222Cr (assuming 2% dilution) will grow to 13,260Cr which gives us an expected forward return of 32% CAGR.

Risks with the thesis

Apart from competition, which is always present in any industry, some of the key risks with the thesis include:

Lending business

Manappuram is in the business of lending money. Most of the surprises in lending are negative. New regulations from the regulators, black swan events like demonetization, and loan waivers by the government are some of the event risks in the thesis.

Manappuram’s lending business relies heavily on collateral. Other than MFI, we expect that the above events may slow down the growth but are unlikely to reduce profitability. So to that extent, we think the business model is quite resilient.

Unsecured lending – MFI

MFI caters to the low-income group. Loans are given without any collateral. Thus there is a risk that these borrowers are not able to service their loans and lenders will not have any recourse to get their money back.

MFI lending practices have evolved over the last decade to significantly reduce the risk of defaults in this segment. All lending is done through JLG which means that multiple people are responsible for the loan. In addition, no borrower can take more than two loans. Lastly, credit data is now available for the borrower. Hence if a borrower defaults they are cut out from the formal lending channels (with lower interest rates) for a long time. Thus borrower has a strong incentive to service the loan.

Key man risk

Manappuram has been promoted by VP Nandakumar. He is the face of the company and the force behind the business. While the next layer of management has its niches, there is no obvious successor if something were to happen to him.

Manappuram has incorporated many new businesses in the last few years. This has brought in key talent into the organization. We expect that some of these new hands will mature and can help address the succession issue.

Overall

Manappuram offers a compelling case of:

- Heads we win with an expected CAGR of 32% over the next three years.

- Tails we don’t lose much. Even, if some of the unexpected events were to materialize, given that the loan book is highly collateralized we don’t expect significant losses.

Variant View

In this section, we outline some of the reasons why Mr. Market is underpricing this company. We then provide our variant view of the same. This section has been put in the thesis to follow Charlie Munger’s dictum, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

While we don’t claim that we know the other side of the argument better than the next person, we sure as hell do try.

Trade Feasibility / Idea Practicality

The company’s market capitalization is 6,365Cr or $884Million. Manappuram is listed on both the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Additional details are provided in the table below:

Thus there is enough liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi Advisors (DDA) and its employees/partners/clients have a position in the stock discussed.

- The stock discussed was for illustration purposes only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one percent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the research report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed a public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.

- None of the employees/partners of DDA have ever served as an officer, director, or employee of the subject company.

- Neither DDA nor its employees/partners have ever been engaged in a market-making activity for the subject company.