Dear Investor / Partner

What a contrast 2018 has been from 2017. In 2017 most of the things went up – even many of the things that shouldn’t have gone up. In 2018 many things went down that shouldn’t have! It is this extreme swing of the market pendulum from greed to fear or vice-versa that we look to benefit from and provide superior long-term capital appreciation. While our year-to-year results will be all over the place over the long term (> 5 years) we hope to meet this goal.

The last few months of 2018 have shown how a small change in liquidity and psychology can translate into a much more magnified impact on the stock market. In India, the liquidity situation changed almost overnight with ILF&S (previously rated AAA) defaulting on its payment and getting downgraded to junk. On the global front, as Central banks continue to normalize interest rates and sell some of the papers that they have bought 2019 will likely continue to experience a contraction in liquidity. We will have more to say about liquidity and its consequences in subsequent sections.

While liquidity is an important factor in the smooth functioning of markets, we continue to be bottom-up stock pickers. We have been able to find some interesting ideas with reasonable entry points given the markets. Hence, these markets are not to be feared but something to be welcomed. If investors have long-horizon (which our investors have) and they are net savers (which our investors are) then these markets allow us to buy businesses at a cheaper price than what was prevailing at the beginning of the year.

Portfolio Performance

Before we present our performance, a few caveats (from last year) are in order:

- The performance provided below is what we have experienced in our portfolio. Partners will have different results based on when they started investing and what stocks they held in their portfolio.

- The performance below doesn’t tell us anything about what we will do in the future. It only tells us what we have done so far.

- We don’t present any risk-adjusted returns. The reason for the same is that we don’t like the traditional definition of risk – standard deviation, beta, etc. Hence we don’t like some of the corresponding alpha measures like Sharpe Ratio, Treynor Ratio, etc. To us, risk is the permanent loss of capital. We feel that risk can only be assessed over long periods by how the portfolio does. So, stay tuned for future results.

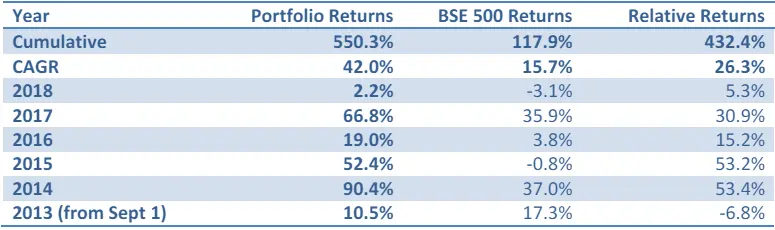

Below is the performance of our portfolio since Sept 1, 2013, when we started focusing on the Indian equity markets.

2018 has been a challenging year for us. While we did beat our benchmark of BSE 500 by a handy 5.3%, we measured ourselves by absolute returns (where we delivered 2.2%). Our investors eat absolute returns rather than relative returns and so do we (our fee structure is based on absolute returns of the portfolio).

The best way of measuring our performance is over 5 years. While we will report yearly performance, results in a corresponding year could be driven as much by luck as by competence. However, over a longer period, results are likely to be driven more by competence than by luck. On a CAGR basis (over >5 years) we continue to report fantastic numbers (42.0% CAGR). These returns, unfortunately, are unlikely to be sustained.

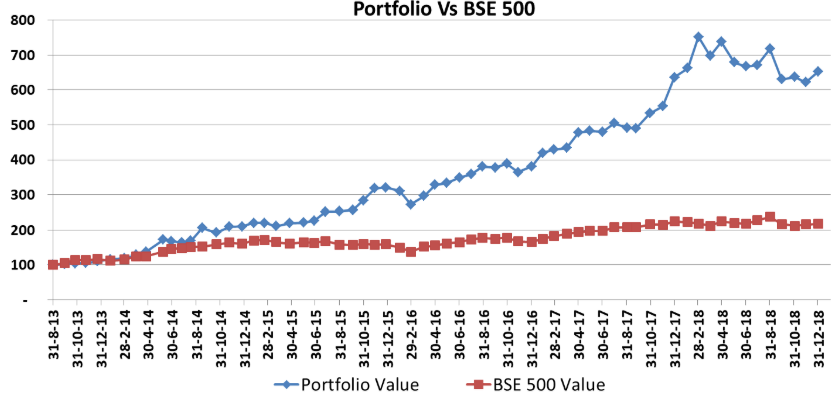

Portfolio performance has been presented in a more granular manner by looking at the monthly values of the portfolio and BSE 500. We had a great first two months of 2018 which helped save us from subsequent drawdowns that ensued. As we said last year, our experience is that gains and drawdowns in the portfolio come in chunks as we have a concentrated portfolio. We expect these chunky gains/losses to continue in the future. We proved it again this year.

Partner’s portfolio performance

Here we repeat what we said last year about our investor’s portfolio performance. Since our partners have different start dates, we will discuss your performance separately. Here we want to highlight some of the factors that drive the performance:

- Performance of our equity picks. This performance is best reflected in the performance of our portfolio mentioned earlier.

- Equity picks that clients decide to have in their portfolio.

- Weightage of these picks in their portfolio

- Price at which they bought/sold these securities.

- Subsequent behavior of the client in terms of buying/selling as the equity prices moved around.

- Cash component in their portfolio.

Key learnings of 2018

One of the reasons to write an annual letter is to list out the key learnings of the year. By writing down these learnings we have found that we retain these learnings better. We follow Charlie Munger’s dictum, “I like people admitting they were complete stupid horses’ asses. I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.”

Having sell discipline

The fundamental tenet of our investment approach is to stack rank all our opportunities by the expected return. As the markets kept increasing in late 2017/early 2018, the expected returns of many of our stocks fell to low single digits or worse. While we did sell some of these stocks we didn’t sell enough. Ideally, we should have sold the stocks much more aggressively.

Case in point is Chaman Lal Setia. We presented this case study in the 2017 Asian Investing Summit when the stock was around 100 Rs/share. In late 2017, and early 2018 we had the opportunity to sell our holdings for around 190-200/share given that the expected return was in the low single digits. While we sold a good portion of Chaman Lal, we should have sold much more. We kept inventing new reasons why we should own some of this stock.

This leads me to the next learning.

Cash should always be a residual

As an investor, we are never afraid to hold significant cash if we do not find good buying opportunities. However, when the stock goes up a lot (and hence the expected return comes down), we have realized that we don’t apply the same discipline. We didn’t sell more of Chaman Lal in 2018 because we thought we would have too much cash in our portfolio.

Key learning from 2018 is that cash on the books shouldn’t influence our buying and selling decisions. Rather it is our buying and selling decision that should determine the cash on the books.

Too much of a good thing can be wonderful

In the 2017 letter, we talked about a position which we took from being the fifth largest in 2016 to being the largest position in 2017. The position worked out phenomenally well in 2018. The position in question is Infinite Computer Solutions. We also presented a case study on Infinite in November 2017 on the Sumzero platform. The thesis can also be found on our website.

In 2018, the promoter decided to take the company private. The price discovered from reverse book building was fair and it was one of the possibilities in our thesis. Since this was the largest position in our portfolio it significantly boosted our portfolio performance.

It re-emphasizes the learning we mentioned last year – conviction in a position should reflect in its sizing. We sized the position appropriately and were amply rewarded.

Concentration vs Diversification

There is an age-old debate in the investing world about whether one should concentrate or diversify. Warren Buffett has been quite vocal on the same with his comment, “If you can identify six wonderful businesses that is all the diversification you need. And you will make a lot of money. And I can guarantee that going into a seventh one instead of putting more money into your first one is gotta be a terrible mistake.”

While we have been and continue to be highly concentrated, we have evolved our approach to this subject. We now prefer to diversify across businesses where we feel that the expected return and risk of owning those businesses are similar. This reduces the risk of over-concentration without penalizing us for the lower return.

In volatile markets, diversification gives us opportunities to move money around into the most attractive things.

Peering into the future

Many readers of the 2017 annual letter requested that we lay out our future expectations in our annual letter. At the same time, we are acutely aware of John Kenneth Galbraith’s quote, “The function of economic forecasting is to make astrology look good.”

We don’t consider ourselves to be macro forecasters. We agree wholeheartedly with Howard Marks’s recommendation, “We never know where we are going, but we should know where we are.”

This section is our attempt at understanding where we are.

Where are we now?

Below we provide charts and exhibits that address some of the top-of-the-mind issues among investors. The source of these charts/exhibits is mentioned along with them.

Exhibit 1: Most equity markets did poorly in 2018. India was among the better of the lot. Given negative returns, Cash was among the better options.

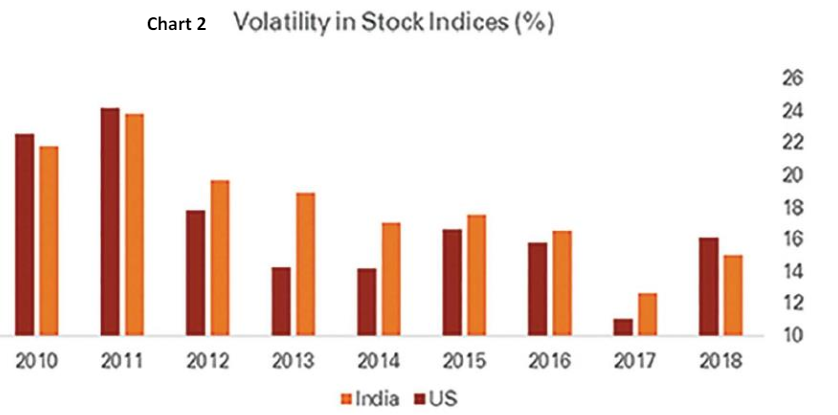

Chart 2 source is the 2019 Investment Outlook by ICICI. Volatility in 2018 in Indian and US equity returned to the historical norm. 2017 was an aberration. The volatility was much higher in the years 2010-2012 and we are well below those levels currently.

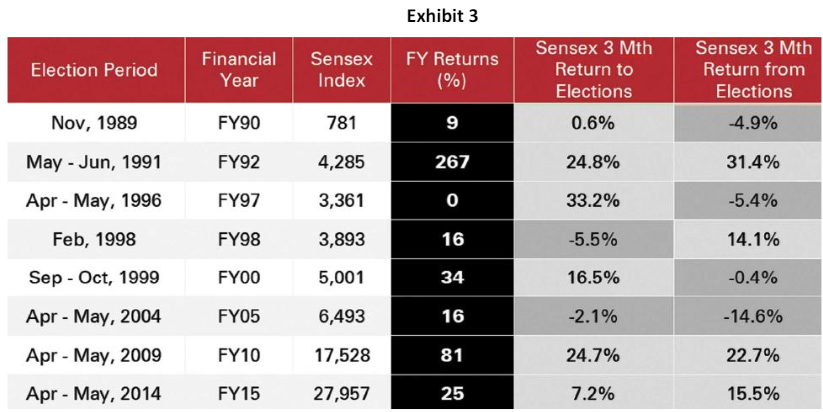

Exhibit 3 source is the 2019 Investment Outlook by ICICI. It highlights that national government election outcomes do tend to have short-term impact. However, their impact becomes muted as the time horizon lengthens.

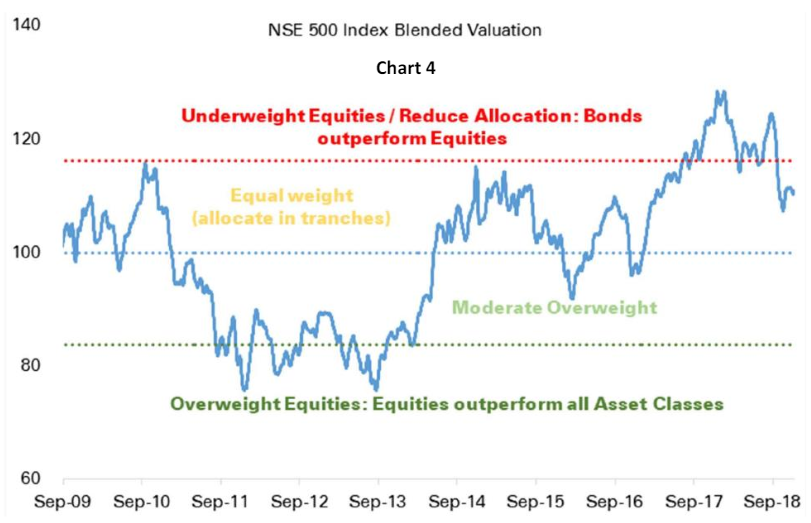

Chart 4 source is the 2019 Investment Outlook by ICICI. It clearly shows that valuations are no longer as stretched currently as they were in 2017. However, they are still above the median range.

Chart 5 source is the Economist. It illustrates that the key central banks of the world have pumped an immense amount of liquidity since 2009. For the first time in many decades, in 2019, these central banks in aggregate are expected to pull liquidity out.

What can we expect in 2019?

Below we provide some of our expectations for 2019:

- Liquidity will continue to have a significant impact on the performance of equity markets. If key central banks of the world do pull out liquidity (as is expected in the above chart), it can have a magnifying impact on the equity markets. We have seen what a small liquidity impact in India (ILF&S episode) can do to the markets. If liquidity gets pulled from developed markets it will impact fund flow into emerging markets like India and hence their stock market performance.

- Liquidity goes hand in hand with the significant debt that corporations have taken in the last decade due to low interest rates. As major central banks normalize interest rates, the cost of debt will go up in developed markets. Many of the corporates in developed markets are overleveraged and they may have a tougher time.

In the Indian context, corporates are a lot less leveraged and this deleveraging has been going on for a few years. Hence, we do expect that Indian corporates are in a much better shape to withstand tightening interest rate cycles in developed markets.

- The banking system (especially PSU Banks) in India has been going through a clean-up over the last 4-5 years. This clean-up has also ensured that many of the loans made by these PSU banks in the last few years are much better than in the past. Hence, we do expect that banks’ results will start improving in 2019. A healthy banking system can also better withstand some of the concerns around credit availability (and its serviceability) that we talked about in the previous point.

- One of the big unknowns of 2019 is the upcoming national election in India. As we discussed in our exhibit on election results and market performance, over the medium to long term these election results seem to have a minor impact. So while the equity market is nervous about the upcoming elections, we think it can lead to higher volatility which can create more opportunities for our style of investing.

- Other global macro factors like Oil prices, trade wars, and more and more countries growing inward-focused are likely to have an impact on the equity market return. Our crystal ball on these issues is very hazy and we have no idea how they will play out in 2019.

- Volatility in the last few years has been subdued as compared to 2010-2012. Given some of the issues that we have talked about, we expect volatility to go up in 2019.

- Lastly, the valuation of the NSE 500 is still above its median. Hence, markets don’t seem cheap even after the drawdowns that we have seen in 2018. Thus stock picking will continue to be alive and do well. We believe that Indian equity markets are among the few places where active investors can do well given the inefficiencies.

How does it impact the portfolio?

Given our expectations for 2019, we are positioning the portfolios accordingly:

- Demanding higher returns from our ideas.

- Preserving optionality by not being afraid of being in cash.

- Focusing on companies where management can be trusted and they are running the company with high integrity, good capital allocation, and are taking care of minority shareholders.

- Willing to be contrarian where the risk/reward makes sense. As an example, we invested in a few companies in the Banking and Finance (NBFC) sector especially after they were hit hard by the ILF&S crisis.

Concluding Thoughts

2018 was a tough year for most market participants. However, as the saying goes, “When things get tough, the tough get going.” One of the reasons many investors don’t enjoy the good returns of the equity markets is that they are greedy and scared at the wrong time.

One of the questions we ask ourselves is “Do we deserve what we are seeking – superior long-term capital appreciation? Why?” Howard Marks answers it best, “to get superior returns one needs to be different and to be right.” Neither is easy but we intend to put in our best effort.

The risk that we need to guard against, as Ben Graham put it is “The investor’s chief problem—and even his worst enemy—is likely to be himself.” Through these annual letters, we intend to guard our partners from being their own worst enemies. In the process, we hope to continue our learning and become better investors. May the force be with us!

Appendix: Investment Principles

Investment principles listed below are the North Star that helps guide our approach to investing. At DoorDarshi we have been heavily influenced by Warren Buffett and Charlie Munger. Naturally, we have borrowed heavily from what they have taught us. These principles are also available on our home page at https://doordarshiadvisors.com

Partnership

My approach towards my investors is that of a partnership. In the current setup, I am the Managing Partner while my investors are the limited partners. However, my key consideration is always to ensure that structure (fees, communication) would be acceptable to me if our roles were to be reversed. This principle borrows heavily from what Warren Buffett has laid out in his Owner’s Manual – “Though our form is corporate our approach is a partnership.”

Long-Term Orientation

In a world where everyone has all the information, we have to stake out our competitive advantage. The key one that we have is long-term orientation. We primarily invest in companies where the thesis may play out over many years. This reduces the competition and allows us to enjoy our returns over the long term.

We carry the same approach when we work with our investors/partners. We would rather have one investor for ten years rather than twenty investors for one year. This allows us to take a long-term view of our relationship with our investors.

Invest in our best ideas

We invest the majority of the portfolio in the top 5–10 positions. These positions are chosen based on their attractiveness from a future return perspective. In following this approach we subscribe to Charlie Munger’s dictum in spirit, “A well-diversified portfolio needs just four stocks.” A key advantage of this approach is that it allows us to know our top positions better than most people and take advantage of the decent returns that will come from those positions.

Contrarian Bias

We like to buy good stocks when they sell at a discount. This approach, by definition, forces us to go where the crowd is not going – selling things that are going up and buying things that are falling. We are able to have this contrarian bias because we always keep the forward return in mind whenever we invest in any security i.e. what % return we expect from the security from the day of investing to the day the price will match the value.

However, we are not contrarian for the sake of being contrarian. We will sell the stock even if it is falling if we feel that some new information has changed our thesis. This is what led us to sell Pincon even though the price fell.

Don’t lose money

We take seriously the dictum that the art of making money is to not lose money. Warren Buffett has expressed the same through his famous rules on investing. There is the simple maths that if we lose 50% of our portfolio we need to make 100% to get even. The more pernicious impact though, is psychological. We start doubting ourselves a little more; we don’t invest in our best ideas to the extent we should and we start looking for social proof.

To guard ourselves we ask for a high Margin of Safety in our position. This has led us to miss many opportunities. However, we would rather miss opportunities than get into sub-par opportunities which could later turn out to be value traps.

Management and Business Quality

Most of the mistakes we have made in our investing journey have been where we misjudged the management or business quality of the company. Since many of the Indian businesses are owner-operated, the quality of the management becomes paramount. However, judging the quality of management is very subjective.

The best we have been able to do is to create a mosaic of information about management and use that to reach our decision. We continue to increase the weightage of this element as we consider investing in potential ideas.

Continuous Learning

To us Value Investing is more than an investment approach; it is a way of life. This approach requires us to keep learning so that we become a better investor; and more importantly, a better human being. In our experience Value investing draws us towards the “right crowd.” This allows us to learn not just from our investment but also from our investors who are a self-selected group of individuals.

What partners can expect?

With our investing principles as our guide, our partners can expect the following:

- We will continue to focus on long-term results even at the cost of short-term performance. Hence, the best way to judge us is by looking at cumulative returns over a long period rather than year-by-year returns.

- We will focus on absolute performance at the cost of relative performance. It is no good if we deliver 10% when the market has delivered -20%. We would rather be in cash and suffer short-term relative performance penalty than risk capital of our partners. Hence, though we show our portfolio performance versus BSE 500 performance we have no interest in knowing what constitutes that index.

- We will follow a concentrated investing strategy. This will cause our investing results to come in chunks rather than in a smooth linear fashion. However, finding good investment ideas is difficult, and we want to use the full weight of our capital to take advantage of them when we find them.

- We want to make money with our partners rather than from them. Hence we will continue to have a fee structure that we would be comfortable paying if our roles were reversed.