A US (Delaware) domiciled fund that focuses on investing in listed Indian equities.

Our goal is to deliver superior returns over the long term by partnering with like-minded investors

Investment Philosophy

01.

02.

03.

04.

Why invest with us?

Fantastic Track Record

Uncorrelated Returns

Participate in India’s story

Amazing Opportunities

Aligned fee structure

Skin in the game

Testimonials from our Investors

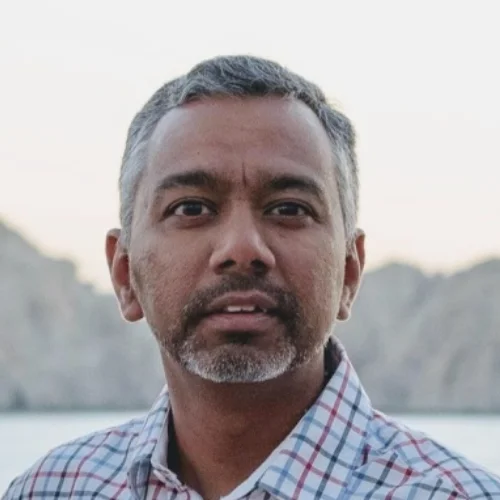

I was looking for exposure to the Indian equities market with a competent investor. Rajeev has local knowledge, years of experience in fundamental company analysis and a proven track record even before launching his fund. DoorDarshi India Fund has been a great investment but my real investment has been in Rajeev.

Ellen Weinstein InvestorShamrock Communities, CEO

I have known Rajeev for over 35 years. I have always found Rajeev to be very candid, transparent, and down to earth - qualities that I personally think are needed for someone to do well in investment business. I have also studied and followed Buffett’s value investing approach. Rajeev’s Doordarshi fund is applying that value investment approach to Indian equity market - which I believe provides a fertile ground for ideas for a long time to come.

Bhawani Singh Investor

Doordarshi India Fund has allowed me to participate in the fast growing Indian capital market and into equities beyond just the few large cap stocks offered by mutual funds or ETFs available in the US. The lack of institutional imperative allows the fund manager, Rajeev Agrawal, to unleash the full potential of the fastest growing major economy by finding fast growing or significantly undervalued Indian companies to invest in. I am very happy with the results over the 3 years when I first invested in Doordarshi.

Kshitij Garg Investor

As an early investor in the fund, I appreciate getting exposure to one of the fastest growing economies in the world with a savvy manager with a proven record of good stock selection.

Aash Shah Investor

I was drawn specifically to the focus on the Indian market for the fund and the emphasis on long term strategy. I have also been impressed with Rajeev's approach to investing and level headed thinking and clarity

Raman Subramnian InvestorGoogle Employee

While the returns from the fund have been stellar, what I like the most about the fund is how Rajeev analyzes the investment, follows it, and makes adjustments.

Ashok Mittal Investor

What I love about Doordarshi Advisors and Rajeev is their transparency and long-term vision. The solid returns on my investment so far are testament to his expertise in the field.

Manish Jain InvestorChief Technology Officer, Biotech Industry

DoorDarshi India fund has lived up to its name by giving fabulous returns. The stock selections by Rajeev have been a class apart. I am very happy that I invested with him, and I can now look forward to a comfortable retirement.

Nitin Aggarwal InvestorCFA FRM

For the next few years, India's GDP is arguably going to grow higher than any other country. DoorDarshi employs deep research and evidence driven data before investment.

Aninda Bose InvestorCEO, DigiDrub | Investor | TEDx Speaker

DoorDarshi India Fund has a fantastic track record and a long-term orientation. The fund enables one to benefit from the fast growth of the Indian economy while being based in the US.

Ruyintan (Ron) Mehta InvestorRetd Serial Entrepreneur

President, WIN Foundation (NGO), Maker Bhavan Foundation (NGO)