Dear Investor / Partner

A new year calls for a new beginning. This year we are starting the tradition of writing an annual letter for our esteemed partners. In starting this annual letter, we are following the path laid down by the luminaries of the investment world. This annual letter will serve a few different purposes:

- Provide a mechanism to judge ourselves. This will be through our portfolio performance for the year gone by as well as cumulative performance since we started focusing on the Indian equity markets.

- Talk about key learnings from the year. This, in itself, is worth the effort of writing this annual letter. The more we write (which is infrequent), the more we are impressed with its effectiveness in pounding things into us.

- Communicate our investing principles and what can be expected with our approach. It will help investors decide if we are the right choice for them resulting in better alignment over time.

- Lastly, seek out your help!

Portfolio Performance

Before we present our performance, a few caveats are in order:

- The performance provided below is what we have experienced in our portfolio. Partners will have different results based on when they started investing and what stocks they held in their portfolio.

- The performance below doesn’t tell us anything about what we will do in the future. It only tells us what we have done so far.

- We don’t present any risk-adjusted returns. The reason for the same is that we don’t like the traditional definition of risk – standard deviation, beta, etc. Hence we don’t like some of the corresponding alpha measures like Sharpe Ratio, Treynor Ratio, etc. To us, risk is the permanent loss of capital. We feel that risk can only be assessed over long periods by how the portfolio does. So, stay tuned for future results.

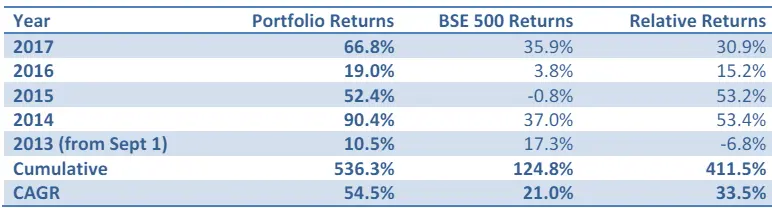

Below is the performance of our portfolio since Sept 1, 2013, when we started focusing on the Indian equity markets.

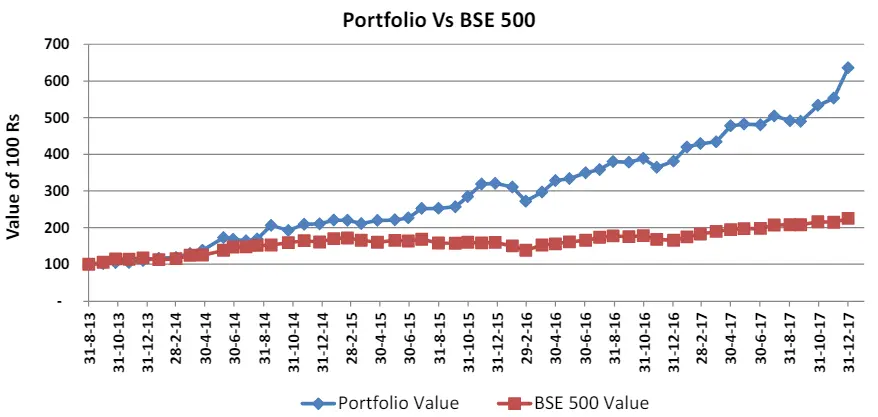

The same information has been presented in a more granular manner by looking at the monthly values of the portfolio and BSE 500. Sharp readers of the letter will notice that a sudden spurt in the last few months of 2017 significantly aided our 2017 results. Our experience is that gains and drawdowns in the portfolio come in chunks as we have a concentrated portfolio. We expect these chunky gains/losses to continue in the future.

Without sounding immodest, we are amazed with our portfolio performance. Never in our wildest dreams did we expect that we would have a 6x in less than 5 years? This is especially so since the broad index – BSE 500 has done 2.25x. Thus our outperformance is truly remarkable.

For 2017 our performance is a noteworthy 66.8%. While 66.8% performance is great, it is 54.5% CAGR over the last 4.33 years that we are truly tickled about.

Enough of self-praise! Let us move on to something that you care about – your portfolio performance.

Read morePartner’s portfolio performance

Since our partners have different start dates, we will discuss your performance separately. Here we want to highlight some of the factors that drive the performance:

- Performance of our equity picks. This performance is best reflected in the performance of our portfolio mentioned earlier.

- Equity picks that clients decide to have in their portfolio.

- Weightage of these picks in their portfolio

- Price at which they bought/sold these securities.

- Subsequent behavior of the client in terms of buying/selling as the equity prices moved around.

- Cash component in their portfolio.

While each of the factors listed above is important, we think what differentiates true outperformance is how the investors behave when markets swing wildly. Do they sell as the equities become expensive and buy as they become cheap? Or are they caught up in the market mania on either side? Of course that begs the question, when is a company expensive and when is it cheap? How much should one invest in a company when it is cheap?

These are some of the questions that one has to contend with in investing. Many of these questions can only be answered with experience in the markets. It also requires us to keep adjusting our behavior based on the feedback that we receive through our portfolio performance. With that mindset let us jump into the next section where we talk about key learnings from the year gone by.

Key learnings of 2017

We approach this section with the mindset best elucidated by Charlie Munger’s speech in 2007 to USC Law School, “Wisdom acquisition is a moral duty. It’s not something you do just to advance in life. As a corollary to that proposition which is very important, it means that you are hooked for lifetime learning. And without lifetime learning, you people are not going to do very well. You are not going to get very far in life based on what you already know.”

Below are some of the key lessons that we learned / re-learned in 2017.

The Importance of Management

Management makes a big difference in how an investment thesis plays out. We have been aware of the importance and have increasingly gravitated towards investing in companies where we are comfortable with management.

Once in a while though, an idea looks compelling enough, the industry looks ripe for this new idea, and the company’s recent business performance makes the narrative compelling. However, there is this nagging feeling about the management. Our (re)learning from 2017 is to not get involved if there is discomfort with management.

The mea culpa we are talking about is Pincon Spirits. If you have not heard about it, don’t worry. We also wish we never heard about it. The company talked about how they are converting the unorganized liquor business to an organized liquor business, the massive opportunity as the newer generation is more comfortable drinking openly, and so on. The narrative was perfect. However, there were always open questions about management.

We sold our starter position in the company once it came under the scanner of SEBI as a shell company. Subsequent events have confirmed to us that it was the right decision. The saving grace in this ordeal was that the position was very small. We were still doing early research to get comfortable with the idea when we hit the pothole.

Don’t take profits too quickly

There is an adage on Wall Street, “You can’t go broke taking small profits.” However, following this strategy could cause one to miss out on big profits. In 2017 we got our first 10X since we started focusing on Indian equity markets.

The stock in question is Chaman Lal Setia Exports (CLSE). We presented a case study on CLSE at the Asian Investing Summit in April 2017. You can access the case study at https://goo.gl/XZ7dVH. If any of the investors would be interested, we would be happy to forward a copy of the presentation.

In the case study, we outlined that CLSE has a very long runway, and on a conservative basis, the stock could more than double by June 2020 from its April 2017 price. Since our presentation in April 2017, the stock has already gone up by 70%. Thus staying invested when we have conviction and not booking small profits is a key to making good returns.

The attractiveness of an idea should be reflected in its allocation

We have been using our proprietary forward return analysis framework to evaluate the attractiveness of the various ideas in our portfolio. The more attractive an idea is on a probability-adjusted basis, the more of the portfolio we are allocating to the idea.

The result of this strategy has been higher allocation to higher return ideas. While the returns don’t show up every year, over a longer period this approach has worked well for us. We used this approach to take the fifth largest position in the portfolio in 2016 and made it the largest position in the portfolio in 2017. In subsequent annual letters, we will keep you updated on how this position works out.

Work with the “right” investors/partners

We like to work with investors who demonstrate the following characteristics:

- Long-term orientation

- Reasonable expectations

- Understand our investment approach

- Recognize that we will make mistakes from time to time

We couldn’t be happier with our investor base. The key demonstration of this came when we reached out to them acknowledging the mea culpa with Pincon Spirits. Everyone who had the position understood why we are changing our stance and appreciated our approach of dealing with it.

Given the happy experience, I am encouraged to re-iterate our investment principles so that we and our investors continue to be aligned.

Investment Principles

Investment principles listed below are the North Star that helps guide our approach to investing. At DoorDarshi we have been heavily influenced by Warren Buffett and Charlie Munger. Naturally we have borrowed heavily from what they have taught us. These principles are also available on our home page at https://doordarshiadvisors.com

Partnership

My approach towards my investors is that of a partnership. In the current setup, I am the Managing Partner while my investors are the limited partners. However, my key consideration is always to ensure that structure (fees, communication) would be acceptable to me if our roles were to be reversed. This principle borrows heavily from what Warren Buffett has laid out in his Owner’s Manual – “Though our form is corporate our approach is a partnership.”

Long-Term Orientation

In a world where everyone has all the information, we have to stake out our competitive advantage. The key one that we have is long-term orientation. We primarily invest in companies where the thesis may play out over many years. This reduces the competition and allows us to enjoy our returns over the long term.

We carry the same approach when we work with our investors/partners. We would rather have one investor for ten years rather than twenty investors for one year. This allows us to take a long-term view of our relationship with our investors.

Invest in our best ideas

We invest the majority of the portfolio in the top 5–10 positions. These positions are chosen based on their attractiveness from a future return perspective. In following this approach we subscribe to Charlie Munger’s dictum in spirit, “A well-diversified portfolio needs just four stocks.” The key advantage of this approach is that it allows us to know our top positions better than most people and take advantage of the decent returns that will come from those positions.

Contrarian Bias

We like to buy good stocks when they sell at a discount. This approach, by definition, forces us to go where the crowd is not going – selling things that are going up and buying things that are falling. We are able to have this contrarian bias because we always keep the forward return in mind whenever we invest in any security i.e. what % return we expect from the security from the day of investing to the day the price will match the value.

However, we are not contrarian for the sake of being contrarian. We will sell the stock even if it is falling if we feel that some new information has changed our thesis. This is what led us to sell Pincon even though the price fell.

Don’t lose money

We take seriously the dictum that the art of making money is to not lose money. Warren Buffett has expressed the same through his famous rules on investing. There is the simple maths that if we lose 50% of our portfolio we need to make 100% to get even. The more pernicious impact though, is psychological. We start doubting ourselves a little more; we don’t invest in our best ideas to the extent we should and we start looking for social proof.

To guard ourselves we ask for a high Margin of Safety in our position. This has led us to miss many opportunities. However, we would rather miss opportunities than get into sub-par opportunities which could later turn out to be value traps.

Management and Business Quality

Most of the mistakes we have made in our investing journey have been where we misjudged the management or business quality of the company. Since many of the Indian businesses are owner-operated, the quality of the management becomes paramount. However, judging the quality of management is very subjective.

The best we have been able to do is to create a mosaic of information about management and use that to reach our decision. We continue to increase the weightage of this element as we consider investing in potential ideas.

Continuous Learning

To us Value Investing is more than an investment approach; it is a way of life. This approach requires us to keep learning so that we become a better investor; but more importantly, a better human being. In our experience Value investing draws us towards the “right crowd.” This allows us to learn not just from our investment but also from our investors who are a self-selected group of individuals.

What partners can expect?

With our investing principles as our guide, our partners can expect the following:

- We will continue to focus on long-term results even at the cost of short-term performance. Hence, the best way to judge us is by looking at cumulative returns over a long period rather than year-by-year returns.

- We will focus on absolute performance at the cost of relative performance. It is no good if we deliver -10% when the market has delivered -20%. We would rather be in cash and suffer short-term relative performance penalty than risk capital of our partners. Hence, though we show our portfolio performance versus BSE 500 performance we have no interest in knowing what constitutes that index.

- We will follow a concentrated investing strategy. This will cause our investing results to come in chunks rather than in a smooth linear fashion. However, finding good investment ideas is difficult and we want to use the full weight of our capital to take advantage of them when we find them.

- We want to make money with our partners rather than from them. Hence we will continue to have a fee structure that we would be comfortable paying if our roles were reversed.

Seek your help

Warren has set a mighty example for us through his annual letters. Not only are the letters full of amazing lessons, they are a good guide on how to behave. Warren has regularly sought help from his investors for new ideas that he can invest in. Given this is our first annual letter, we will seek out help from you on a few different dimensions:

- When you have a good thing going, seek more of it! We are proud of our investors/partners as mentioned earlier. Our experience is that many of the new investors that they refer have similar characteristics. So if you know of investors who could benefit from our approach to investing, please don’t hesitate to refer them to us. You would help them and help us, and in the process deepen your relationship with both parties.

- Provide feedback on our Annual Letter. We will be eager to hear what you like and what you would want us to do more of. As you know, we don’t like to talk about specific stock ideas unless it helps in illustrating key concepts. So we can’t talk too much about our existing portfolio. Everything else is fair game.

Concluding Thoughts

Equity investing is one of the best elements of capitalism. It allows one to participate in promising businesses with good management over the long term and enjoy the proceeds. The risk that we need to guard against, as Ben Graham put it is “The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Through these annual letters, we intend to guard our partners from being their own worst enemies. In the process, we hope to continue our learning and become better investors. May the force be with us!

Rajeev Agrawal

Managing Partner

DoorDarshi Value Advisors

show less