We are dividing this article into two sections:

- Key highlights for us from the 2019 letter.

- Using information from the letter to assign value to Berkshire as a business.

Key highlights from the letter

Future Reporting changes

Berkshire will do away with reporting annual changes in Berkshire’s book value from next year. It will only report changes in market value vs S&P 500. Reasons for the change include:

- Berkshire has morphed from being primarily the owner of marketable stocks to primarily being the owner of operating businesses.

- Operating companies owned by Berkshire are reported at book value while marketable stocks are reported at market prices. Thus book value under-reports the value of operating companies.

- Over time Berkshire will buy significant stock of its shares at above book value but below intrinsic value.

- Buying stock at above book value will reduce the book value but in fact, would add value for the remaining shareholders.

Berkshire clusters of value

Warren clustered the component of value in Berkshire into:

- Operating non-insurance businesses earned $16.8 billion in 2018. This $16.8 billion is the earnings after all income taxes, interest payments, compensation depreciation, and amortization. The pre-tax income of these businesses grew by 24% in 2018 to $20.8 billion. Acquisitions were a very small part of this yoy growth. After-tax gain in 2018 was a more impressive 47% thanks in large part to the cut in corporate tax rate.

- The collection of marketable equities in Berkshire’s portfolio was worth $173 billion at year-end. These businesses gave dividends of $3.8 billion to Berkshire and retained earnings which were many multiple of that dividend (exact figure is not given). Berkshire has a deferred tax liability of $14.7 billion on the unrealized gain from its equity holding.

- Companies where Berkshire shares control with other parties. These include Kraft Heinz, Berkadia, Electric Transmission Texas and Pilot Flying J. Berkshire’s portion of after-tax operating earnings of these businesses was $1.3 billion in 2018.

- $112 billion of US Treasury bills and other cash equivalents, and another $20 billion of miscellaneous fixed-income instruments.

- Insurance businesses, which have been the engine of Berkshire’s growth. Berkshire had an underwriting pre-tax profit in 2018 of $2 billion, and over the last 16 years had an underwriting pre-tax profit of $27 billion. The float of insurance businesses has grown to $122.7 billion.

Additional Insights

While Warren didn’t give any specific intrinsic value to Berkshire, he gave us enough pointers to come up with our valuation. Some additional pointers in the letter that we should keep in mind include:

- Berkshire value is maximized by having these five clusters of value in a single entity. It allows Berkshire to allocate capital most efficiently, generate funds at very low cost, reduce dependence on a specific business line, and minimize overhead.

- Warren said while one can do the sum of parts calculation of the above five clusters of value; the whole is significantly greater than the sum of parts.

- Through the tax cuts enacted by the government, the government has transferred 40% of its ownership in Berkshire back to the shareholders. (This is a unique perspective that we haven’t seen mentioned elsewhere). Thus tax cut has considerably increased the value of the businesses and the stocks that Berkshire owns and thus its value for its shareholders.

- Berkshire equity capital has grown to $349 billion.

- Berkshire equity holdings on a weighted basis earn 20% on net tangible equity capital without employing excessive levels of debt.

Valuing Berkshire

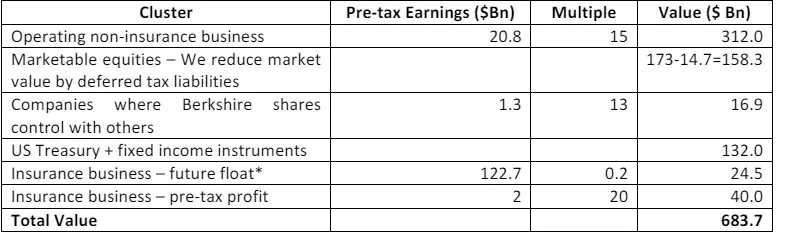

Using the sum of parts calculation, we value different parts of Berkshire as follows:

*The value of insurance float is already reflected in marketable equities and US treasuries. The value here reflects excess return over cost that may come from future float creation. Please see the assumption sections to understand how we have come up with a multiple of .2x.

Below we provide our rationale for some of the multiples used:

- Operating non-insurance business clusters contain unique assets that will be difficult to replace. There are too many to mention but the key ones include BNSF, Berkshire Hathaway Energy or the next big ones – Lubrizol, Marmon, Precision Castparts, etc. We think that most of the big businesses will continue to generate excess return on capital for a long period. Besides, these businesses did quite well in 2018 and grew at 24% on a pre-tax basis and seem to have strong momentum. Hence, we have applied 15x multiple to pre-tax earnings

- We are a little less bullish on businesses where Berkshire shares control. Hence, we have applied a lower multiple of 13x.

- See the detailed explanation of assumptions to understand multiple on the float.

- For the pre-tax profit of the overall insurance business, we chose to apply a lower multiple of 20x rather than the 25x we did for Geico. We reason that the overall insurance portfolio is not as dominant or as high growth as the Geico business is.

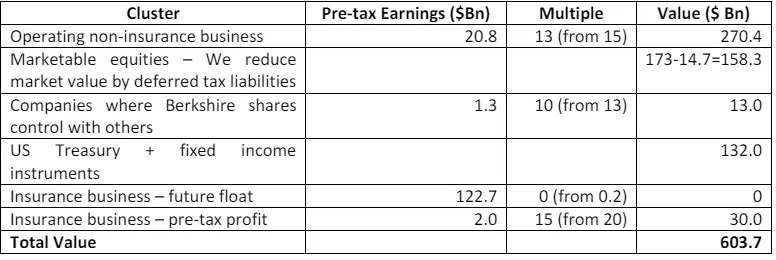

Valuing Berkshire – Material slippage

In this section, we assume that Berkshire performance slips materially going forward. Hence, we reduce multiples to reflect the same:

- We assume that operating businesses’ performance suffers and hence reduce the multiple.

- Similarly we reduce multiple companies where Berkshire is a part-owner.

- We reduce the value of float assuming that excess return falls from 8% in the base case to 6%. In such a scenario float won’t add any value.

- Lastly, we reduce multiple on operating pre-tax profit of insurance business.

We cannot justify applying these low multiples to the high quality of businesses that Berkshire owns. However, we wanted to see how the valuation changes even under very conservative assumptions.

Margin of Safety (MOS)

At current price of $201.91 for B shares, Berkshire is being valued at $496 billion in the market. Against this, our sum of parts calculation is $600 – $680 billion. Thus the stock can be up by 20-35% to be fair valued.

In his letter, Warren has mentioned that the whole of Berkshire is worth more – significantly more – than the sum of its parts. That is additional MOS which is not incorporated in our valuation above.

Anti-fragile

The biggest MOS of Berkshire is not even in the numbers. It is in the fact that Berkshire is anti-fragile. If markets and economies (financial markets generally lead the challenges that are subsequently seen in economies and sometimes even cause them) were to go south in a hurry, Berkshire can be a pillar of strength for the following reasons:

- Berkshire has significant cash and cash equivalents which will allow it to buy good businesses at good valuation.

- During times of stress, Berkshire is the first port of call. In the past, Berkshire did good deals during times of stress given its capital and cash. There is a very high probability that history will repeat itself should stress develop again in the system.

- Berkshire has operating business in diversified sectors. Many of these businesses are central to the economy and are likely to be far less impacted.

- Berkshire is a cash generating machine (Free Cash Flow is averaging $20 billion over the last few years). Thus a lot more cash will accumulate as we wait for those opportunities.

- Warren has committed to buy Berkshire if it becomes available at good valuation. His recent move to stop reporting book value change from next year is another important step in that direction.

- Warren has been spending more time in his letters on buyback and what it means for the shareholders of Berkshire. This focus on educating shareholders about buyback and its implication is a very strong indication to us that Warren is getting ready to move much more aggressively in the direction of repurchase.

It is difficult to assign a specific value to this anti-fragile nature of Berkshire. However, it is this anti-fragility of Berkshire which gives us the biggest comfort in owning Berkshire.

Conclusion

Overall, we think that Berkshire is trading at a good discount to our estimates of its intrinsic value. So far Warren has been quite restrained about buying back big quantity of Berkshire. With the elimination of book value growth as a metric to watch and his focus on educating investors about buyback implications, we think that the stage is set for significant buy backs in 2019 and beyond.

In his 2019 letter Warren comes across as quite optimistic about its businesses, its prospects, its valuation and how tax cuts have given significant value back to shareholders.

All of these portends very well for the future. To us it seems that the stage is set, let the buybacks (oops we meant let the party) begin!

PS: We enjoyed valuing Berkshire. For nerds like us, it was a weekend that was pure fun. Please feel free to reach out if you have specific insights/judgments/feedback from us.

Valuation Assumptions

We will use information given in the shareholder letter and 2018 annual report to do a rough calculation of Berkshire value.

- We have ignored accounting profit/losses since new regulations skew the profitability of Berkshire based on how the equity portfolio has done in the year.

- We have assumed that the present value of $14.7 billion of deferred tax liability on equity investments is due today. This is extremely conservative knowing fully well that a large chunk of this liability is not going to come due for a very long time. What happens to a liability that never comes due? It is not a liability!

Geico valuation and its implication

Warren mentioned that Geico has increased Berkshire intrinsic value by $50 billion. When Berkshire purchased Geico it was valued at $4.6 billion (50% was bought for $2.3 billion). Thus Warren is valuing Geico at $52.3 billion. This is for a business which has a float of $22.1 billion and has generated underwriting profit of $15.5 billion (pre-tax) over 23 years. While there would be many insurance analyst who can do a more thorough job, here is our crude allocation of $52.3 billion across two parameters of insurance that matter – float and underwriting profit:

- 2018 underwriting profit of $2.5 billion is an aberration for Geico. Averaging last 3 years underwriting profit, we get around $.85 billion / year. We will assume normalized pre-tax profit of $0.85 billion.

- Given Geico is the second largest automobile insurer in US, and is growing its market share and operating profits rapidly; we will apply a hefty 25x to pre-tax profits to get $21.25 billion of value from operating earnings.

- Thus the rest of valuation of Geico is contributed by float. Hence, almost $31 billion of the value of Geico is coming from float. Of course float becomes more valuable as the return on float net of cost of float goes up. Modeling it we realize that the excess return net of cost on float comes to around 13% over the last 23 years for Geico.

- Above model assumes that float has grown at a steady rate of 9.9%/year from $2.5 billion in 1995 to $22.1 billion in 2018. Of course, we realize that reality is anything but a straight line.

- In valuing Geico float at $31 billion, inherent multiple of value/float is 1.4x.

Valuing insurance float

We can now apply insights from Geico’s valuation and extrapolate it to the broader insurance portfolio of Berkshire.

- We will make the following conservative assumptions for the float of the overall insurance portfolio:

- Float grows at 6% over the next 25 years and then flat lines. Insurance float has grown at 17.9% cagr since 1980 and at 8.6% since 2000. So 6% seems like a conservative number.

- Excess return of 8% over the cost of float for the next 25 years. Based on our model, Geico’s excess return has been 13% over the last 23 years.

- The discount rate of 12% on the value generated from the float to come up with the present value.

- Under these assumptions, the value of float for the overall insurance portfolio is worth $147 billion. This is a multiple of 1.2x on the float for the overall insurance portfolio vs 1.4x that we think Warren implied for Geico. We have already accounted for the current value of float in Treasury and listed equity. So the value added will be 0.2x.

- Note that if the excess return of float over its cost drops to 6%, instead of the 8% assumed earlier, the float doesn’t add any value as the discount rate cancels float growth and excess returns.

Disclosure: I am/we are long BRKB. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: DISCLAIMER: This analysis is not advice to buy or sell this or any stock; it is just pointing out an objective observation of unique patterns that developed from Berkshire annual letter 2019. Factual material is obtained from Berkshire 2019 letter and is believed to be reliable, but the poster is not responsible for any errors or omissions, or for the results of actions taken based on information contained herein. Nothing herein should be construed as an offer to buy or sell securities or to give individual investment advice.

show less