Executive Summary

Ujjivan Financial Services Ltd (UFSL) is a special situation opportunity. UFSL is the holding company of Ujjivan Small Finance Bank (USFB). We can buy USFB today at a discount of 39% by buying UFSL. This discount will be eliminated in the next 12-15 months which will give us a total return of 64% and a CAGR of 51% from today.

Short-Term Trigger

UFSL is in the process of reverse merging with USFB. The owners of UFSL will get 11.5 shares of USFB for every 1 share of UFSL. At the current price of USFB (19.0/sh), 11.5 shares of USFB is worth 219/sh. As against the derived price of 219/sh, the market price of UFSL is 132.75/sh. Thus USFB is available at a discount of 39% to its market price if we buy UFSL.

The above discount is expected to close in 12-15 months as UFSL goes through the various steps of reverse merging itself with USFB. The regulatory approval process has already started with SEBI giving its acceptance subject to fulfillment of certain conditions. The management is committed to completing the reverse merger and has been working on it since USFB was listed in December 2019!

Assuming that the reverse merger is completed in March 2023, we will earn a total return of 64% and a CAGR of 51% from today.

Background

UFSL was started in 2005 by Samit Ghosh and was focused on serving the unbanked and underbanked sections of society. UFSL built its operation gradually, starting from Bangalore and expanding nationally. He attracted foreign capital for his venture including well-known names like Michael and Susan Dell Foundation, Sequoia Capital, IFC, CDC Group, NewQuest Asia, CX Partners, and many more.

Not only did UFSL service the corresponding target segment well, but it also provided 20%+ cagr returns to most of the investors who invested when the company was private. In 2015, UFSL was one of the institutions to whom RBI offered an in-principle SFB (Small Finance Bank) license. One of the conditions for securing an SFB license was that UFSL had to be majority-owned by Indians. Hence, UFSL went for an IPO in 2016 to have the majority of the shares owned by Indians.

Read moreUSFB started its operation in February 2017 and all the operations of UFSL were transferred to USFB. Thus UFSL became a holding company. Since SFBs were required to list within 3 years of starting their operation, USFB went for an IPO in December 2019. USFB IPO was among the most successful IPO in 2019 having been subscribed 170x.

Even when USFB was getting listed, the goal of the management was to merge the two entities – USFB and UFSL. RBI has now allowed the holding company to reverse-merge with their SFB subject to approval by RBI on a case-by-case basis. Hence, both UFSL and USFB have agreed on a merger. It is this merger that provides us with a compelling investment opportunity.

Management

As mentioned earlier, Samit Ghosh started UFSL in 2005. He served as its MD and CEO until January 2017. In February 2017 as all the operations of UFSL were transferred to USFB, he moved to the bank and became its MD and CEO. He retired from USFB at the end of November 2019 after attaining the age of 70 years.

Samit has been the guiding light for both UFSL and USCB and has a deep imprint on both organizations. In the 2021 Annual Report, Samit said the following in UFSL’s chairman letter, “UFSL

shareholders have waited patiently to be integrated into the operating company and we are hopeful that RBI will permit the reverse merger of UFSL with USFB when a formal application is made 3 months before the Bank’s 5th anniversary, which is on February 01, 2022.”

We are pretty comfortable that management is keen to merge the two organizations and create value for shareholders.

The base case Scenario

USFB and UFSL have already applied to RBI for merging in the ratio of 11.5 shares of USFB for 1 share of UFSL. Our base case scenario assumes the following:

- RBI is expected to give its approval as it has indicated the same in July 2021.

- As per SEBI regulations, USFB will have to issue shares to bring down ownership of UFSL to 75% or below in USFB before the final merger takes place. This will require USFB to do a QIP or Rights issue to bring UFSL ownership down from 83.3% to 75% as required by SEBI.

- We expect all the approvals from various regulators will be received by early 2023.

- We expect shareholders of UFSL will own shares of USFB by March 2023.

Under the above assumption, our expectations are:

- UFSL shareholders will own 11.5 shares of USFB. At the current price of 19.0/sh, they are worth 219/sh.

- Given that the current price of UFSL is 132.75/sh, we expect a total return of 64%.

- Assuming that this value is unlocked by March 2023, we get a cagr of 51%.

Bear case Scenario

We think that even in a bear case scenario the reverse merger goes through. Our rationale is based on the fact that multiple entities namely Equitas, Ujjivan, and IDFC are working towards their reverse merger with the corresponding banks. Unless RBI was comfortable, they wouldn’t have allowed SFBs to start exploring reverse mergers.

Hence, in our bear-case scenario, we assume the following:

- Merger gets delayed so it takes till Dec 2023 to get the underlying shares of USFB.

- USFB will fall by another 20% in the next two years from its current price of 19/sh (it has already fallen by 48% since its IPO price of 37/sh. It is important to highlight that the IPO of USFB was subscribed to 170x when it came out in December 2019. Strange things happen in the stock market – USFB went from being a darling of the stock market in 2019 to being almost a pariah of the stock market at this point!).

Even under these gloomy assumptions, our expectations are:

- If USFB shares were to fall by 20% from their current price of 19/sh, 11.5 shares of USFB will still be worth 174.8/sh.

- The current price of UFSL is 132.75/sh.

- Thus we expect a total return of 31% and a cagr over 2 years of 14%.

Overall Valuation

UFSL offers a compelling case of:

- Heads we win with a total return of 64% and a CAGR of 51% over the next 1.25 years.

- Tails we still win with a total return of 31% and a CAGR of 14% over the next 2 years.

- It is rare to find situations where even under adverse conditions, not only do we not lose, we get a reasonable return!

- In our “heads we win” scenario we have assumed that the USFB share price remains stagnant. We think there is a very high probability that the share price of the bank improves significantly over this period. Some of the reasons include:

- Covid has hurt the asset quality of USFB massively. From having a pristine balance sheet 18 months back, the bank now has stressed assets (including restructuring) reaching 20% of its book. Bank has done aggressive provisioning in the past 18 months and now provisions constitute more than 10% of the book. We think that the additional provisions required from Q3 will not be substantial.

- There is significant management change at USFB (more details a few points later). Whenever there is a management change, the new management is quick to point out issues with existing asset quality. Q2 of FY 2022 gave new management that opportunity and they have outlined the maximum provision that they are expecting.

- Market participants on the other hand expect that bank results in FY 23 will be overwhelmed by the credit cost that is in the pipeline. We think the market is missing the improvement in collection efficiency in Q2 and the significant provisions that the bank has already taken. Management also took the help of an outside agency to assess the book and already took the provisions that were required.

- Bank has continued to transition its book from being 84% unsecured in Dec 2018 to 68% unsecured in Sept 2021. The bank has a stated goal of getting to 50% unsecured loan book in a few years. As the unsecured proportion of the loan book reduces, the credit cost of the bank should reduce as well. This will reduce the negative surprises enabling it to command better valuation in the future.

- Bank has reduced its cost of funds by more than 2% in the last 2 years. Reduction in the cost of funds now allows the bank to participate in loan segments that were not economically viable earlier. This should further help with the credit quality of the book and lower credit costs in the future.

- In August 2021, Nitin Chugh who was an MD and CEO since Dec 2019 resigned. This caused market participants to be worried about the asset quality of the bank. The market was also worried that some of the digital initiatives of the bank may suffer.

- After Nitin’s resignation, many of the past management personnel from UFSL have now rejoined the bank. Ittira Davis was appointed as MD and CEO on Dec 6, 2021. Ittira is an MBA from IIM Ahmedabad and a career banker. He joined UFSL in 2015 and was COO of USFB till June 2018. He was then MD & CEO of UFSL till March 2021.

- We are comfortable that senior personnel from the past are now guiding the bank during these turbulent times. The new management of USFB has seen many ups and downs in the 15-year journey of UFSL and is very conversant in dealing with the stress in the book. Their past guidance of credit cost for negative surprises was on the mark. Based on the current guidance we expect that the big credit cost has already been accounted for and we should see good performance going forward.

There are many additional reasons which I am skipping to keep this section brief. Suffice it is to say that we think that the upside in USFB from the current price is itself quite meaningful. That is a core part of the thesis but it is not baked in our return estimates!

- There is additional protection from the fact that both USFL and USFB’s current share prices are quite depressed. USFL started its IPO journey in May 2016 and was listed at around 250/sh. Since then it has touched a high of 500/sh and the all-time low is close to the current price of 132.75/sh. Similarly, USFB started its IPO journey in Dec 2019 when shares were offered at 37/sh. It listed around 50/sh in Dec 2019 and the current price of 19/sh is close to the lowest it has been.

Deja Vu

We have seen a very similar situation in IDFC in 2020. We had submitted a thesis for IDFC on Sumzero which can also be accessed here or from our website. The only difference is that discount in UFSL is not as extreme as it was in IDFC. However, IDFC was expected to take longer to play out while we expect that UFSL should play out a lot sooner.

Risk

The biggest risk to the thesis is if regulators don’t allow the reverse-merger to proceed. We think that the regulatory risk is remote because:

- RBI (banking regulator) has given in-principle approval to multiple entities for exploring a reverse merger. Given that the management of UFSL and USFB has done all its activities as per the rules, we think that the probability of regulatory surprise is even lower.

- SEBI (securities regulator) has already given the go-ahead for a reverse merger subject to meeting certain requirements. These requirements are on expected lines.

- Stock exchanges shouldn’t have an issue.

- The last step is NCLT where again there shouldn’t be an issue since the debt of the bank is quite limited. Shareholders are keen to have a simple structure and will be happy with the reverse merger. A reverse merger will create a lot of value for them.

Trade Feasibility / Idea Practicality

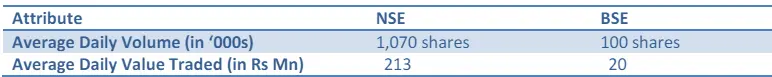

The company’s current market capitalization is 1,604 Cr or $211 Million. UFSL is listed on both NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Additional details are provided in the table below:

There is reasonable liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi India Fund (DIF) and DoorDarshi Advisors’ (DDA) and its employees/partners/clients have position in the stock discussed.

- The stock discussed was for illustration purpose only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- DIF, DDA, or its employees/partners don’t have actual/beneficial ownership of one per cent or more at any point so far in their individual capacity.

- DIF, DDA, or its employees/partners don’t have any other material conflict of interest at the time of publication of the research report.

- DIF, DDA, or its employees/partners haven’t received any compensation from the subject company in the past twelve months.

- DIF, DDA, or its employees/partners haven’t managed or co-managed public offering of securities for the subject company in the past twelve months.

- DIF, DDA, or its employees/partners haven’t received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- DIF, DDA or its employees/partners haven’t received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- DIF, DDA or its employees/partners haven’t received any compensation from the subject company or any third party in connection with the research report.

- DIF, DDA or its employees/partners haven’t served as an officer, director or employee of the subject company.

- DIF, DDA or its employees/partners haven’t been engaged in market making activity for the subject company.