Executive Summary

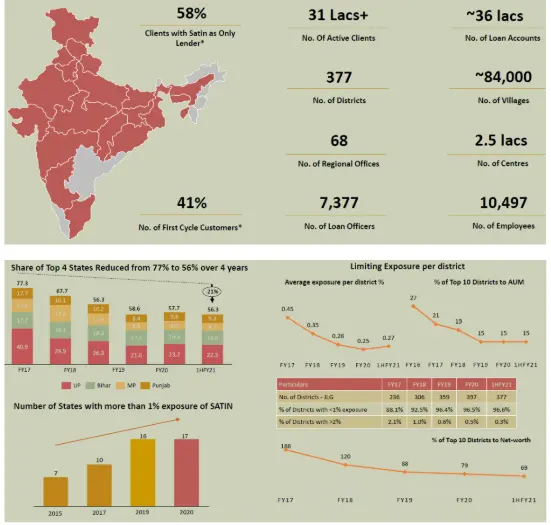

Satin is among the largest MFI (Micro Finance Institution) in India (excluding banks). MFIs cater to the lowest segment of the society in India and regulations require that at least 85% of the lending has to be uncollateralized. Hence, even minor economic disruption has an outsized impact on this sector.

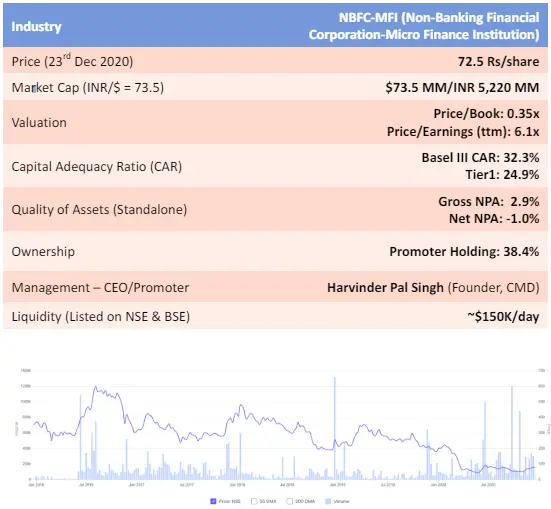

Satin has grown its AUM at 47% cagr between FY 12 and FY 20 and at 29% in the last 3 years. It is currently trading at ~3.4x PE of FY 20 earnings, 0.35x PB (accounting for recent rights issue) having normalized ROE of ~13-15%. Founder management used to own 30% of the company till FY 20. Management significantly increased its stake to 38% through a recent rights offering and also by buying rights entitlement of other shareholders. We are partnering with other marquee investors including MIT Endowment and Nordic Microfinance.

Headwinds

Covid-19 has created significant headwind for the sector. Given the lockdown in India, economic activity came to a standstill in April – June (Q1 FY 21) quarter.

MFI industry went through a similar headwind during the demonetization period in 2016 and 2017. Income for borrowers of MFI was impacted as this segment deals in cash and significant cash was withdrawn from circulation. Market participants are extrapolating the weakness experienced by MFI during demonetization years for the post-Covid period.

The road ahead

Collection efficiency which was 50-60% in Q1 FY 21 has gone to 85-95% in the September (Q2) quarter for most of the MFI players. Collection efficiency continues to improve in subsequent months after Q2.

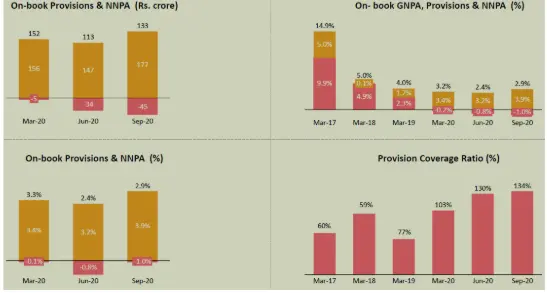

Moratorium from RBI has helped financial players from recognizing stress in the books post Covid lockdown. MFIs have also enjoyed similar benefit. We expect stress as reflected by GNPA will increase significantly in quarter ending December (Q3). Hence, we expect the provision cost will continue to be high over the next few quarters.

Financial sector was suffering from tight liquidity in the last few years. Concerted efforts by RBI and the government have addressed the problem and there is now ample liquidity in the system.

Satin Businesses

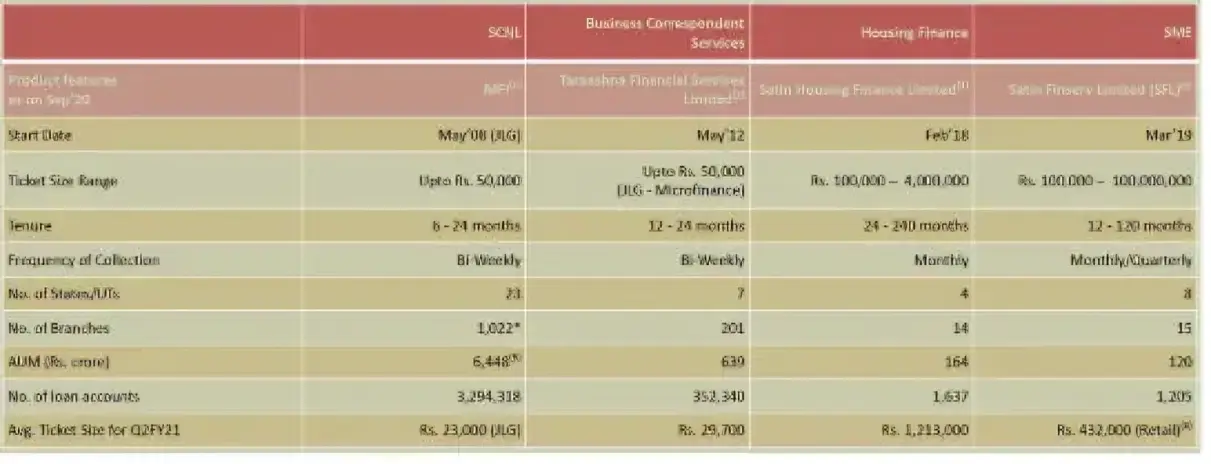

Satin is primarily a MFI and >90% of its book is made up of uncollateralized loans. Over the last few years, company has also entered into the collateralized segment of housing finance and loans to MSME.

- MFI lending (₹60 Bn): Focused on JLG (Joint Lending Group) with no collateral.

- Business Correspondence (₹11 Bn): Extending loans to MFI customers on behalf of banks and collecting fees.

- MSME (₹3 Bn): Small ticket loans to entities with property as collateral

- Housing finance (₹2 Bn): Focused on affordable housing

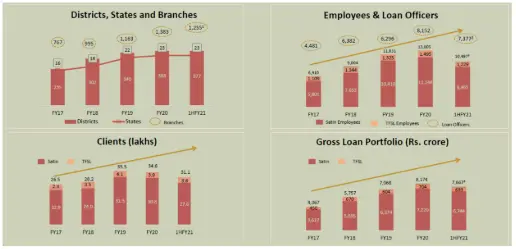

Satin has consciously diversified its presence across states. From 77% of AUM coming from the top 4 states in FY 17 it has come down to 56% in H1 FY 21

Read moreManagement

Satin was founded by Harvinder Pal Singh (HP) in 1990. Management adapted well to new regulatory changes and started focusing on the rural microfinance vertical in 2008. HP is a chartered accountant and is the Chairman and Managing Director of the company.

Ownership

We prefer investing in NBFC where management has a significant stake in the company. Besides, we like prominent investors to be co-owners in the company. Both those criteria are met with Satin.

| Shareholder | Ownership* |

| Promoters (HP Singh and related parties) | 38.3% |

| MIT | 3.1% |

| Nordic Microfinance | 6.5% |

Valuation

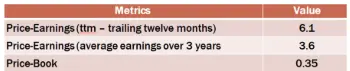

Satin trades at 3.4x FY 20 earnings, 3.7x average earnings over FY 18-20, and 6.1x ttm (on a fully diluted basis accounting for rights issue). On a PB basis, Satin is valued at 0.35x (again accounting for dilution). This valuation is for a business that has normalized ROE of ~13-15%, ROA of ~2.0-2.5%, and CAGR of 15%+ over a business cycle.

Management seems to agree that it is cheap and bought extra rights share at 60/share thus increasing their stake by 8% from 30% to 38% in the last 6 months

Asset Quality and Capital Adequacy

Satin has maintained superior asset quality with on-book GNPA at 2.9% and NNPA at -1.0% as of Q2 FY 21. Under Ind AS (new accounting standard of India which mirrors IFRS), provision coverage (including standard assets provision) of NPAs was 134%.

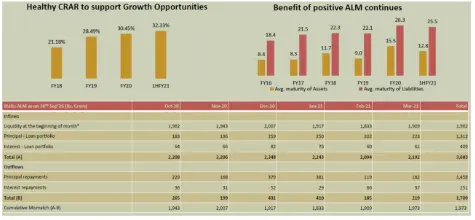

Company is well capitalized with total CAR (Capital Adequacy Ratio) of 32.3% including Tier 1 capital of 24.9% as against statutory requirement of 15% and 10% respectively. Given high capitalization we expect that company won’t have to raise new capital for the next few years.

Satin is rated A- (Stable) by ICRA and CARE.

Basic Facts

Company Background

Satin Creditcare Network Limited (SCNL) was set up in 1990 to provide individual business loans to urban shopkeepers. It was registered with the Reserve Bank of India (RBI) as a deposit-taking NBFC under the name, Satin Leasing and Finance Company Limited. Following its conversion into a public limited company in 1994, the company was renamed Satin Creditcare Network Ltd. in 2000.

The company stopped accepting public deposits from November 2004 and the RBI changed its classification to Category B (non-deposit taking) from Category A (deposit taking) in February 2009 and converted it into an NBFC-MFI in November 2013. The company’s microfinance operations are based on the Grameen Bank joint liability group (JLG) model and were spread across 1,355 branches in the country as on June 30, 2020.

Business Overview

Satin provides financing to bottom of the pyramid customers. After demonetization company has also ventured into secured areas like housing finance and MSME customers. More than 90% of the book comes from uncollateralized loans.

SCNL: Parent entity providing micro-financing loan to bottom of the pyramid customers.

- Taraashna (TFSL): TFSL is a Business Correspondent (BC) allowing banks and NBFCs to reach

out to JLG customers. TFSL has collaborated with nine Principal Partners, including six

Scheduled Commercial Banks (Yes Bank, DCB Bank, RBL Bank, IndusInd Bank, Jana Small

Finance Bank Limited and IDFC First Bank) and three NBFCs (Reliance Commercial Finance,

Northern Arc Capital (erstwhile IFMR Capital) and Hiranandani Financial Services Private

Limited). - SHFL: SHFL provides financing for affordable housing in the retail segment. Its low ticket size

ensures that the focus is on rural housing. - SFL: NBFC providing loans to MSME (Micro, Small, and Medium Enterprises) customers

against “immovable property” as collateral.

The below table provides an overview of these entities and the AUM as of Q2 FY 21 (end Sept 2020).

More than 75% of Satin’s book is for the rural segment.

Business Performance

Over the last few years, Satin along with its subsidiaries has continued to expand its presence across India. This has increased its geographical presence, the customer base that it serves, as well as the total AUM that it manages.

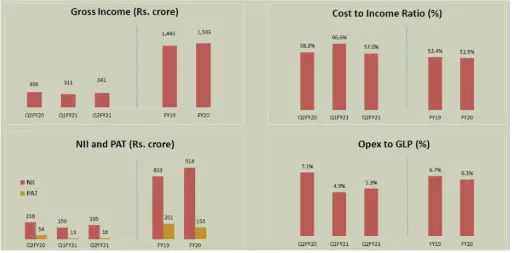

It has also improved the interest income and profitability of the company. However, profitability is impacted by episodic events which are part and parcel of this business model. Hence, a conservative capital structure and low-cost structure are paramount to be able to withstand the challenges.

Current challenge of Covid-19 pandemic is likely to impact the company’s results in FY 21 and to some extent in FY 22. The extent of impact will depend on how quickly borrowers are able to start generating income and start paying these loans. Usage of Credit bureau checks, strict limits on the maximum amount that a lender can lend, limited instances of political influence and good monsoon has given the confidence to the industry that impact from Covid-19 is unlikely to be as severe as it was during demonetization

Risk Management

The most important aspect of a financing business is how company manages risk. MFI loans are riskier. They are given based on the cash flows of the customers. However, cash flows are subject to significant variability. Satin manages the risk by distributing it across many customers (akin to insurance firms insuring many people) and across wide variety of geographies (to alleviate issues in one region affecting the overall book). This coupled with small ticket sizes and regular collection (fortnightly for uncollateralized loan in case of Satin) allows them to manage the risk.

Satin was hit very hard during demonetization years in 2016 and 2017. Satin not only had significant exposure to states like UP, Bihar and MP; these states were also among the worst affected as well. Since then company has been on a journey to reduce concentration of AUM in any particular state.

Diversification of book across states is a work in progress. Company has a stated goal of bringing exposure to any individual state below 20% over the next few years. They are also working to reduce exposure to top 10 districts.

Asset Quality

Company suffered massively during the demonetization period and its GNPA shot up to 15%. Over the last few years company has gradually provided for these NPA. As of Q2 FY21, GNPA on the books is 2.9% against which company is carrying provisions of 3.9% thus having excess provisions of 1%.

Around 10% of the customers have not paid any installment since Covid-19 related lockdown. These customers account for 10% of AUM. A good portion of this 10% AUM will likely turn NPA in Q3. Our expectation based on the demonetization experience is:

- The company will be persistent in recovering these dues from their customers well past the 180 dpd (days past due) as they did after demonetization.

- Company is likely to take provisions much more aggressively this time around as compared to demonetization. Hence over the next few quarters company’s profitability will be impacted while they work through the bad loan.

Liquidity

Liquidity is the lifeblood of financial organizations. Since the default of ILF&S in September 2018, the Indian financial system has been under extreme liquidity strain. The COVID-19 pandemic further exacerbated the situation as the whole system became extremely risk-averse.

RBI, as the central bank of the country, has taken significant measures to ease liquidity in the system. These measures have dramatically improved the liquidity in the system and most of the creditworthy borrowers are now able to borrow. However, the scars from the liquidity challenges are visible on the balance sheet of most of the financial institutions, especially NBFCs.

Satin is no different. It has taken extra measures to ensure that there is sufficient liquidity. It has a positive ALM for multiple quarters and also carries a significant amount of approved but undisbursed sanctions. The high capital adequacy of the company also gives comfort for future borrowings. These

factors have mitigated concerns about liquidity for Satin.

As of FY 21 Q2, Satin had liquid cash of 1,962 Crs along with approved and undisbursed credit lines of 1,000 Crs. This is more than enough liquidity for Satin.

Valuation

Company is currently trading at the following metrics:

Trailing twelve month number reflects significant provisions company has made in the last 3 quarters on account of Covid-19. We expect that the provisions on account of Covid-19 will continue for a few more quarters. Once the industry has better visibility on how MFI borrowers will behave, we can handicap the provision requirements.

For our valuation purposes, we have assumed that FY 21 will be a washout. We also assume that the cost of provision will continue into FY 22. However, our crystal ball is quite hazy for FY 22. Hence, our valuation of Satin is based on our expectation that the business normalizes in FY 23.

To be conservative, we have assumed that the business generates 200 Cr of PAT in FY 23. A similar amount of PAT was generated in FY 19 when Satin had lower amount of capital. We also assume that a business like this should trade at a multiple of at least 8x Price to Earnings. Hence, the market value of Satin could be 1,600 Cr in FY23.

Assuming that the Rights share are fully paid up and there is no need of additional dilution (as company has high capital ratio), we get an expected value of 222/sh.

From current price of 72.5/sh to an expected value of 222/sh would be a 3.0x in 2.5 years or a cagr of 56%.

Risks with the thesis

Apart from competition, which is always present in any industry, some of the key risks with the thesis include:

Lending business

Satin is in the business of lending money. Most of the surprises in lending are negative. New regulations from the regulators, black swan event like demonetization and loan waiver by government are some of the event risk with the thesis.

These risks have been accentuated by the current Covid-19 crisis and the uncertain economic trajectory for the future.

Unsecured lending – MFI

MFI caters to the low income group. Loans are given without any collateral. Thus there is a risk that these borrowers are not able to service their loans and lenders will not have any recourse to get their money back.

MFI lending practices have evolved over the last decade to significantly reduce the risk of defaults in this segment. All lending is done through SHG and JLG which means that multiple people are responsible for the loan. In addition, no borrower can take more than two loans. Lastly, credit data is now available for the borrower. Hence if a borrower defaults they are cut out from the formal lending channels (and the benefit of lower interest rates) for a long time. Thus borrower has strong incentive to service the loan.

Management Risk

Satin has been founded by HP Singh and he is also the CMD. Thus HP has significant influence on the company and may not act in the best interests of the minority shareholders and the company.

Having observed HP through various crises and through the 30-year journey of the organization gives us the comfort that we are in good hands.

Overall

Satin offers a compelling case of:

- Heads we win with expected CAGR of 53% over the next few years.

- Tails we don’t lose much. Even, if some of the unexpected events were to materialize, there is enough Margin of Safety between the book value of the company and the price at which we are buying.

- Our assumption that PAT in FY 23 only goes back to what the company did in FY 19 strikes us as quite conservative. This is especially the case as management has expressed its desire to start growing the book. We expect this AUM growth will translate into a material earnings increase over the next few years.

- Applying a low Price Earnings multiple of 8x on future earnings is also very conservative. A low multiple will allow us to tide over any adverse developments.

Variant View

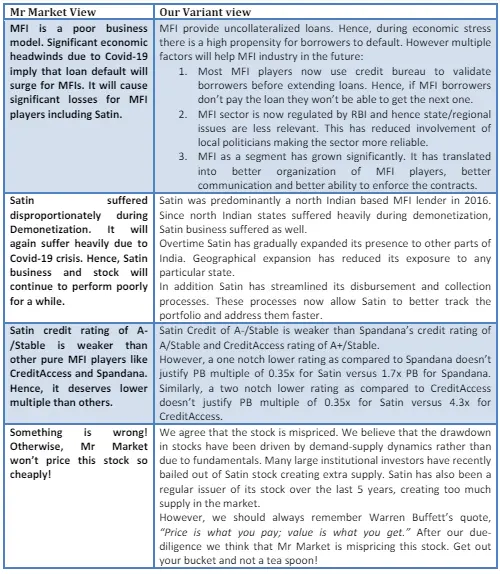

In this section we outline some of the reasons why Mr. Market is underpricing this company. We then provide our variant view of the same. This section has been put in the thesis to follow Charlie Munger’s dictum, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

While we don’t claim that we know the other side of the argument better the next person, we sure as hell do try

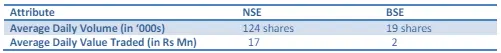

Trade Feasibility / Idea Practicality

The company’s current market capitalization is 554Cr or $75Million. The above market cap assumes a fully diluted share count after the rights issue has been fully paid. Satin is listed on both the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Additional details are provided in the table below:

There is reasonable liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi Advisors’ (DDA) and its employees/partners/clients have a position in the stock discussed.

- The stock discussed was for illustration purpose only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one per cent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the research report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.

- None of the employees/partners of DDA have ever served as an officer, director or employee of the subject company.

- Neither DDA nor its employees/partners have ever been engaged in market-making activity for the subject company.