Executive Summary

JM Financial (JMF) is an integrated and diversified financial services group. The Group’s primary

businesses include:

- Investment banking, wealth management and securities (IWS) which includes fee and fund based activities for its clients.

- Mortgage Lending which includes both wholesale mortgage lending and retail mortgage lending (home loans, education institutions lending and LAP)

- Distressed credit which includes the Asset Reconstruction (ARC) business

- Asset Management which includes the mutual fund (MF) business.

- Distressed credit which includes the Asset Reconstruction (ARC) business

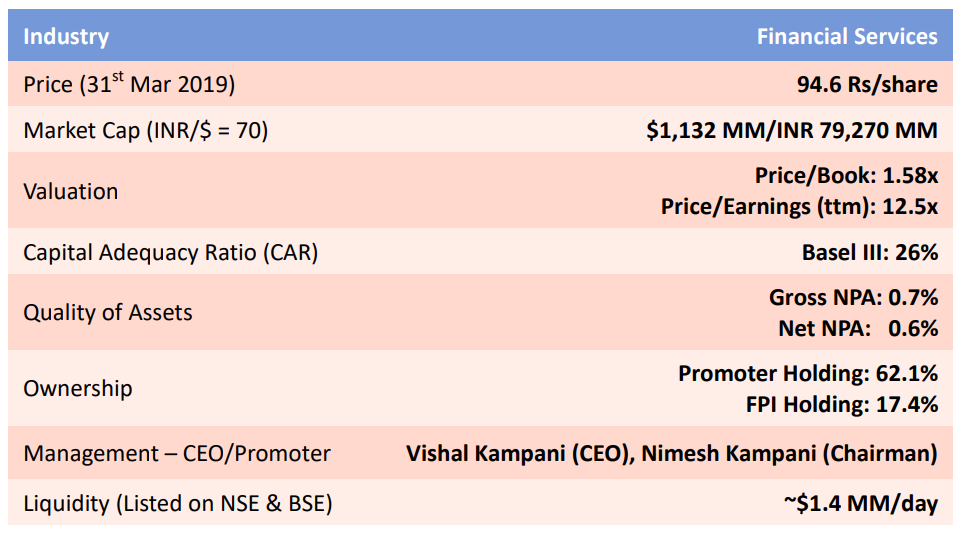

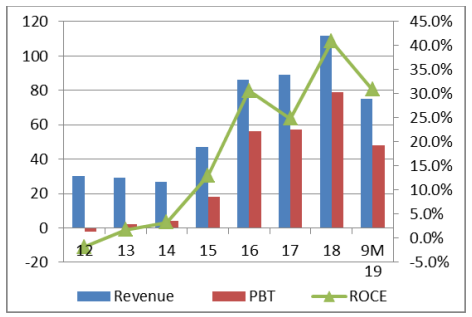

Over the last 8 years (from FY 10 to FY 18) JMF has delivered:

- Revenue growth of 23.5%.

- PAT growth of 19.5%.

- EPS growth of 17.8%

- ROE improvement from 10% to 16%.

Headwinds

In Sept 2018, Indian financial system had a mini Lehman moment. One of the biggest infrastructure

NBFCs in India (ILF&S) went from being rated AAA to Default. ILF&S had loan book of more than

100,000 Crores ($15 Billion) and its debt was quite widely held in the financial system. Overnight,

liquidity disappeared; NBFCs found it hard to raise funds; NBFC valuation were re-rated in the

market; and, the question became who is next! L&FS episode also highlighted an important chink in the armor of NBFC – their ALM (Asset Liability

Mismatch) with short-term funds being used for long-term lending. Current situation

IJMF is a conservative firm. Since the crisis, it has taken multiple steps

Read moreCurrent situation

JMF is a conservative firm. Since the crisis, it has taken multiple steps:

- Reduced the loan book in Q3 FY 19 and paid off some of the debt.

- Consequently, brought down leverage and profitability in the lending business.

- JMF now has Debt:Equity of 2.2x and CAR (Capital Adequacy Ratio) of 26%.

- Slow-down in capital markets has lowered profitability in IWS business.

Management

JMF was founded by Nimesh Kampani (currently the non-Executive Chairman). Nimesh’s son, Vishal Kampani – graduate of London Business School – is now the MD and CEO of JMF. Vishal has been with JMF since 1997 and was promoted to MD in 2016. He has spent a lot of time in the tranches building out various businesses of JMF before being elevated to MD. Kampani family owns 62.1% of the company. Foreign Portfolio Investors (FPI) own 17.4%. High insider ownership along with past behavior of management gives us comfort that minority investor’s interests are aligned with that of the management.

Valuation

JMF currently trades at 94.6/share. Our sum-of-parts calculation gives a conservative valuation of

132/share (Institutional investors paid 162/share in February 2018 to buy a piece of the company).

Hence, we think that there is a 40% upside from the current price. We think this gap of 40% should

get bridged in the next year because:

- Growth will come back in lending business as liquidity concerns fade.

- Distressed assets (Asset reconstruction) business is in a sweet spot where a lot of distressed assets are getting resolved. Their biggest holding – LeelaVentures – was bought by Brookfield in 19 Q4 and should provide a good trigger for profitability.

- IWS business should regain momentum after national elections in May 2019 as capital

- markets activity picks up as uncertainty abates.

Basic Facts

Company Background

JMF origins go back to 1973 when it was founded by Nimesh Kampani. Through multiple name

changes and tie-ups, company has evolved to its present form. Some of the key events in the history

of the company include:

| Year | Event |

|---|---|

| 1973 | Company was founded |

| 1998 | Joint Venture with Morgan Stanley |

| 2005-6 | Preferential issue of shares to Tiger Global, Blueridge and Azim Premji |

| 2007 | Separation from Morgan Stanley |

| 2014 | Partnership with Vikram Pandit – ex CEO of Citibank – for real estate lending subsidiary (JMFCS) |

| 2018 | Raised 650 Cr through QIP at 162/share |

| 2018 | Raised 825 Cr in JMFCS at 2.7x P/B (post raise) |

Business Evolution

JFM was primarily a fee based business which started as an advisory firm to its clients. Company has

kept the strong roots in advisory and added new segments. From FY 10 to FY 18 JMF has delivered:

- Revenue growth of 23.5%

- PAT growth of 19.5%

- EPS growth of 17.8%

- ROE improvement from 10% to 16%

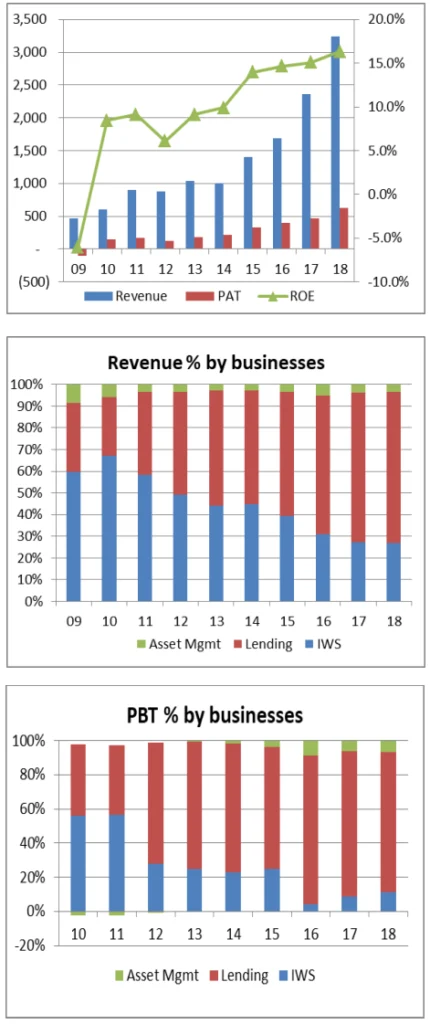

This steady growth has been possible as

company has built out new businesses which

have grown well. The key segment is the

lending business which has grown from

contributing 30% of revenue in FY 09 to

almost 70% in FY 18.

Lending segment in these charts also contains

the ARC (Asset Reconstruction) business

which has become a meaningful business in

itself.

Its original business of IWS (Investment

Banking, Wealth Management and Securities)

business now constitutes a much smaller

portion of the overall revenue.

Asset management contribution has also

come down.

Importance of lending business becomes even

more pronounced when we look at its

contribution in PBT. From 45% in FY 10 it now

contributes 80%.

Asset management business has turned

around and has become profitable.

Lastly, IWS business contribution has become

a lot more subdued as other businesses has

helped drive the growth of the firm.

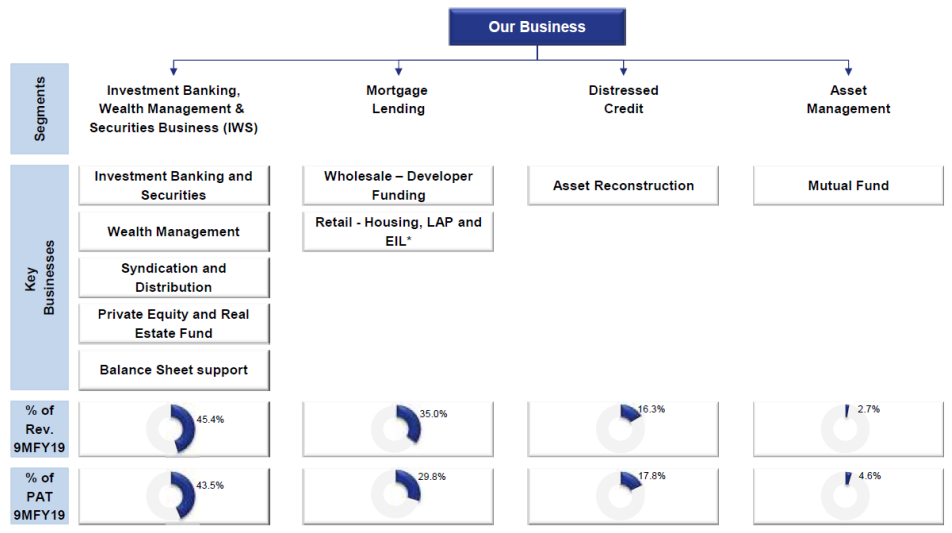

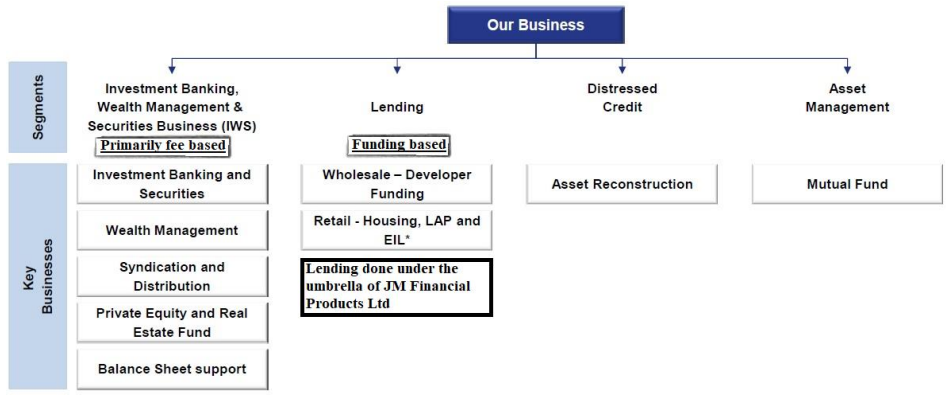

Business Segments

We will now take a deep dive into the various segments of the company to understand this company

better.

Source: JMF Presentation Q3, FY 2019

Above chart shows the various segments and their contribution in the first nine months of FY 19. In the above chart company has added both the fees and fund based activities of its IWS clients. Separating out the fund based activity in its own segment, in our view, aids in understanding the business. Hence, we have moved around one of the business contribution (JMFP – JMF Products) from IWS to Lending to aid in our understanding. The adjusted business segments looks as below.

Lending Segment

Company provides lending in the following verticals:

- Wholesale construction financing to Real estate developers.

- Structured finance / corporate lending to Corporates.

- Capital markets lending to high net worth clients.

- Retail Mortgage lending to individual and SME (Small and Medium Enterprise) clients.

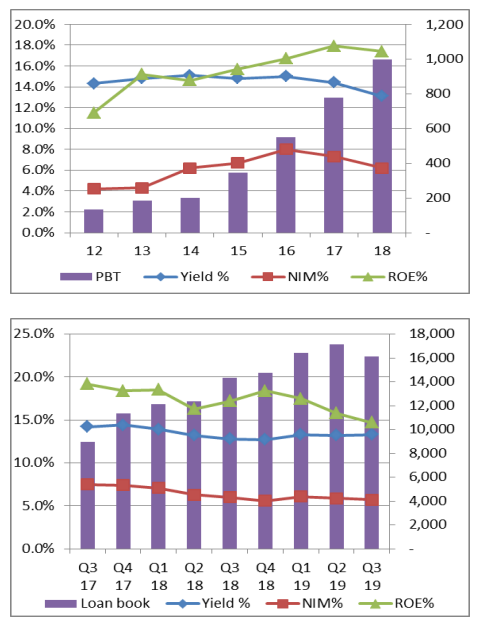

Lending book has grown from 2,000 Crores in FY 12 to 16,000 Crores in the latest quarter. This fast growth has helped drive the profitability of the business.

Yields and NIM (Net Interest Margin) have fallen in the last few quarters and years as company has increasingly focused on higher collateral and better quality loans.

Though ROE has held up well till FY 18, it has started to come down in the last three quarters of FY 19. This is because management has taken a conservative stance in the recent market dislocation and de-grown

the loan book.

Liquidity in the financial system became very tight during the recent market dislocation. Many NBFCs struggled to fulfill their obligation to their clients. However, steps taken by the company enabled it to tide over

the recent crisis. These moves have also reduced the company leverage to a very conservative Debt:Equity of 2.15x.

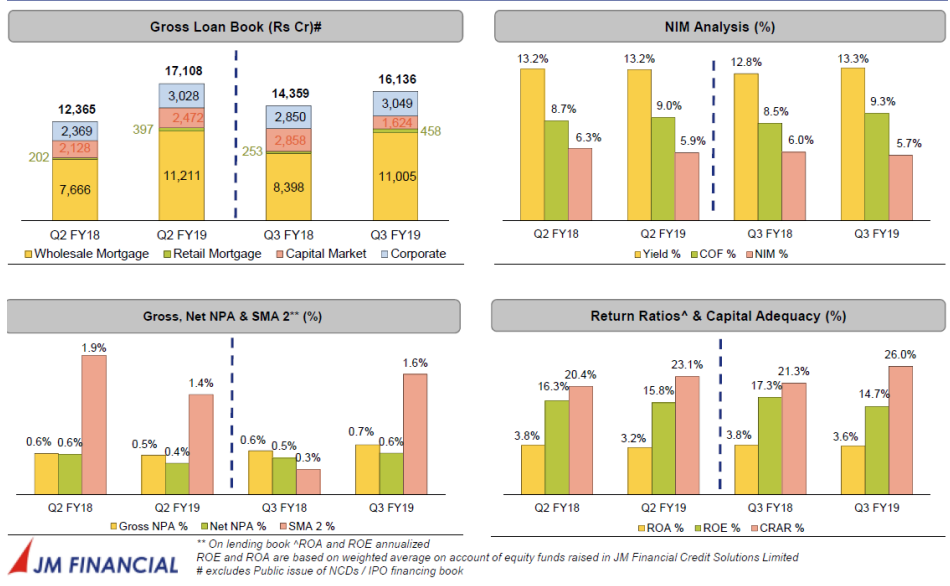

Lending Book Profile – Ind as

Source: JMF Presentation Q3, FY 2019

Lending to real-estate developers is the biggest constituent of its loan book. This is also the highest yielding loan book for the company. Corporate loan is the second largest and is a mix of structured finance and promoter finance. Corporate loans are primarily originated in the IWS segment. Capital markets comprise of margin finance and loans for IPO and NCD issues. Retail mortgage is a recent

vertical for the company and it will take a while for this is to get built out.

Company follows very conservative lending practices. This has translated into a very high quality of loan book with GNPA (Gross NPA) of 0.7% and NNPA (Net NPA) of 0.6%.

High capital adequacy of 26% (versus RBI mandated 15%) gives company a long runway to build out its loan book without having to raise new equity.

68% of the sources of fund are long-term thus allowing company to maintain duration of assets with

duration of liabilities.

We will take a deeper dive into the 2 entities that drive the bulk of lending business:

- JMF Credit Solutions (JMFCS) – Real-estate developer finance

- JMF Products (JMFP) – Capital markets, Corporates, Retail & overflow from developer finance.

JMF Credit Solutions (JMFCS)

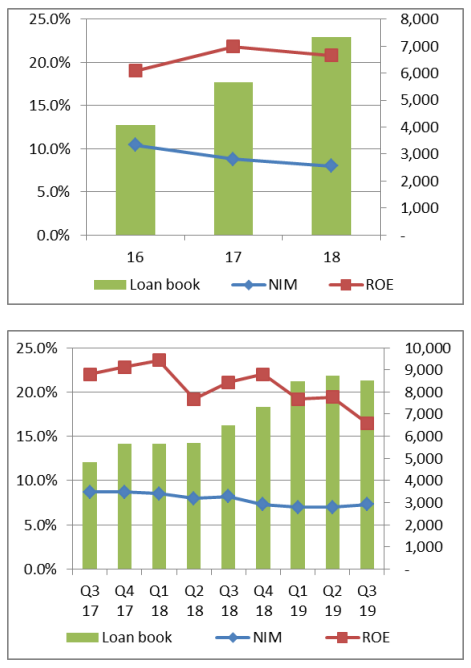

JMFCS is primarily engaged in the business of

extending wholesale credit to developers of

real estate projects. Over the last 2.5 years,

JMFCS loan book has more than doubled and

it has translated into similar growth in

profitability.

ROE has come down in the recent quarters as

company raised capital and reduced loan

book to manage the liquidity crisis.

JMFCS raised 875 Crores in 2019 Q2 valuing

itself at 7,175 Crores which implied a

valuation of 2.7x Price / Book (post raise).

Post the raise Debt:Equity has come down to

2.15x and Capital adequacy has gone up to

30.3%.

JMFCS has high asset quality with GNPA of

1.02% and NNPA of 0.93% in FY 18. 85% of

loan book is secured by cash flow of projects.

JMFCS is rated AA by rating agencies in India. Parent (JMF) owns 47.13% of JMFCS.

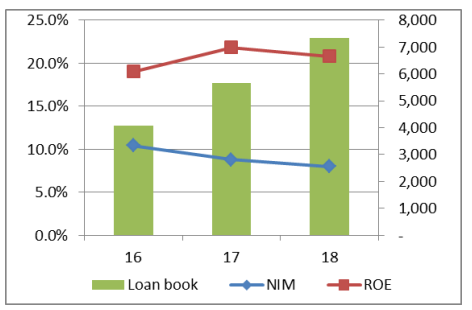

JMF Products (JMFP)

JMFP is in the business of lending to multiple

segments:

- Structured finance/ corporate lending to corporates

- Capital markets lending to high networth individuals, retail and wealth segment clients.

- Extend large sized loans to real estate developers.

JMFP is in the process of building out its Retail lending segment. Retail segment will provide loans to SME (Small and Medium Enterprise) as well as housing finance to individual clients through a wholly owned subsidiary of JMFP, JM Financial Home Loans Limited (JMFHLL).

In the last 2.5 years JMFP has doubled its loan book and profitability has moved in tandem with the loan book.

ROE has come down in the recent quarters as JMFP is focusing on secured book resulting in lower NIM. In addition, reduction of loan book in Q3 reduced profitability and hence ROE. Leverage in Q3 FY 19 is down to 3.9x (vs 4.4x last year).

JMFP continues to have pristine asset quality with GNPA of 0.26% and NNPA of 0.23% in FY 18. JMFP is rated AA by rating agencies in India. Parent (JMF) owns 99.35% of JMFP.

Distressed Credit (ARC) Segment

JMF ARC was established in 2008. Overtime regulatory changes have enabled ARC to play a crucial role in resolving distressed assets. Recent regulatory developments streamlining insolvency and bankruptcy proceedings and the regulatory framework around distressed assets in India, are providing attractive opportunities for the acquisition and resolution of distressed assets from banks and other financial institutions at competitive prices.

These changes are providing stronger tailwind

to bigger ARCs like JFM ARC. Hence, JMF ARC

AUM has grown a lot.

JM’s share of AUM has grown as it has taken

higher AUM for itself due to deals being done

primarily in cash and due to better

opportunities in this space.

ARC revenue and profitability varies a lot y-o-y

based on resolution of assets. Hence, this

business behaves more like a private equity

business.

As IBC resolution picks up pace we expect ARC

PAT to improve significantly. Biggest asset of

ARC – LeelaVentures – has been bought by

Brookfield in 19 Q4 which should drive

profitability in Q4.

ARC raised 280 Cr in FY 18. JMF ownership of

ARC increased to 57.1%

JMFARC is rated AA-

Investment Banking, Wealth management and Securities (IWS) Segment

The investment banking and securities business includes management of capital markets transactions, advising on mergers & acquisitions, and private equity syndication. IWS also provides investment advisory and distribution services, involving equity brokerage services, wealth management and distribution of financial products. This segment also includes the institutional equities business.

In FY 2019 JMF changed its reporting so that

all lending to IWS clients was included in IWS

business. For our purposes, however, we have

kept lending from JMFP as part of the lending

business

Business performance varies from year to

year as sentiment in capital market changes.

Business was muted in FY 12-14 as capital

markets were in doldrums. During FY 15-18

business performed well as capital market

sentiment improved. Results in 9M FY 19 are

however weak due to prevailing sentiment in

capital markets

Wealth management AUM has grown well

providing stability. Wealth management is a

fee based business and the yields are not very

high.

Alternatives business (Private Equity and Real

Estate fund) AUM has shrunk.

Brokerage business is a highly competitive business and company has lost market share. IWS has these multitudes of business in one segment

to provide a bouquet of services to its clients. This allows for stickier relationships with their clients.

Asset Management (MF) Segment

In this segment, company offers mutual funds to cater to the various needs of its customers.

Asset management business has transformed

from primarily being a Debt business (in FY

12) to primarily an equity business (FY 18).

Since equity mutual funds earn higher fees

from its customers, even though the AUM has

been flat over the last few years, revenue has

continued to improve.

Higher revenues have also translated into

higher profitability. Since this business doesn’t

need much capital, ROCE has also improved

with profitability.

JMF MF market share is around 0.5%. Their

primary target segment is the high net-worth

and corporate customer. They are looking to

grow the AUM without sacrificing the

profitability.

JMF owns 59.5% of the asset management business.

Having looked at the various business segments in depth, let us turn our attention to the management of the company.

Management

Management is a critical factor in the success of any investment. In an industry like finance, where

leverage magnifies management actions, choosing the right management becomes critical

Nimesh Kampani (Non-Executive Chairman)

Nimesh Kampani is one of the eminent deal makers of India. He laid the roots of the current day JMF by starting an investment bank in 1972. Since then, and many deals later, it has evolved into a strong financial services firm in India.

Nimesh is held in high regard in the industry.

Vishal Kampani (MD, CEO)

Vishal is son of Nimesh. He did his MS from London Business School and joined JMF in 1997. In 2016 he was promoted to MD and CEO.

Vishal has worked in the trenches in various businesses of JMF and has been the driving force behind many others. He is extremely hands on and his interaction with analysts and media gives us a lot of comfort that we are in good hands.

Board of Directors

JMF has strong BOD with 2 Promoter-Directors (mentioned above) and 6 Independent Directors (ID).

All IDs are of high repute.

- E A Kshirsagar: ID. Specialist in corporate structure and strategy

- Dr Vijay Kelkar: ID. Former Finance Secretary, GOI. PhD Univ of California, Berkeley

- Darius Udwadia: ID. Founder partner Udwadia & Udeshi, Solicitor & Advocate

- Keki Dadiseth: ID. FCA. Former Director, Unilever PLC

- Paul Zuckerman: ID. Fmr Chairman, Warburg & Co

- Jagi Mangat Panda: ID. MD Ortel Communications.

What we like about the management?

- Management incentives are aligned with that of the shareholders as management owns 62% of the company.

- Management is highly conservative. This is demonstrated through:

- Low leverage (2.2x) and high capital adequacy (26%).

- High asset quality (GNPA 0.7%, NNPA 0.6%).

- Management shrunk the business when cash and asset cover started coming down in the lending business due to competition.

- Management takes write-downs quickly and through P&L, rather than reserves

- Management has long-term mindset

- High level of transparency in reporting and through conference calls.

- Comment from 19 Q2 CC, “we are building this business for decades and not for the next quarter.”

- Strong next level leadership

- Each business segment has a clear leader.

- Leaders of business in place for many years.

- Equity culture to align incentive (employee owns 3%-4%).

Valuation

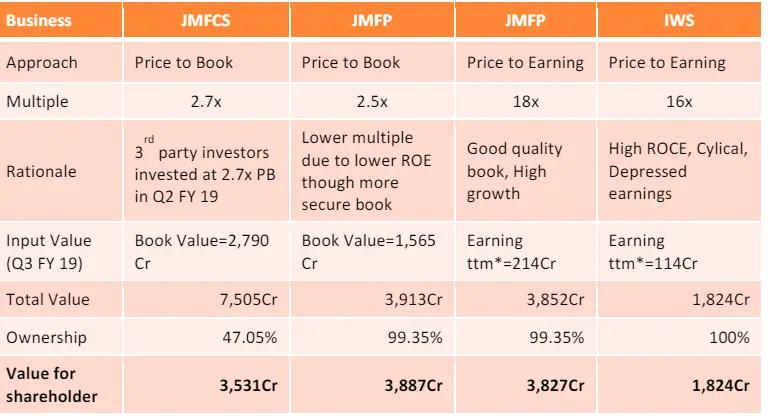

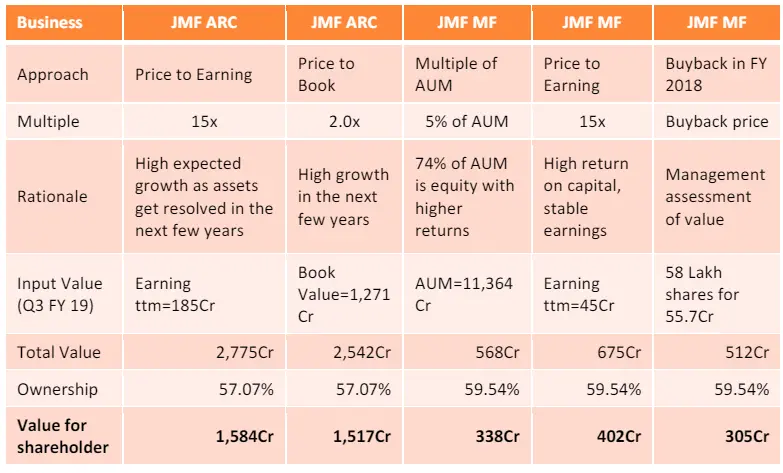

We will value JMF using a sum-of-parts valuation since many different businesses exist. For some businesses we use more than one approach and then use the average.

The current price of 94.6/share is significantly lower than the intrinsic price of 132/share. This gives us an upside of 39.8% in the short term.

We expect this gap (current price of 94.6/share) from intrinsic value (of 132/share) should close over the next year for the following reasons:

- Lending business (which slowed down for most of FY 19) will pick up pace in FY 20 as liquidity conditions ease.

- IWS business has been muted as Capital market sentiments are depressed. We think to post the national election in India in 2019, capital market sentiments should improve.

- ARC business is expected to do many resolutions which should drive profitability.

- Besides, as banks are under ongoing pressure to address distressed bank loans they will continuously provide new supply of distressed assets.

Risks with the thesis

Apart from competition, which is always present in any industry, some of the key risks with the thesis include:

Liquidity situation

JMF along with many others in the industry slowed down loan growth as liquidity vanished from the markets. We think that liquidity situation should ease and many of these institutions will go back to start making loans.

We are starting to see liquidity already ease out in the system. RBI has already provided one rate cut in Q4. RBI is also very eager to ensure that credit is flowing in the system and NBFCs are a critical party of that system.

Real estate lending in JMFCS

Lending to the real-estate sector is currently going through a downturn. Many of the real-estate developers are struggling to sell their inventory. Lack of sales is slowing down cash-flows of builders and poses a potential risk to lenders.

We believe that JMFCS has been a conservative lender where they have lent out to developers in Bangalore, Chennai and Mumbai. They also have good cash-flow coverage on these loans and are unlikely to be impacted by the slowdown. Lastly, JMFCS raised money from marquee investors in Q2 FY 2019 at 2.7x price to book which gives us comfort that their book is good.

Conservative management doesn’t grab growth opportunities

In the earlier part of the thesis, we have mentioned that management is extremely conservative. One of the risks with the thesis is that management waits too long to disburse loans. In the interim, opportunities to give out the best loans with the highest yield pass away.

The long tenure of management in the financial services space gives us comfort that management will act when they see opportunities. Vishal (current MD) has built out the lending business and understands this space well.

Regulatory risk

After the liquidity crisis there were concerns about RBI coming up with tighter regulations for NBFC.vSo far we haven’t seen any new regulations (6 months since the crisis erupted). However, the concerns persist.

Given importance of NBFC in credit ecosystem, we think RBI is likely to take a calibrated approach in bringing any tighter norms for NBFC. In the interim, stronger NBFCs will be able to address the short term challenge and will be better positioned for the evolving landscape.

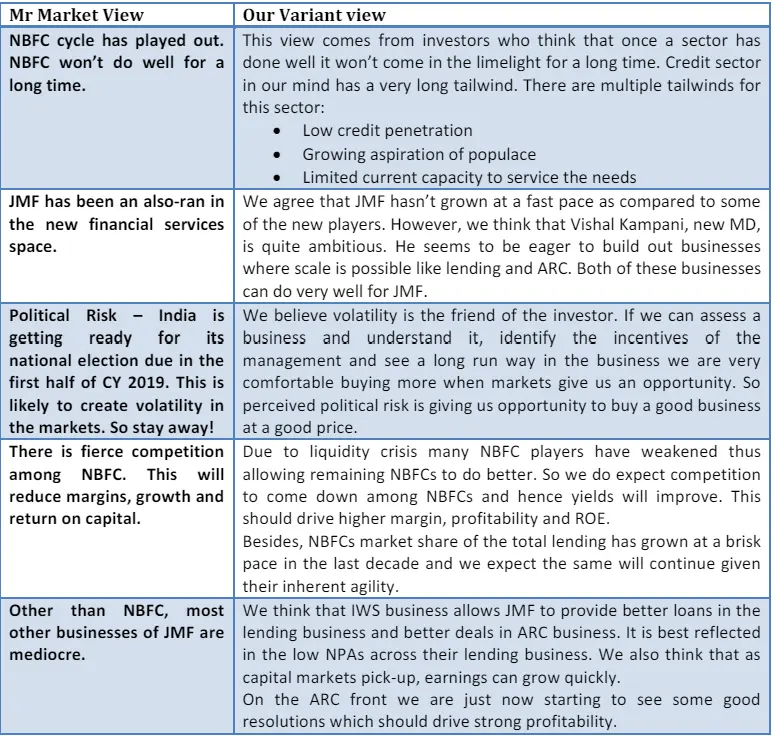

Variant View

In this section we outline some of the reasons why Mr. Market is underpricing this company. We then provide our variant view of the same. This section has been put in the thesis to follow Charlie Munger’s dictum, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

While we don’t claim that we know the other side of the argument better the next person, we sure as hell do try.

Trade Feasibility / Idea Practicality

The company’s market capitalization is 6,365Cr or $1,132Million. JMF is listed on both the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). On average, around $1.4 Million worth of shares trades every day across the exchange.

Thus there is enough liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- The content of this report is only for the information of the readers and is not to be construed as investment advice. Please consult your financial advisor before acting on it.

- We at DoorDarshi Advisors (DDA) along with our employees/partners/clients may own stocks mentioned in this report from time to time.

- I am registered as an Investment Advisor with SEBI

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one percent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.