Executive Summary

IIFL Finance was recently carved out from the restructuring of IIFL Group. The recent spin-off, antipathy towards NBFC (Non-Banking Finance Corporation), and, projection of the recent past into the future, are contributing towards creating an interesting opportunity.

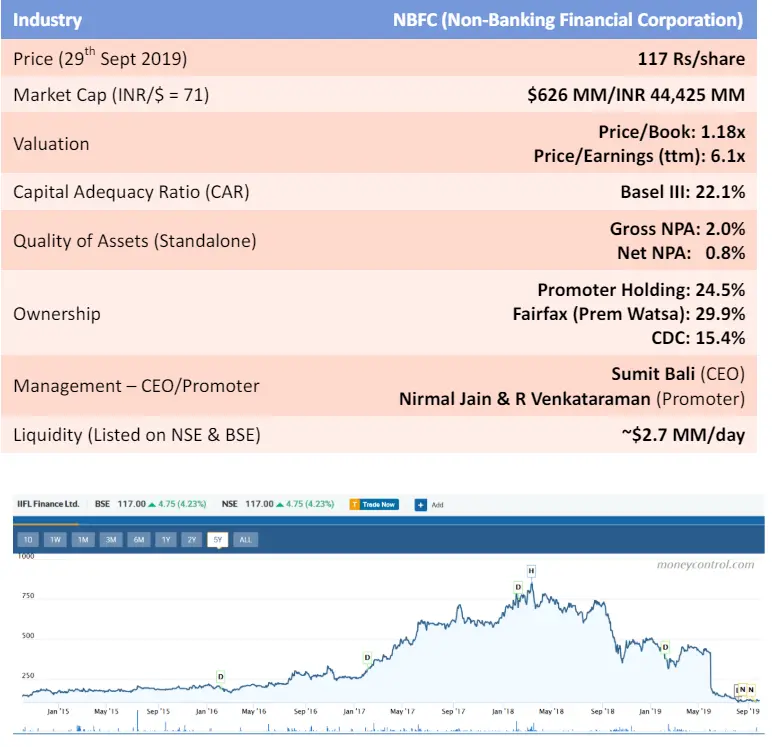

We have a company that as a combined entity has grown at 20%+ over the last 10 years, trading at 6-7x PE, 1.2x PB having normalized ROE of 15-17%. Founder management continues to own 25% of the company, has bought more recently, and, we are partnering with other marquee investors like Fairfax Holding (Prem Watsa) and CDC.

Headwinds

Since the default by one of the biggest Infrastructure NBFC firm in India (ILF&S) in Sept 2018, funding for all NBFC firms in India has declined substantially. Hence, many NBFC firms are struggling with Asset Liability Mismatch (ALM), deterioration in asset quality, plummeting growth rate and falling stock price (aka “The perfect storm”).

The road ahead

NBFC contribute 15% of the total credit provided by financial firms in India. Given stress in public sector banks, NBFC has been providing upwards of 25% incremental credit in the last few years. Liquidity stress in the financial system has reduced NBFCs ability to provide incremental credit.

Indian government and the regulators have announced various measures to mitigate the liquidity stress in the system. We expect that these measures will increase the flow of credit to NBFC and normalcy should return in FY 21.

Read moreIIFL Finance Businesses

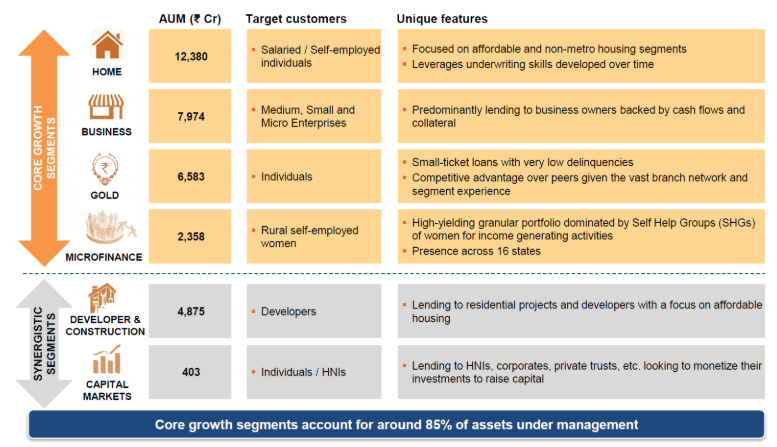

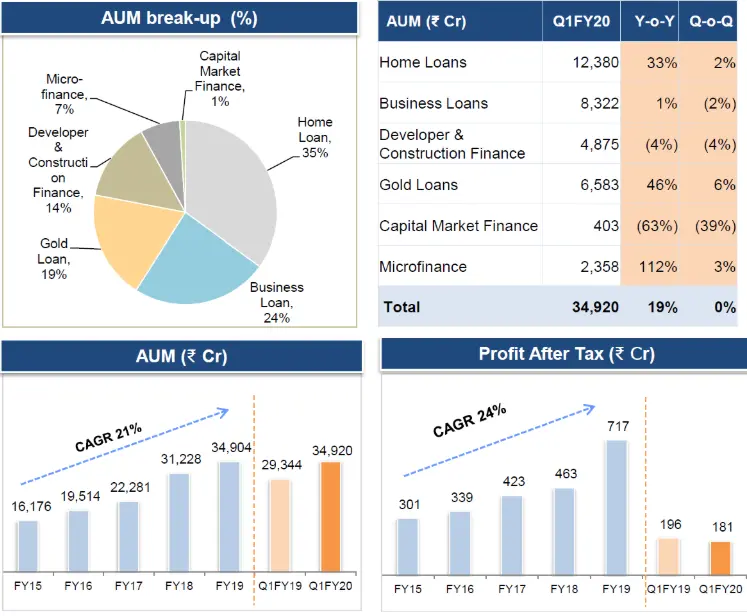

IIFL Finance has multiple business lines that provide a diversified loan book and flexibility to direct incremental capital into higher-yielding opportunities:

- Home loans (₹124 Bn): Focused on affordable and non-metro housing segments.

- Business loans (₹80 Bn): Focused on MSME segment backed by cash-flow and collateral.

- Gold loans (₹66 Bn): Small ticket loans to individuals against gold with low delinquency.

- Micro-finance loans (₹24 Bn): Focused on rural self-employed woman.

- Developer & Construction finance loans (₹49 Bn): Lending to residential projects and developers with a focus on affordable housing.

- Capital markets (₹4 Bn): Focused on HNIs, corporates, private trusts, etc. looking to monetize their investments to raise capital.

IIFL has consciously moved away from large ticket developer loan to more granular loans across the various segments. This allows them to securitize their loan book and raise liquidity. As of Q1 FY 20, of the total loan book of 349 Bn, 91 Bn was securitized.

Management

IIFL Group was founded by Nirmal Jain and R Venkataraman. From a standing start, Nirmal and Venkataraman have grown IIFL group to be worth more than 100Bn. In 2019 IIFL Group was split into three different entities and we are focusing on one of the entities – IIFL Finance.

Nirmal Jain is Chairman of IIFL Finance. Prem Watsa in 2016 letter of Fairfax India had this to say for Nirmal Jain, “And the founder, Nirmal Jain is an outstanding entrepreneur.”

Sumit Bali joined IIFL Finance as CEO of the company. He is MBA from IIM Ahmedabad and worked as head of the retail asset portfolio at Kotak Mahindra Bank.

R Venkataraman is Non-Executive Director of the company.

Ownership

We prefer investing in NBFC where management has significant stake in the company. Besides, we like prominent investors to be co-owners in the company. Both those criteria are met with IIFL Finance.

| Shareholder | Ownership* |

| Promoters (Nirmal Jain and R Venkataraman) | 24.5% |

| Fairfax Group (Prem Watsa) | 29.9% |

| CDC | 15.4% |

*Ownership reflects merger of NBFC subsidiary with IIFL Finance.

Valuation

IIFL Finance trades at 6-7x FY 19 and expected FY 20 earnings and 1.2x book value (Q1 FY 20). This is for a business which has good return on capital (normalized ROE of 15-17% and ROA of 2.3% in FY 19) and is expected to grow at CAGR of 10-15% over the foreseeable future. The group has a history of being nimble and has delivered 20%+ growth over the last decade.

Management seems to agree that it is cheap. In the current month, Nirmal Jain, Chairman, has bought 0.5 Million shares at around 115.5 Rs/share.

Asset Quality and Capital Adequacy

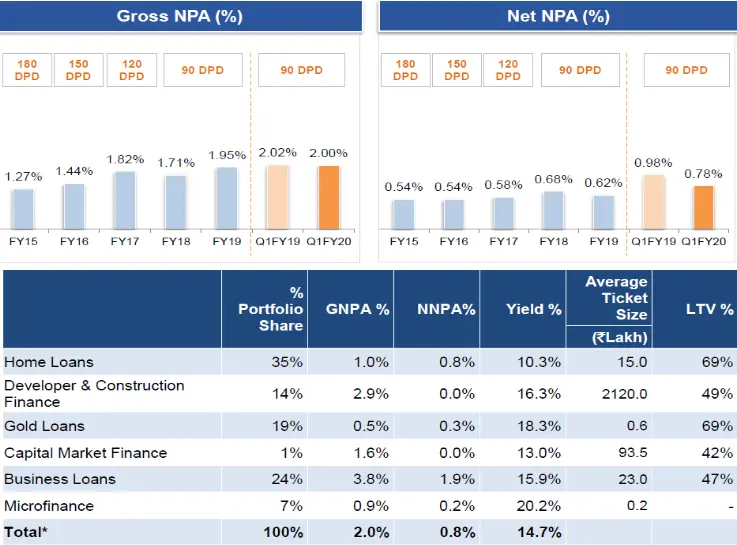

IIFL Finance has maintained superior asset quality with GNPA at 2.0% and NNPA at 0.8% as of Q1 FY 20. Under Ind AS (new accounting standard of India which mirrors IFRS), provision coverage (including standard assets provision) of NPAs was 131%.

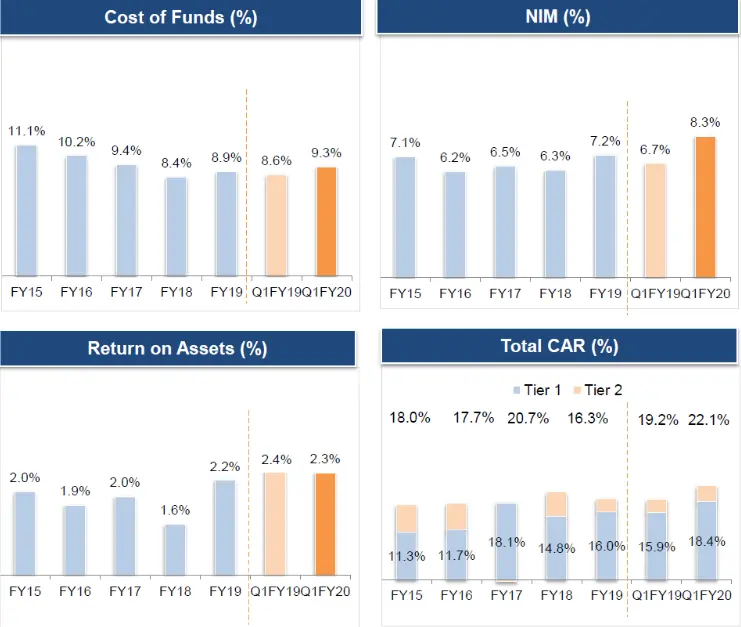

Company is well capitalized with total CAR (Capital Adequacy Ratio) of 22.1% including Tier 1 capital of 18.4% as against statutory requirement of 15% and 10% respectively. Given high capitalization we expect that company won’t have to raise new capital for the next few years.

IIFL Finance is rated AA (Stable) by ICRA and Crisil.

Basic Facts

Company Background

Founded in 1995 as an independent business research and knowledge provider, IIFL had evolved into a one-stop financial services solutions provider. In 2018 group decided to reorganize and list three separate companies for each of the core businesses; namely IIFL Finance (loans and mortgages), IIFL Wealth (wealth and asset management) and IIFL Securities (equities, investment banking, commodities).

The goal of the re-organization was to attract talent to grow faster and compete more effectively. Subsequently all three businesses have been listed in 2019. Stock market has given warm reception to the newly listed new entities – IIFL Wealth (up 10% since listing on Sept 19, 2019) and IIFL Securities (up 5% since listing on Sept 20, 2019) – while giving cold shoulder to the already listed NBFC (down 40% since record date for spinning off these two entities).

Business Overview

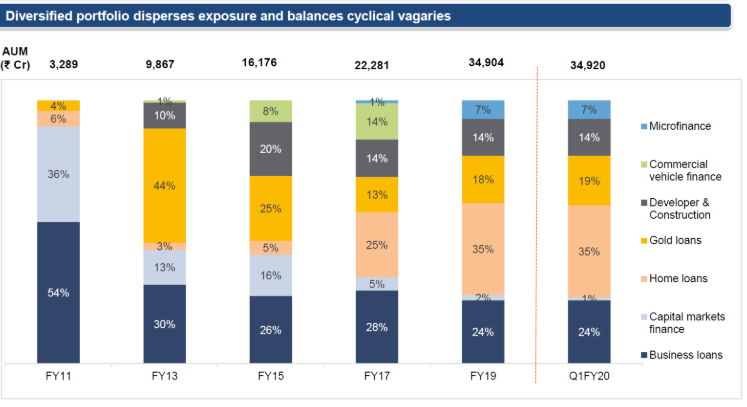

IIFL Finance provides financing to various segments of the economy. IIFL has added new products to its bouquet of offering to diversify its loan book and move from a wholesale focused operation to retail focused. Retail AUM is now 85% of the total AUM

IIFL Finance has continued to focus on its core growth segments which are retail oriented. This has allowed the book to become more resilient to the macro headwinds and has given flexibility to raise liquidity as needed by securitizing the assets.

Company has a well balanced portfolio of assets and most of these are secured assets (other than Microfinance). IIFL takes security in the form of collateral and the underlying cash-flow in case of business and developer & construction finance loans.

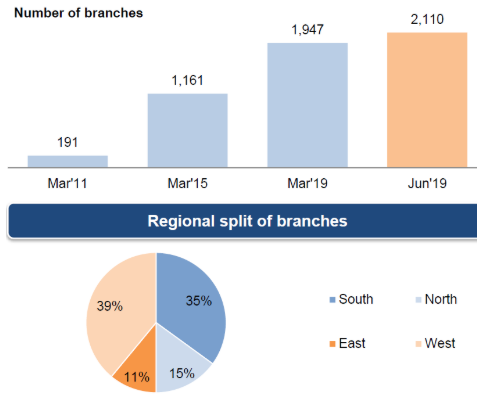

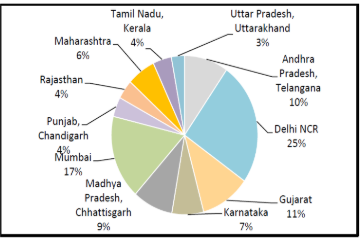

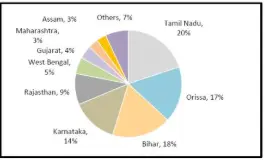

Company has grown its AUM by continuously expanding its footprint and now the branch network of

the company is well balanced across various regions of India.

Company uses its physical presence to cross-sell. As an example, company needs branch for the safekeeping of gold (provided as collateral against gold loans). Thus gold loan pays for the cost of branch while other loans are launched at minimal cost. This model allows company to have low Opex to AUM of 3.6% in FY 19 and 2.8% in FY 18. However, Opex to AUM is inflated in FY 19 as company expanded its branch network in FY 19 (from 1,378 in FY 18 to 1,947 in FY 19) and the full benefit of this expansion will be visible in the next few years.

End to end digitization of various operational and credit processes (sourcing, onboarding, credit underwriting, disbursal and monitoring/collection) have also enabled company to keep a tight leash on the opex costs besides delivering better credit outcomes.

Besides providing more loans from branches, company earns additional fee income by being distribution partner of various investment and insurance products.

Let us now dive into the key business segments of the company.

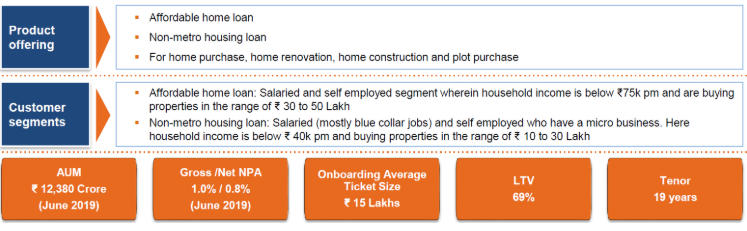

Home Loan

Home loan is the largest business segment for the company by assets. Loans in this segment are provided to the end users who have both economical and sentimental reasons to be current with their loans. Thus it has relatively low delinquencies and good asset quality.

Government of India (GOI) mission of “Housing for all” by 2022 has given a further flip to this segment. GOI provides subsidy – called CLSS (Credit Linked Subsidy Scheme) – towards interest cost for buying affordable houses (targeted at the economically weaker section of the society). Thus many banks and NBFCs are getting into affordable housing finance including IIFL. IIFL customers have received subsidy of 7Bn under CLSS so far.

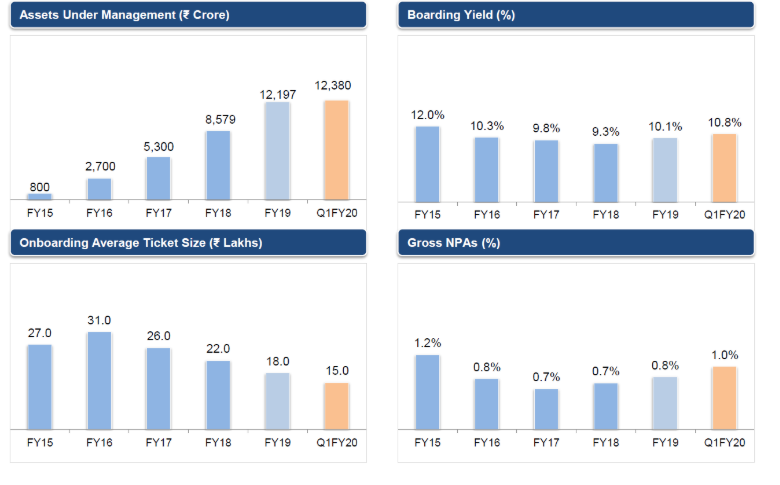

Average ticket size of home loans reduced from ₹ 3.1 million in FY 2015-16 to ₹ 1.8 million in FYv 2018-19. Reduction in ticket size is reflective of the fact that IIFL has gone into smaller cities and towns and reached out to the marginalized segment. Not only has this diversified their loan book across more customers (number of home loan customers has gone up from 31,000 in FY 17 to 215,000 at the end of Q1, FY 20); it has also made their loan book more compliant with PSL (Priority Sector Loans).

All banks are required to have certain percentage of their loans PSL compliant. If banks can’t disburse enough PSL compliant loans, they try to buy out these loans from firms like IIFL. Thus, IIFL portfolio of home loans has become more attractive to banks that are having a shortfall in meeting their PSL target. 57% of IIFL home loans are PSL compliant in Q1 FY 20 as compared to 25-30% at the end of FY 16.

Of the ₹124Bn loan book, ₹40Bn has been securitized/assigned for raising precious liquidity given the current market environment. This is up from ₹11Bn at the end of FY 18.

Home loan book is well diversified across various states of the country. Digital penetration in affordable home loans has reduced operational cost, improved credit outcome and reduced turnaround time. Digital penetration has increased from 5% in FY 17 to 49% in FY 19.

Below chart shows the progress of home loan business segment over the last five years.

Pristine asset quality with 1% GNPA, critical mass with AUM of 124 Bn, low average ticket size and reasonable yields, position this segment to be a growth area for the firm.

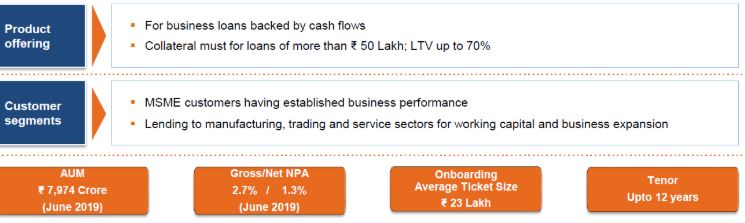

Business loan

Business loan is the second largest segment of the company by assets. Loans in this segment are predominantly given to business owners backed by cash flows and collateral. These loans focus on balancing prudent credit underwriting with instant in-principal decision and automated disbursements based on analytical scorecards.

39% of the business loans have been given in the Western region of the country while 35% have been given in the Northern region. East at 5% is the smallest region.

Lowering the Average Ticket Size (ATS) has enabled the company to get better yields as many of these MSME (Micro, Small and Medium Enterprise) have suffered from lack of credit. GNPA in this segment is higher than home loans and something we should track closely.

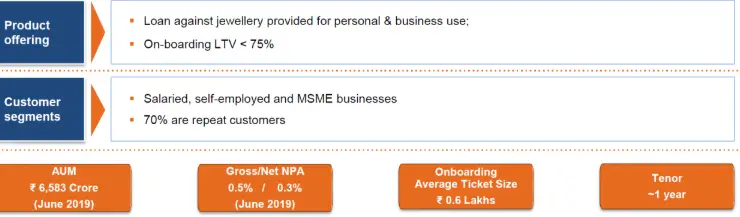

Gold loan

We find that Gold loan is one of the best forms of collateralized loan. Credit cost for these types of loans is under 1%. However, what determines success in this business is the operating cost of the business. We had in the past presented our thesis on Manappuram which is the second largest Gold loan lender in the country. More details on this business segment can be found in that thesis.

Company approves and disburses loans to its customers within 30 minutes of their walking into the branch. Sales executive uses applications deployed on tablet to screen customers for earlier defaults, frauds and negative customer lists.

As in the case of business loan, Western region is the biggest for gold loan with 42% contribution, followed by Southern at 22%. Eastern is the smallest at 14%.

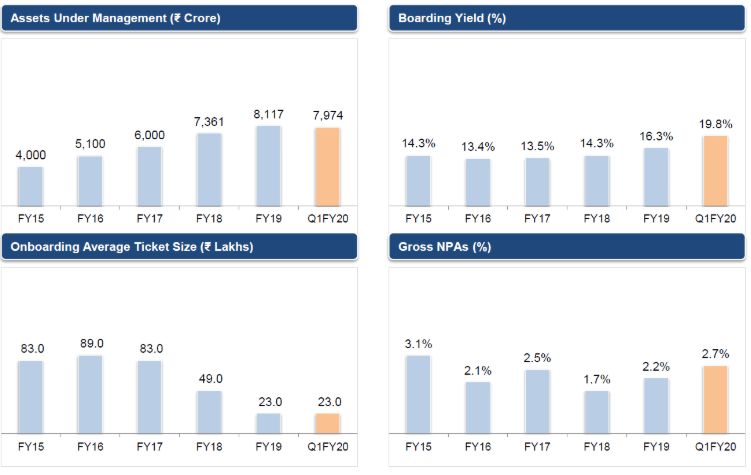

Company grew its gold loan book by 50% in FY 19 and so far Q1 FY 20 has continued to see good traction. As mentioned elsewhere, company looks to gold loan business for recovering the cost of setting up branches and then launches other businesses from these branches with minimal costs.

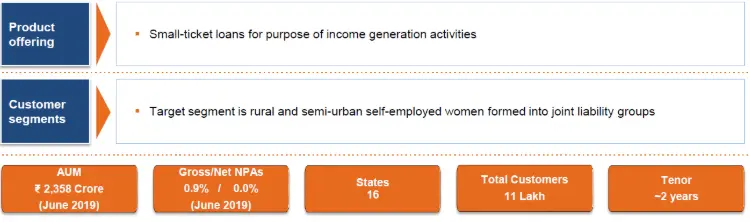

Microfinance loan

Microfinance is the only business segment in IIFL Finance which is not collateralized. Instead, company gives loan to a group of women which are organized as SHG (Self Help Group) or JLG (Joint Lending Group).

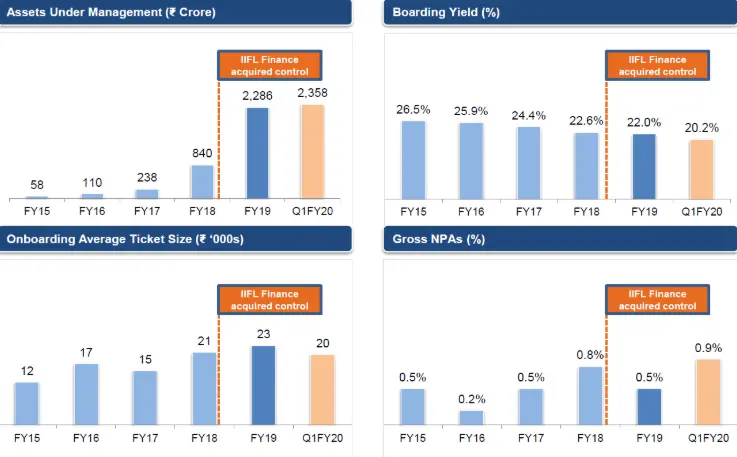

Company got into this business segment by acquiring a MFI (Micro Finance Institution) called Samasta MFI. Since its acquisition, IIFL has scaled up this segment and now it is among the top ten MFI in India.

Company loan book is diversified across various states with none contributing more than 20% of the book.

Yield of MFI portfolio has come down since Samasta’s acquisition by IIFL Finance. This is because of RBI regulation restricting MFIs from having a maximum interest spread of 10%. As the cost of funding has come down for MFI, yield on the portfolio has also come down.

Customer base of MFI loans is likely to graduate to larger ticket sized loans, like gold loans and affordable housing loans over time. All MFI customers also buy credit linked insurance coverage to avoid credit losses due to untimely death.

Consolidated View

Having looked at the key business segments, let us now focus on the overall business of IIFL Finance and how it has evolved over the last few years.

Company has a well-diversified loan book which is primarily retail focused (85%). It has been reducing the wholesale book which includes Developer & Construction Finance and Capital Markets Finance to make its loan book more robust. It has also moved out of Vehicle Finance and Medical equipment financing business in the last few years. It also moved into micro finance by buying an existing MFI, Samasta, and scaled it aggressively.

Despite this re-positioning, AUM has grown at a rapid 21% with a corresponding increase in profitability.

Any lending operation has to keep tight control of a few parameters to do well:

- Borrow at cheap rate

- Lend at reasonable rate and thus derive good interest spread and NIM (Net Interest Margin)

- Keep the operating expense of the operation tightly controlled in relation to AUM

- Keep a tight control on the credit quality of the asset

- Derive good Return on Asset from the above factors

- Using a reasonable leverage also get good Return on Equity

Company has made good progress on most of the parameters discussed above:

- Cost of Funds have come down though they went up again recently given tight liquidity situation.

- NIM (Net Interest Margin) has expanded.

- Leading to better Return on Assets

- With sufficient Capital Adequacy Ratio (CAR) to grow the business.

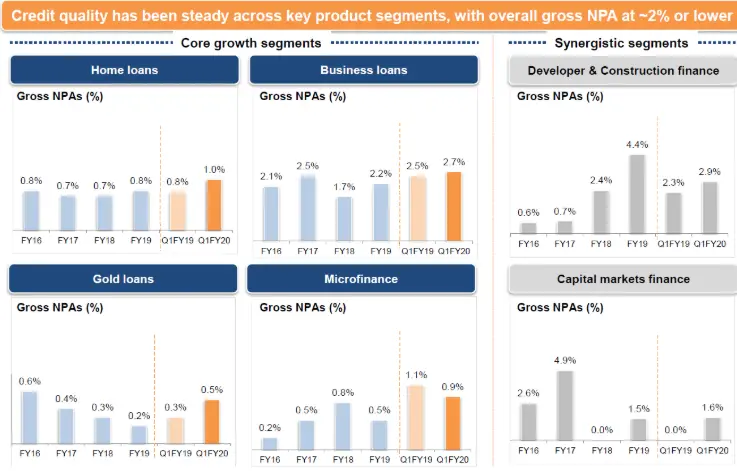

Given the “perfect storm” in NBFC space, company has so far good done a good job of maintaining its asset quality across business segments. However, we will be tracking NPA closely. GNPA has grown from 1.27% in FY 15 to 2% in Q1 FY 20. NNPA has grown from 0.54% in FY 15 to 0.78% in Q1 FY 20.

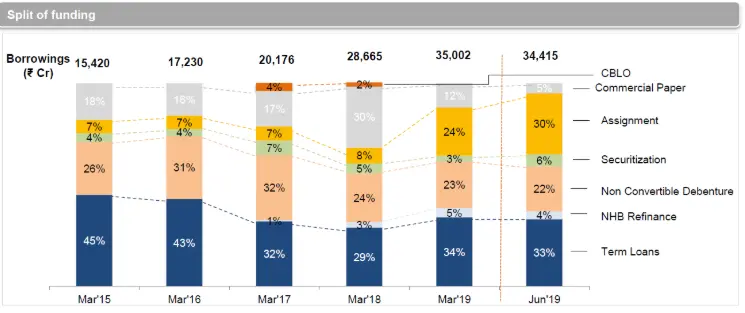

Finally we should look at the funding profile of IIFL and how its ALM (Asset Liability Management) enables it to tide over the current tight liquidity situation.

Company has reduced short-term funding to just 5% of the total need in Q1 FY 20 as compared to 32% in FY 18. It has filled this gap by assigning and securitizing its loan book. Assignment and Securitization (A&S) now constitute more than one third of the funding book. Company raised 130Bn of funding in the last three quarters through A&S. IIFL move to have 85% of its loan book focused towards retail has greatly aided in assignment and securitization.

Company also raised 45Bn of funding in the last three quarters from ECB (External Commercial Borrowing), NCD (Non-Convertible Debenture) and re-financing from NHB (National Housing Bank).

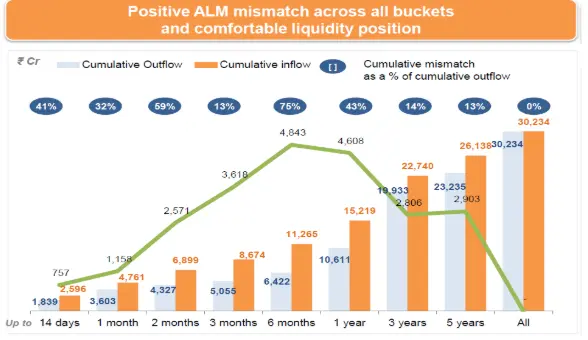

Last factor to consider is the ALM mismatch which has hurt many NBFCs during this crisis. IIFL has done a good job of having a positive ALM mismatch (inflow from assets exceeds outflow from liabilities) across all time buckets. This has allowed the company to grow its loan book while other NBFCs struggle to be appropriately funded for the upcoming liabilities. However, given the current environment, ALM mismatch has to be carefully monitored.

Valuation

We will value IIFL Finance using our forward return analysis framework. In this method we will project earnings a few years out and then apply reasonable multiples to come up with expected forward return.

PAT projection

- Company had consolidated PAT of Rs 804 Cr in FY 19. This PAT was inflated in FY 19 as company had a one-time pre-tax gain of 105 Cr from selling its Vehicle Finance business to Indostar.

- We expect PAT in FY 20 to be in a similar range as FY 19. Thus we are expecting that company PBT will grow by 105 Cr on a base of 1,000 Cr or approximately 10%. 10% growth rate is reasonable given current headwind in NBFC space.

- As we look further out into FY 21 and FY 22, we expect PAT to grow by 10% CAGR. This will be driven by:

- Headwinds currently prevailing in NBFC will abate as better liquidity becomes available to NBFC.

- Company is well positioned in high growth business segments. In the past, company had delivered a growth rate of 20%+ both in AUM and profitability and had expressed a desire to continue to grow at that pace.

- There will be additional tax benefit from the recent tax reduction on Indian corporates from 35% (including all cess) to 25%. We have not accounted for any gain that will come from these changes. Company tax rate in FY 19 was 29% and in FY 18 was 32%.

- Company won’t need to dilute equity to support 10% growth. Company has capital adequacy of 22.1% in Q1 FY 20. This coupled with the fact that company generates normalized ROE of 15-17% will allow it to continue growing at 10% without any need for outside capital.

- Assuming PAT grows at 10% CAGR in FY 21-22, PAT will be at 970Cr in FY 22. Applying a multiple of 12x, we expect company to be worth 11,670Cr by June 2022.

- In our mind 12x multiple is very reasonable for the following reasons:

- Company is expected to have reasonable earnings CAGR of 10% during FY 20-22.

- Company has normalized ROE of 15-17%.

- Company is owner operated and management is very passionate about the business.

- Company has a long runway ahead of it given the huge need for finance and the company moving into under-penetrated segments.

Expected Return

- Company’s current market cap is 4,350Cr (assuming merger of India Infoline into IIFL Finance and issuing of additional shares of IIFL Finance to existing holders of India Infoline).

- Above market cap accounts for dilution from ESOP that are currently outstanding.

- Thus market cap of 4,443Cr will grow to 11,670Cr by June 2022 which gives us an expected forward return of 42% CAGR.

Risks with the thesis

Apart from competition, which is always present in any industry, some of the key risks with the thesis include:

Lending business

IIFL Finance is in the business of lending money. Most of the surprises in lending are negative. New regulations from the regulators, black swan event like demonetization and loan waiver by government are some of the event risk with the thesis.

These risks have been accentuated by the current liquidity crisis in the market, real-estate slowdown (where IIFL Finance Developer & Construction Finance business segment has a loan book of 4,900Cr) and slowdown in the broader economy.

Unsecured lending – MFI

MFI caters to the low income group. Loans are given without any collateral. Thus there is a risk that these borrowers are not able to service their loans and lenders will not have any recourse to get their money back.

MFI lending practices have evolved over the last decade to significantly reduce the risk of defaults in this segment. All lending is done through SHG and JLG which means that multiple people are responsible for the loan. In addition, no borrower can take more than two loans. Lastly, credit data is now available for the borrower. Hence if a borrower defaults they are cut out from the formal lending channels (with lower interest rates) for a long time. Thus borrower has strong incentive to service the loan.

MFI book of IIFL Finance is relatively small at 7% of the total loan book.

Management Risk

IIFL Finance has been founded by Nirmal Jain and R Venkatarman. Sumit Bali has joined as CEO from Kotak Mahindra Bank where he was heading Retail asset portfolio of the bank. While Nirmal and Venkataraman are old hands, Sumit is relatively new in IIFL Finance. Thus we will be monitoring progress of IIFL Finance closely.

We expect that Nirmal and Venkataraman will continue to be closely associated with IIFL Finance and guide the CEO. Besides, CEO, Sumit Bali, has long experience in similar space with a pedigreed bank – Kotak Mahindra Bank – and seems like a great hire to us.

Overall

IIFL Finance offers a compelling case of:

- Heads we win with expected CAGR of 42% over the next three years.

- Tails we don’t lose much. Even, if some of the unexpected events were to materialize, given that loan book is highly collateralized we don’t expect significant losses.

- Our conservative assumption of 10% growth rate in PAT should allow us to tide over sudden adverse development in asset quality.

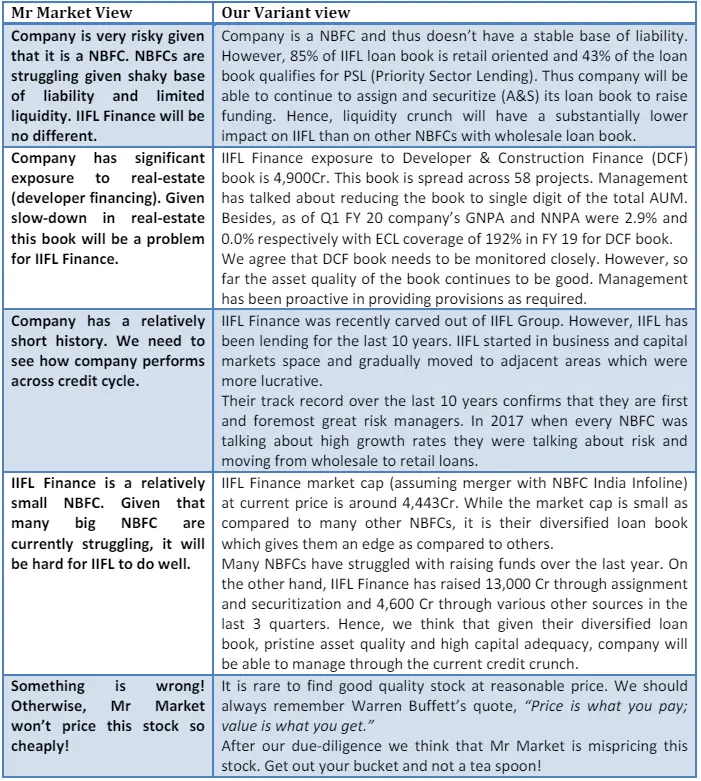

Variant View

In this section we outline some of the reasons why Mr. Market is underpricing this company. We then provide our variant view of the same. This section has been put in the thesis to follow Charlie Munger’s dictum, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

While we don’t claim that we know the other side of the argument better the next person, we sure as hell do try.

Trade Feasibility / Idea Practicality

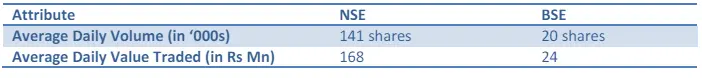

Company’s current market capitalization is 3,744Cr or $527Million. Market cap of the company will increase to 4,443Cr (at current prices) after merger with India Infoline (its NBFC subsidiary where CDC owns the stake) and the corresponding issue of new shares. IIFL Finance is listed on both NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Additional details are provided in the table below:

Thus there is enough liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi Advisors’ (DDA) and its employees/partners/clients have position in the stock discussed.

- The stock discussed was for illustration purpose only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one per cent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the research report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.

- None of the employees/partners of DDA have ever served as an officer, director or employee of the subject company.

- Neither DDA nor its employees/partners have ever been engaged in market making activity for the subject company.