Dear Investor / Partner

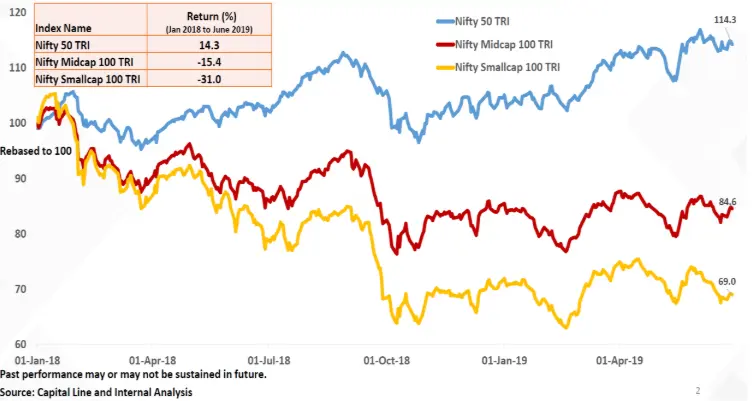

Since 2018, the Indian stock market has been a story of 2 caps!

- Small and mid-cap stocks: Nifty small-cap is down 31%, Nifty mid-cap is down 15.5%

- Large-cap stocks: Nifty 50 is up 14.3%

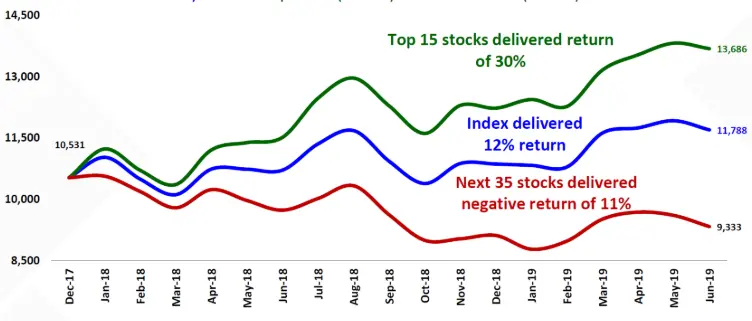

Even within the Nifty 50, only a few stocks have driven the performance.

While small and mid-cap indices have performed poorly, many individual stocks have seen worse performance. We think that these performances are being driven by investor psychology:

- Investors have taken 18 months of the pain and are ready to throw in the towel.

- Redemption from these portfolios is causing fund managers to sell these equities.

- Many of these stocks don’t have deep markets, so buying or selling pressure can move the stock wildly.

- Selling is begetting more selling thus causing stock prices to fall.

Future Expectations

For the first time in 5 years, we are starting to see select equities at mouth-watering levels. Our crystal ball is as hazy as ever. However, at current valuations, we think that the upside/downside ratio is squarely in our favor. This is the time to step up and take advantage of the opportunities that the stock market is providing us. Some of the key tenets that guide us as we step forward include:

- Management is paramount: We choose management with the same care that we choose partners in our business.

- Long-term orientation: We think a few years out when other market participants are thinking a few months (or worse a few weeks) out. Thus, we can wait patiently for the value to come to us rather than worry about the daily moves in the market.

- Pick the best risk/reward stocks from our investment universe: We force rank all our ideas and will pick the best among them as per our investment process. This process has done very well for us in the past.

- Select investor base judiciously: Our investor base understands the value of compounding and lets us follow our process. We are delighted with our investor base and we will continue to be selective as we work with the new ones.

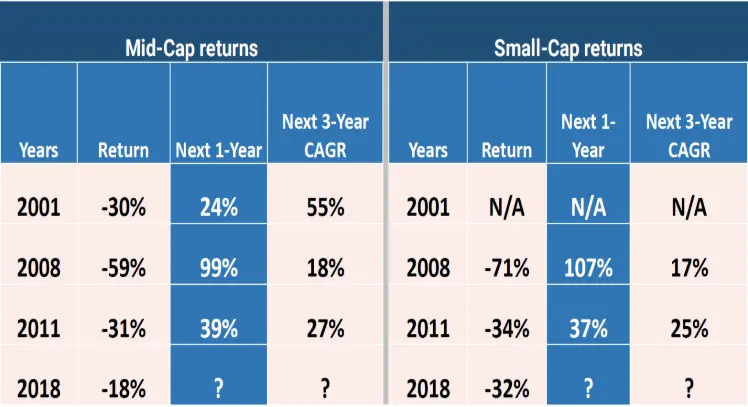

To finish up this missive, here is a table that shows how the mid-cap and small-cap indices have performed after a significant drawdown. While the past may not be a good predictor of the future, it is a good prologue. The key takeaway is: keep the faith!

Past performance may or may not be sustenance in the future.

Postscript: All charts and tables in this letter have been taken from Kotak Mutual Fund presentation on mid-caps and small caps

show less