Executive Summary

Indostar is an NBFC (Non-Banking Finance Corporation) promoted by private equity firm Everstone (with a total AUM of $5Billion). Indostar was incorporated in 2009 and was listed on a stock exchange in 2018 company came out with its IPO at 572/share in 2018 which was over-subscribed 6.8 times.

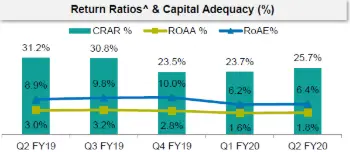

At a current price of 167.5/sh, the company’s market value is 1,545 Crs. This translates into ttm PE of 6.6x, PB of 0.5x, and Price to Adjusted Book of 0.55x. AUM over the last 5 years (from FY 14 to FY 19) has grown at 35% cagr. The company continues to be highly capitalized with CAR of 25.7% and Tier 1 of 23.8%.

Headwinds

Since the default by one of the biggest Infrastructure NBFC firms in India (ILF&S) in Sept 2018, funding for all NBFC firms in India has declined substantially. Hence, many NBFC firms are struggling with Asset Liability Mismatch (ALM), deterioration in asset quality, plummeting growth rate, and falling stock price (aka “The perfect storm”).

The road ahead

NBFC contributes 15% of the total credit provided by financial firms in India. Given the stress in public sector banks, NBFC has been providing upwards of 25% incremental credit in the last few years. Liquidity stress in the financial system has reduced NBFC’s ability to provide incremental credit.

The Indian government and the regulators have announced various measures to mitigate the liquidity stress in the system. We expect that these measures will increase the flow of credit to NBFC and normalcy should return in the later half of FY 21.

Read moreIndostar Businesses

Indostar has multiple business lines that provide a diversified loan book and flexibility to direct incremental capital into higher-yielding opportunities:

- Vehicle Finance (₹45 Bn): Focused on financing new and used CV (Commercial Vehicle) owned by individuals or small truck operators.

- Corporate Lending (₹36 Bn): Focused on providing loans to mid and large companies with products like promoter funding; mezzanine funding; real estate developer financing and structured and acquisition financing.

- SME Finance (₹19 Bn): Providing financing to SMEs (Small and Medium Enterprises) usually against cash flow and collateral.

- Housing Finance (₹7 Bn): Provides financing for home loans.

Indostar has been gradually moving its book more to retail loans (Vehicle Finance, SME Finance, and Housing Finance). Retail loans (in Q2 FY 20) constitute 66% of the total loan book as compared to 5% in FY 16 and 12% in FY 17. This increase in retail loans is aided by buying out the vehicle finance portfolio of IIFL in FY 19 and focusing on incremental lending in Vehicle finance.

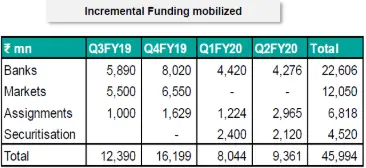

The higher proportion of retail loans allows Indostar to better securitize and assign these loans to the banks thus creating another source of funding in this tight liquidity environment.

Management and Owners

Indostar is majority-owned by Everstone and a clutch of other private equity firms. It is led by R Sridhar, a 30+ year veteran of the financial services industry. Sridhar was previously associated with the Shriram group and was Managing Director of Shriram Transport Finance (STFC) from 2000 to 2012. His deep experience with Vehicle Finance is ideally suited as Indostar pivots from wholesale lending to retail lending.

Sridhar, CEO, and Shailesh Shirali, WTD, along with most of the management team have been heavily incentivized through ESOP. Employees will own 8.5% of the total diluted shares of the firm on the exercise of ESOP.

Ownership

We prefer investing in NBFC where management has a significant stake in the company. In this case, both the promoter and the key employees own significant stake and their interests are aligned with those of the minority shareholders.

| Shareholder | Ownership |

| Promoters (Everstone and other private equity firms) | 60.74% |

| Employees (through ESOPs) | 8.50% |

Valuation

Indostar trades at ~6.6x FY 19 and expected FY 20 earnings. Besides Price to Book is 0.5x and the Price to adjusted book is 0.6x. ROE in the last 5 years has ranged between 9% and 14%. The low ROE of Indostar is a reflection of the infrastructure buildout over the last few years in its vehicle financing segment.

We believe that most of the heavy lifting to grow its vehicle finance business is now in place including branches, technology, and employees. As liquidity challenges subside, Indostar will be able to grow its AUM upwards of 15% – less than half of the historical rate. Given the operating leverage, earnings could grow at a higher rate than AUM.

At the current valuation, the stock is very cheap. Furthermore, accounting for future growth we think that the stock is compelling.

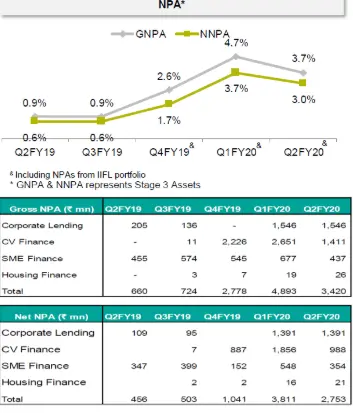

Asset Quality and Capital Adequacy

Indostar had maintained superior asset quality till FY 19 with a GNPA of 0.7% and NNPA of 0.5% without IIFL’s vehicle finance portfolio. However, the higher NPA of IIFL’s CV portfolio has since dented its asset quality with a GNPA of 3.7% and NNPA of 3.0% as of Q2 FY 20.

The company is well capitalized with a total CAR (Capital Adequacy Ratio) of 25.7% including Tier 1 capital of 23.8% as against statutory requirements of 15% and 10% respectively. Given high capitalization we expect that the company won’t have to raise new capital for the next few years.

Indostar is rated AA- (Stable) by various rating agencies.

Basic Facts

Company Background

Indostar was incorporated in 2009 and registered with RBI as NBFC in 2010. In the initial year’s company focused only on Corporate lending as it was much easier to scale up the operation in

Corporate lending. Starting in 2015 company started entering retail business segments like SME financing. In 2017, with the hiring of R Sridhar as its CEO, the company also forayed into Vehicle Finance which along with corporate lending will be the key driver of the business in the future.

Business Overview

Indostar provides financing to various segments of the economy. These include:

- Corporate lending

- Vehicle Finance

- SME finance

- Housing finance

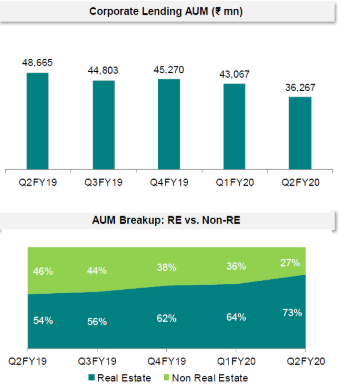

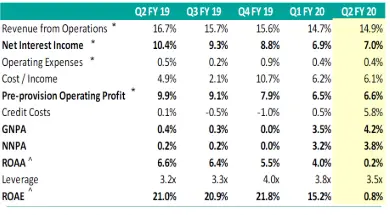

Corporate Lending

Corporate Lending was the first business segment started by IndoStar in 2011. In this business, the Company offers senior secured debt for developer financing, and structured lending to mid-large sized corporates across sectors. In developer financing, the Company lends for the construction of residential and commercial properties, with a typical loan ticket size of Rs 150 – 250 crores. The objective of structured lending is to provide efficient capital structures giving the desired flexibility to manage the cash flows and long term growth prospects of these companies.

All loans within the corporate lending vertical are secured by one or more of the following collaterals: fixed and current assets of the business, pledge of shareholding in the company,

promoters personal assets and personal guarantee etc.

Corporate lending AUM has come down in the last 12 months as Indostar has been focused on preserving liquidity and reducing concentration. Quality of the book can be gauged from the fact that company has actively participated in selldown of the book while the lenders have continued to prepay these loans. In the last 9 months, company has received pre-payments of Rs 2,796Crs. Company typically has many transactions with the same customer which gives comfort to both the sides.

AUM in this book has gravitated towards Real Estate over the last year as many of the non-Real estate loans have been paid.

Yields and NIM in Corporate lending book are quite comfortable. They have come down in the last one year as a prominent account of 155 Crs turned NPA in FY 20. This also worsened the asset quality which moved from 0% GNPA to 4.2% GNPA. It also impacted

return on assets metric.

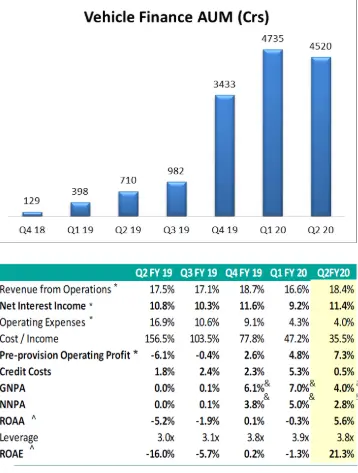

Vehicle Finance

The pre-owned commercial vehicles segment has been the focus area for IndoStar’s vehicle finance business. The key feature of this segment is that previously owned commercial vehicles are more affordable to buyers. As most of these buyers have limited banking habits and credit history for verification of creditworthiness, the risks associated with financing preowned truck financing are perceived to be very high.

The market penetration of organized financing for preowned CVs is quite low, with a majority of the market being served by private financiers within the unorganised sector, and borrowers are subject to exorbitantly high interest rates. Thus this segment provides an opportunity to do good for these borrowers while doing well for the organization. Company wants to be the organised lender of choice to small road transport operators (SRTO) having a fleet size of 2 to 5 vehicles.

Vehicle finance will be one of the core engines of growth for the firm going forward. AUM jumped in Q4 FY 19 as company bought out the CV finance portfolio of IIFL. This acquisition also helped the firm save on 2 years of infrastructure build out in vehicle finance business though it hurt the asset quality of the business.

Yield on vehicle finance business is among the highest of the various segements of Indostar. It also provides high NIM. However, these favorable business characteristics of the vehicle finance business is offset to some extent by the higher credit cost in this business. Overall, this business has lucrative return on capital.

As business volume grows and operating efficiency kicks in, we expect these returns on capital can improve further.

SME Finance

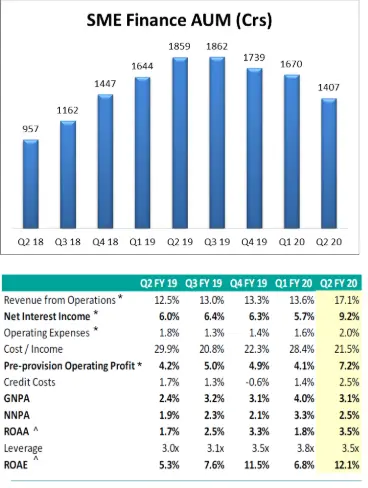

IndoStar forayed into SME Finance in FY2016 as the first step towards building its retail franchise. The SME Finance vertical operates from 10 branches with 16% of overall loan book coming from SME Finance.

The Company’s SME Finance is aimed at primarily lending to SME’s for the growth and expansion of their businesses. All SME finance is secured against the collateral of a self-occupied residential or commercial property. The key focus customer in the SME space includes traders, manufacturers, self-employed professionals and service businesses; with almost 40% of loans disbursed to customers who qualify under the PSL category.

SME finance AUM grew till Q3 FY 19. However, due to liquidity issues, company has curtailed its growth of SME portfolio. Instead, incremental credit is being given to segments which provide better return-risk profile.

Company has been very active in assignment of SME loans to raise liquidity. In Q2 FY 20 company has assigned 246 Crs of SME loans while disbursing only 66 Crs.

As liquidity has tightened, company has been able to improve the yield on the portfolio. This is also translating into better return on assets.

Asset quality has stabilized in Q2 FY 20 and is expected to improve further as company will use SARFAESI provisions to sell some of the collateral and recover the loans that are overdue.

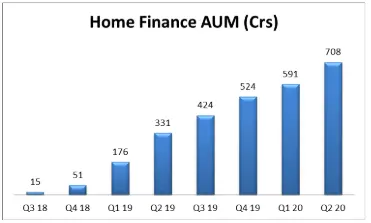

Housing Finance

The Housing Finance business at IndoStar is undertaken by its 100% subsidiary IndoStar Home Finance Private Limited. IndoStar’s focus is on providing loans to the selfemployed and salaried individuals, in smaller Tier II / Tier III cities, and the outskirts of urban markets.

The share of Housing Finance to overall AUM stood at 4.7% at the end of FY2019.

Housing finance business broke even in Q4 FY 19 and is expected to contribute positively to the bottomline going forward.

Indostar has continued to assign home loans to raise liquidity. It assigned 51 Crs of home loans in Q2 FY 20 while disbursing 92 Crs of new home loans.

Consolidated View

Having looked at the key business segments, let us now focus on the overall business of Indostar and how it has evolved over the last few years. Company has become a diversified NBFC with retail contributing to the majority of the loan book. Incremental disbursement trends reconfirm management desire to have retail contributing to 75% of the loan book by end of FY 20.

Indostar is also using retail loans for generating funds through assignment and securitization. Hence, off-book loan has grown.

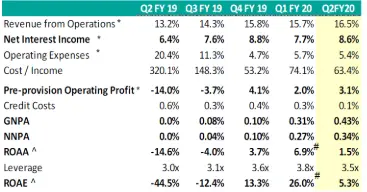

Company is using tight liquidity situation to incrementally disburse money at higher interest rates. Thus the incremental yield of the portfolio has improved. However, increase in cost of borrowings has offset the increase in yields to some extent.

Asset Quality and Return Ratios

Asset quality of Indostar has deteriorated in the recent quarters. This is driven by the higher NPA in the CV portfolio of IIFL that company acquired in Q4 FY 19. In addition, a big account with exposure of 155Cr in Corporate Loan book slipped into NPA in Q1 FY 20. On the other hand, both SME Finance and Housing Finance book quality has been stable.

Company expects improvement in asset quality as collateral underlying NPA are monetised and NPA in legacy IIFL CV portfolio reduces. In addition, company has been providing additional incremental provision to reduce NNPA as can be seen from the table on the left.

Company has maintained high capital adequacy which should allow it to grow its book without any dilution in the next few years. This coupled with incremental lending to higher yielding asset will translate into higher ROE and ROAA over the next few years.

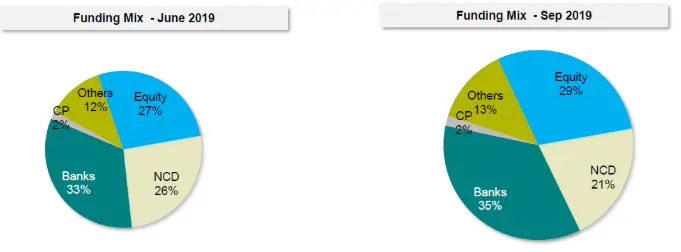

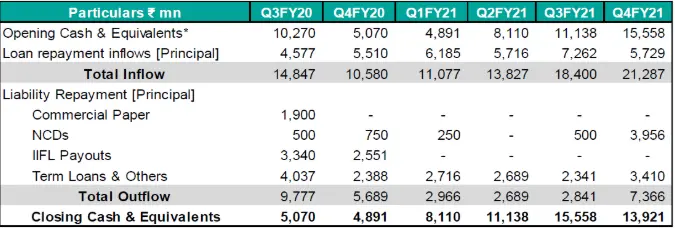

Funding and Liquidity

Company has maintained long-term sources for its funding needs. This has allowed it to better manage the liquidity crisis since Sept 2018.

Looking at the incremental funding in the last year, we can see that almost 25% has been contributed through assignment and securitization. Thus retailization strategy of Indostar is not only reducing risk in the portfolio through diversification, but also allowing company to tide over the liquidity challenges.

Indostar has also closely managed its liquidity by ensuring that company has sufficient liquidity even

under very conservative assumptions as shown in the table above. Company is also looking to take advantage of new schemes from government like Partial Guarantee Scheme where company already has sanctions in place for Rs 1,500 Crs.

Company has taken additional measures to conserve liquidity. It has entered into a partnership with ICICI Bank to originate CV portfolio on the books of ICICI bank. Indostar will keep 6% of the spread from this portfolio and will be responsible for the first 8% of the losses in the portfolio. Thus the capital consumption through this agreement will be 8% versus the usual 10% of Tier 1 and 15% of total capital that is mandated by RBI. Besides conserving cash for Indostar, it allows it to sweat the CV financing infrastructure. Hence, in terms of liquidity, capital and operational efficiency this agreement is a win for Indostar.

Valuation

We will value Indostar using our forward return analysis framework. In this method we will project earnings a few years out and then apply reasonable multiples to come up with expected forward return.

PAT projection

- The company had a PPOP (Pre-Provision Operating Profit) of 396 Cr in FY 19. Extrapolating the run rate for the first half of FY 20, we expect PPOP to be around 520Cr in FY 20.

- We expect provision cost to expand significantly in FY 20 given the higher stress we saw earlier. Provision in H1 FY 20 is already 131 Cr versus 16 Cr in all of FY 19. We expect the provision for FY 20 to be around 200 Cr as some of the stressed assets resolve and the provision cost reverses. Offsetting this reversal will be an additional provision on account of stressed corporate loans.

- Thus PBT in FY 20 is likely to be around 320 Cr versus 380 Cr in FY 20.

- Using a 25% tax rate in FY 20 pats us 240 Cr versus 241Cr in FY 19.

- As we look further out into FY 21 and FY 22, we expect PAT to grow substantially. This will be driven by:

- 15% cagr in PPOP driven by good growth opportunity in the retail book, lower funding cost, higher operating efficiency, and better opportunity for incremental lending.

- Normalization of provision cost in FY 21 and FY 22 to less than 150 Cr.

- Thus PBT in FY 22 will be around 530 Cr.

- Using a 25% tax rate, PAT in FY 22 would be around 400 Crs.

- The company won’t need to dilute equity to support 15% growth in PPOP. The company has more than sufficient capital adequacy of 25.7% in Q2 FY 20. As the book becomes increasingly granular the risk profile will also reduce and the company won’t need to maintain such high capital adequacy. Assuming a PAT of 400 Cr in FY 22 and applying a multiple of 11x, we expect the company to be worth 4,430 Cr by June 2022.

- In our mind 11x multiple is very reasonable for the following reasons:

- The company is expected to have earnings CAGR upwards of 15% during FY 20-22.

- Company normalized ROE would trend toward 15% by FY 22.

- The company is owned by private equity and management has deep expertise in the lending business.

- The company has a long runway ahead of it given the huge need for finance and the company moving into under-penetrated segments like CV (Commercial Vehicle).

Expected Return

- Accounting for the dilution of 8.5% from ESOPs that are currently outstanding, the current market cap is 1,685Cr

- Thus market cap of 1,685Cr will grow to 4,430Cr by June 2022 which gives us an expected forward return of 45% CAGR.

Risks with the thesis

Apart from competition, which is always present in any industry, some of the key risks with the

thesis include:

Lending business

Indostar is in the business of lending money. Most of the surprises in lending are negative. New regulations from the regulators, black swan event like demonetization and loan waiver by government are some of the event risk with the thesis.

These risks have been accentuated by the current liquidity crisis in the market, real-estate slowdown (73% of Indostar’s corporate loan book of 3,627Cr is real estate oriented) and slowdown in the broader economy.

Liquidity Risk

NBFCs are vulnerable to liquidity shocks as the last year has shown. Our thesis expects moderation in the tight liquidity situation over the next few quarters. However, if liquidity continues to be tight, it could significantly slow down the economy increasing credit cost of existing loans and make incremental lending even harder.

Management Risk

Management is an important piece in the thesis of investing in any company. It becomes absolutely critical in a levered institution like Indostar. Thankfully, we are in safe hands with R Sridhar as CEO of Indostar. Prior to joining Indostar, Sridhar was MD at STFC (Shriram Transport Finance Corporation) which he grew to be the largest CV finance player. He is ideally suited to lead Indostar as the company grows its CV lending business.

Management is also heavily incentivized to do well with 8.5% of the fully diluted shares available for employees. Thus we think that management will do what is in the best interest of the shareholders and the promoters.

However, this is a risk we will be watching closely.

Overall

Indostar offers a compelling case of:

- Heads we win with expected CAGR of 45% over the next 2.5 years.

- Tails we don’t lose much. Even, if some of the unexpected events were to materialize, given that loan book is highly collateralized we don’t expect significant losses.

- Our conservative assumption of 15% growth rate in PPOP along with a conservative multiple of 11x should allow us to tide over sudden adverse development in asset quality.

- At current valuation we are buying this company at a significant discount to book and adjusted book.

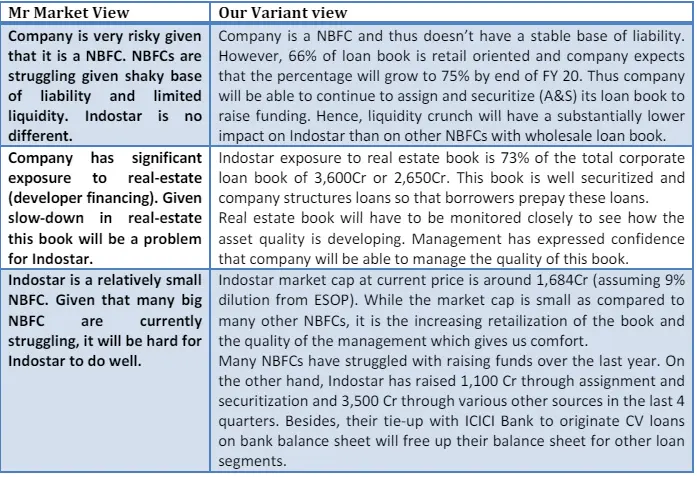

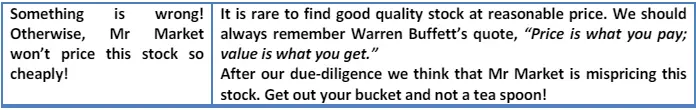

Variant View

In this section we outline some of the reasons why Mr. Market is underpricing this company. We then provide our variant view of the same. This section has been put in the thesis to follow Charlie Munger’s dictum, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

While we don’t claim that we know the other side of the argument better the next person, we sure as hell do try.

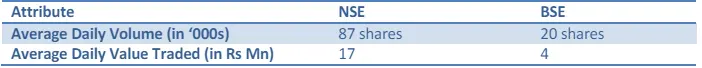

Trade Feasibility / Idea Practicality

Company’s current market capitalization is 1,545Cr or $218Million. Indostar is listed on both NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Additional details are provided in the table below:

There is liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi Advisors (DDA) and its employees/partners/clients have a position in the stock discussed.

- The stock discussed was for illustration purposes only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one percent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the research report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed a public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.

- None of the employees/partners of DDA have ever served as an officer, director or employee of the subject company.

- Neither DDA nor its employees/partners have ever been engaged in a market-making activity for the subject company.