Dear Investor / Partner

We all work towards our goal. The end of the calendar year is a good time to assess how we did against those goals. For most Indian equity investors, 2019 seemed like a year of retracement. However, 2019 provided a perfect opportunity to buy good companies at reasonable prices. Thus, if you were deploying new money, you would have done a huge favor to yourself and your portfolio, by investing more in Indian equity. 2019 was the perfect year to lay the groundwork for juicy returns in the future and we did do our share of the work.

Before progressing further, an apt quote from Charlie Ellis comes to mind, “The hardest work in investing is not intellectual, it is emotional. Being rational in an emotional environment is not easy. The hardest work is not figuring out the optimal investment policy; it’s sustaining a long-term focus at market highs or market lows and staying committed to a sound investment policy. Holding on to sound investment policy at market highs and market lows is notoriously hard and important work, particularly when Mr Market always tries to trick you into making changes.”

We are lucky to have investors who buy into the long-term mindset; have high confidence in our ability; are agnostic to short-term market moves; and understand that our interests and their interests are aligned. Thus, in 2019, which was a down year for us, we had no calls from our investors about withdrawing money. Most investors, on the contrary, added money to the portfolio that they had entrusted to us. They seized on the opportunity that Mr Market gave them.

Portfolio Performance

Before we present our performance, a few caveats (from last year) are in order:

- The performance provided below is what we have experienced in our portfolio. Partners will have different results based on when they started investing and what stocks they held in their portfolio.

- The performance below is not a good predictor of future returns. It only tells us what we have done so far.

- We don’t present any risk-adjusted returns. The reason for the same is that we don’t like the traditional definition of risk – standard deviation, beta, etc. Hence we don’t like some of the corresponding alpha measures like Sharpe Ratio, Treynor Ratio, etc.

To us, risk is the permanent loss of capital. We feel that risk can only be assessed over long periods by how the portfolio does. So, stay tuned for future results.

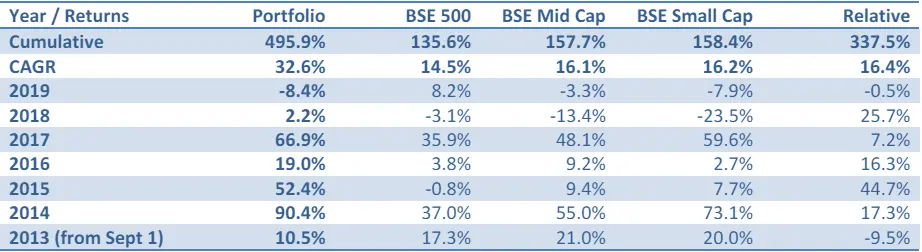

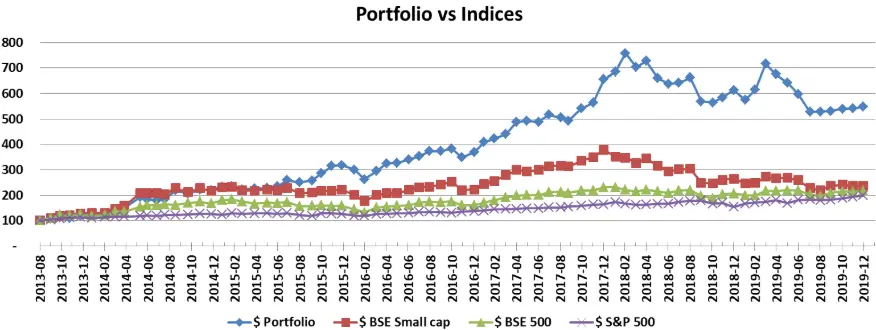

Below is the performance of our portfolio since Sept 1, 2013, when we started focusing on the Indian equity markets.

Read more

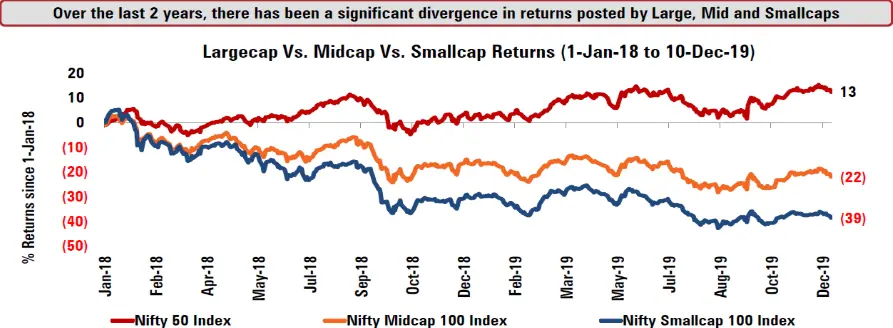

We have added some additional indexes (as compared to last year) as part of our comparison. These new indices correlate better with our portfolio (82% correlation with BSE Small Cap v/s 55% correlation with BSE 500). Even after a very polarized market of 2019 (in favor of large caps), over the last 6+ years returns from small and mid-cap stocks continue to deliver better returns than their large-cap brethren.

These new indices also show the polarization of returns in 2019. Only 8 stocks (five financials – HDFC, HDFC Bank, ICICI Bank, Bajaj Finance, and Kotak Mahindra Bank; two IT services – TCS and Infosys; and RIL) contributed to all of the Nifty-50 Index’s return in CY2019.

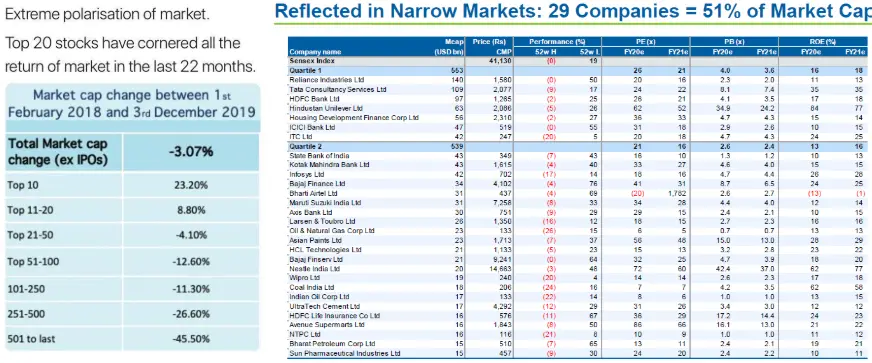

Some additional tables below demonstrate the polarization that we have been talking about. Only 29 companies now contribute to more than 50% of the total market cap of all the stocks listed in India!

We tend to look for companies that are mispriced. Mega caps on the other hand are the most researched and hence the likelihood of mispricing in these stocks is miniscule. Hence, we steer clear of most of the mega caps in our portfolio.

One obvious question is, “Why did megacaps do so well in 2019”? We think there were a few key drivers:

- Flight to safety given the slowdown and the credit crunch in the Indian economy.

- Disclosures of frauds across various companies during the year made investors nervous, thereby, causing them to rush to quality “at any price”.

- Significant inflow of FPI (Foreign Portfolio Investor) to the tune of approximately 100,000 crores in 2019 in equity. Most of this money went into the most liquid (highest traded) names which are the mega caps.

- Move towards passive investing where more money comes to indices-based products. Hence, companies in these indices got a disproportionate amount of the new investor’s money. In addition, this trend was not just limited to India but seen in many other world markets (including the US). When the trend reverses and indexes come down, passive investing will lead to sharper falls (as money comes out).

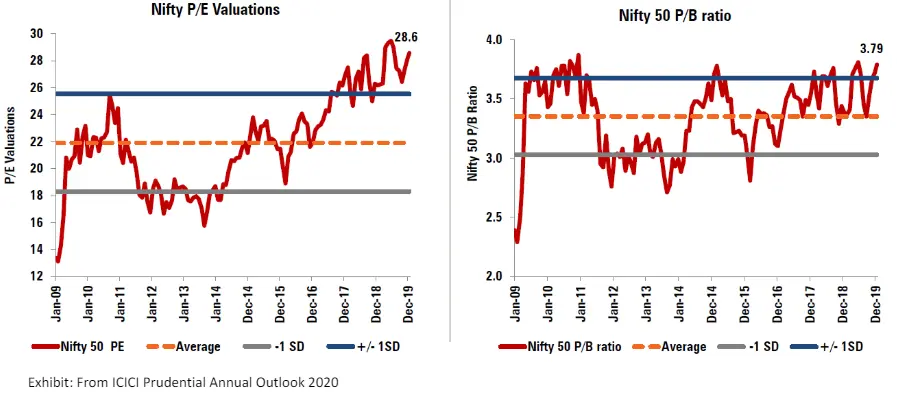

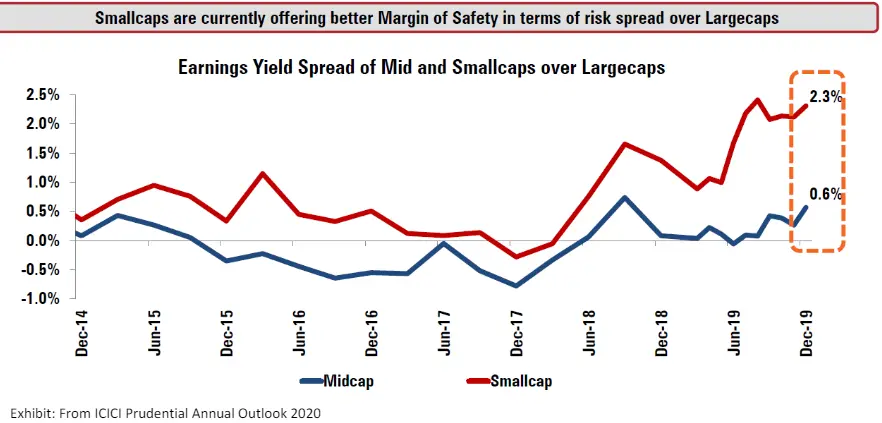

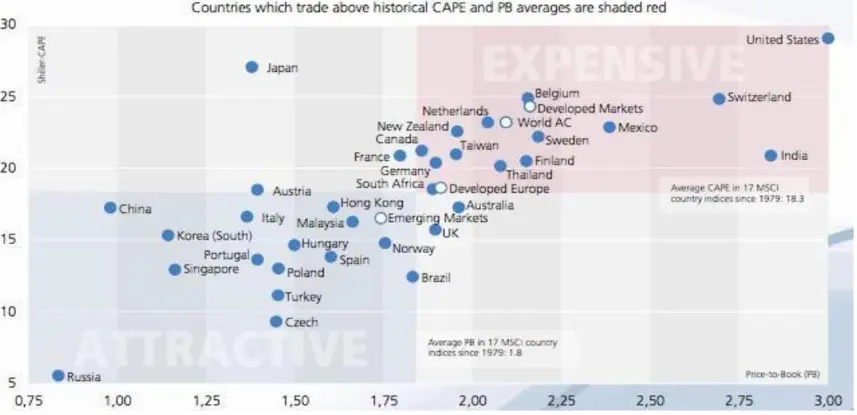

Another question an investor would have is “Given the above factors, why would the trend reverse? Why wouldn’t money keep flowing to the mega caps?” We think that the trend will reverse because mega-caps are trading at a very expensive valuation (see below). Hence, it doesn’t make sense to allocate incremental investment to these names. In contrast, small and mid-cap, are trading at much more lucrative valuations. Besides, no trend goes on forever and history is replete with those examples.

Above chart shows that Nifty 50 is trading at almost a decade high both in terms of Price/Earnings and Price/Book. While these may not be the best measures of value they are a good proxy of the valuations. In contrast small and mid-cap are trading at higher earnings yield and hence lower valuations.

Coming to our portfolio, over the last 6 years we have handily beaten the various Indian indices (in $ and Rupee) terms. The below chart shows Dollar returns (table on page 2 shows the Rupee returns) over the last 6+ years. These results are also compared to S&P 500 results given the S&P 500 significant outperformance in 2019 Over the last 6+ years returns from S&P 500 lag those of our portfolio and those of Indian indices after accounting for Rupee depreciation.

Even though we have shown our performance against the various benchmarks, we don’t worry about the benchmarks. The reason is that most benchmarks are structured by market cap rather than by measures which would be more rational. Hence, they are not a good barometer. A good barometer instead, is the alternative return that we can get if we were to use a different strategy. By that measure, our approach has continued to do well over the long term and it is the long-term that we are after!

Partner’s portfolio performance

Here we repeat what we said last year about our investor’s portfolio performance. Since our partners have different start dates, we will discuss your performance separately. Here we want to highlight some of the factors that drive the performance:

- Performance of our equity picks. This performance is best reflected in the performance of our portfolio mentioned earlier.

- Equity picks that clients decide to have in their portfolio.

- Weightage of these picks in their portfolio

- Price at which they bought/sold these securities.

- Subsequent behavior of the client in terms of buying/selling as the equity prices moved around.

- Cash component in their portfolio.

Key learnings of 2019

2019 was a wonderful year in terms of the learnings it provided. One of the reasons we write an annual letter is to list out the key learnings of the year. By writing down these learnings we have found that we retain these learnings better. We follow Charlie Munger’s dictum, “I like people admitting they were complete stupid horses’ asses. I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.” Below are some of the key lessons that we learned / re-learned in 2019.

Concentration vs Diversification

S Naren, CIO of ICICI, recently mentioned that most investors spend too much time on what to buy and not enough time on portfolio composition and selling. We agree with the sentiment. In our investment process that we outlined, we continuously assess where the next incremental rupee should go and where should it come out from.

However, we continue to evolve in our thought process on the level of concentration in our portfolio. Last year in our annual letter we said, “We now prefer to diversify across businesses where we feel that the expected return and risk of owning those businesses is similar. This reduces the risk of over-concentration without penalizing us for the lower return.” We continue to move in that direction. This year we have gone further and set limits on the maximum amount of the portfolio that will be invested in a position.

Beyond reducing the sharp moves in the portfolio, a diversified portfolio also provides us the psychological ballast. Even if only a few positions do well while most others are getting beaten, it gives us hope. Not everything is hitting new lows. More importantly, we can take money from positions with lower expected returns to deploy into our compelling ideas.

Good investments begin in discomfort

Investments that begin in discomfort tend to work out well. If a sector is doing well and everyone is bullish, the future good outcomes are already priced in. However, the negatives are not accounted for. Hence, any negative news has a disproportionate impact on the price.

On the contrary, when we look at a sector where all the recent news is negative, there are higher probabilities of finding gems. One such sector in India in 2019 was NBFC (Non-Banking Financial Corporation) where default at ILF&S in 2018 resulted in “risk-off” behavior. Many of these NBFCs were beaten out of shape and the shares traded at interesting prices. We wrote case studies on some of these and the case studies can be accessed at our website. One particular case study that worked out well for us is Manappuram Finance. We wrote this case study in September 2018 and it has more than doubled by the end of 2019.

On a related note, we found interesting opportunities in fixed-income securities. While interest rates are negative on $11 Trillion of fixed-income securities globally; and interest rates on bank deposits have fallen to below 7.5% in India; we were able to buy NCD of AA-rated corporates at 18%+ yield! Hence, looking at the entire capital structure can provide interesting opportunities.

Don’t get wedded to our ideas

Most of the Indian businesses are cyclical. Hence, their business and stock performance shows a lot of variability over time. One of the mistakes we have made is to treat some of these cyclical businesses as secular businesses. Hence, we held them assuming the business will continue to grow over time. However, with some of these businesses growth rate flagged and our expectations were not met.

On introspection, we have realized that we also need to work on our endowment bias. In the past, we were loath to sell our holdings. We kept coming up with new reasons to hold them when the past reasons were not sufficient!

Having realized our tendency to get wedded to our ideas, we have made some changes to our investment process to be more rational. Read the next section to find out more.

Keep growing our circle of competence

Warren Buffett has famously said “What an investor needs is the ability to correctly evaluate selected businesses. You don’t have to be an expert on every company or even many.” Yet Warren has continuously grown his circle of competence. He has gone from being a technophobe to investing in technology companies like IBM (which didn’t work out very well) and Apple (which has worked out very well). There are countless examples of Warren growing his circle of competence.

We also spent a lot of time looking at different businesses in 2019. While our portfolios reflect a small subset of the work we did, there are multiple advantages of looking at different things:

- Helps us understand new areas.

- Helps us compare what we are analyzing with what we have in our portfolio and why.

- Helps us assimilate new information. This information helps improve our understanding of various industries and companies. We think it helps us build a better latticework of business models and what causes businesses to succeed and fail.

- Helps find new ideas that we would not have found otherwise.

Warren always says that he doesn’t worry about the macro. The reason why he doesn’t worry about the macro is because he figures out the macro from the micro – by continuously reading about many more companies than he invests in. We intend to continue down this path.

Always change a winning game

I read first about it from Peter Cundill – a very successful investor from Canada. What this means is that when something is working out very well it is time to change that and find new opportunities. My interpretation of this dictum is that when something is doing very well, it implies it has become very popular and anything that is popular is likely to be taken to the extreme.

Applying it to our portfolio, our holdings did phenomenally well in 2014, 2015, 2016, and 2017. So we got attached to them. It took us both 2018 and 2019 to start questioning our beliefs about some of these holdings. This introspection has enabled us to reduce our attachment to some and get rid of others. We have also found many new interesting ideas in 2019. These new positions along with optimization of existing positions positions us well for the future.

Mindset during the bear market

CY 2018-2019 doesn’t look like a bear market to people who invested in large-cap indices like Nifty 50. However, for most value investors like us, who focus more on small and mid-cap, it was a bear market. It reinforced the insight of the famous saying, “Markets can remain irrational, longer than you can stay insolvent.”

As with our things, we have introspected our behavior during this period and how our emotional state fluctuated. Overall, we grade ourselves well for how we handled our mindset, our portfolio, and our investors during the bear market. This was the first bear market for us since launching our firm. Our deep work in our positions gave us the conviction to hold onto our existing positions and buy into newer positions. 2018 management buyout of our largest position (covered in 2018 letter), gave us ample cash to deploy throughout 2019 and we took advantage of the available bargains.

Our investors also showed their resilience and not only held on to their positions but added additional cash to take advantage of the opportunity. Seth Klarman has mentioned that one of the most important things a fund manager can do is to choose the right investors. 2019 demonstrated that we and our investors have chosen each other well.

Update to our Investment Process

Charlie Munger has said, “Any year that you don’t destroy one of your best-loved ideas is probably a wasted year.” By that measure, 2019 was a very fruitful year! We destroyed or fine-tuned many of our ideas. Various learnings in the year were incorporated by updating our investment process to include the following:

- Pre-Mortem: We now not only write down why we like the idea but also write down what would cause the thesis to not work out. This forces us to assess the risks inherent in the thesis which we might overlook when we are summarizing the thesis.

- Start trimming earlier: We realized that endowment bias causes us to hold on to our positions for far too long. To offset the endowment bias we now start trimming our position a little earlier (i.e. at higher expected returns). This act of trimming offsets the endowment bias and helps us be more objective.

- Concentration vs Diversification: We have started restricting our largest position to not exceed a certain percentage of the portfolio (even when the forward return of the position far exceeds anything else). This is an acceptance of the fact that “shit” happens.

- Look broadly: We now spend time reading about companies even though we currently have no interest in investing in them. By reading more broadly we improve our understanding of the various business models. This in turn makes us a better business analyst. Besides, reading about the micro (companies) helps us derive a better understanding of the macro (the broader economy).

Peering into the future

We don’t consider ourselves to be macro forecasters. However, we agree wholeheartedly with Howard Marks’s recommendation, “We never know where we are going, but we should know where we are.”

This section is our attempt at understanding where we are.

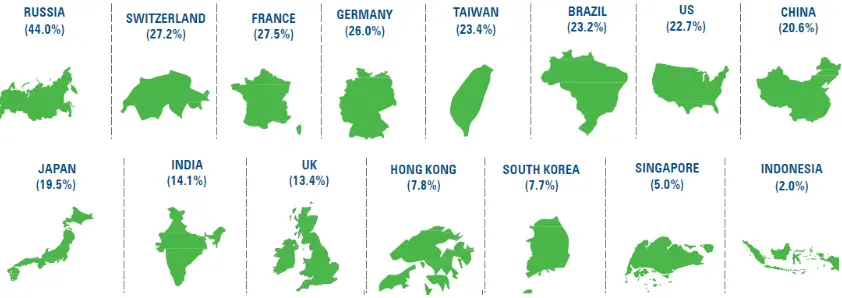

Worldwide Equity Returns

Indian equity performance was sub-par when compared to many of the world markets. This is a contrast to last year when Indian equity did much better as compared to most of the world markets (though the returns were negative).

From a valuation perspective, Indian stocks don’t look as expensive on a Shiller CAPE basis. However, on a P/B basis, Indian stocks seem overpriced. We believe that the following will help Indian equities in 2020:

- The reduction in corporate tax rate announced in 2019 will flow through to reported earnings and hence will make the PE comparison look favorable.

- Indian corporate profit margin has been at a decadal low. As capacity utilization improves some of these margins will improve as well.

Indian fund flow and trading

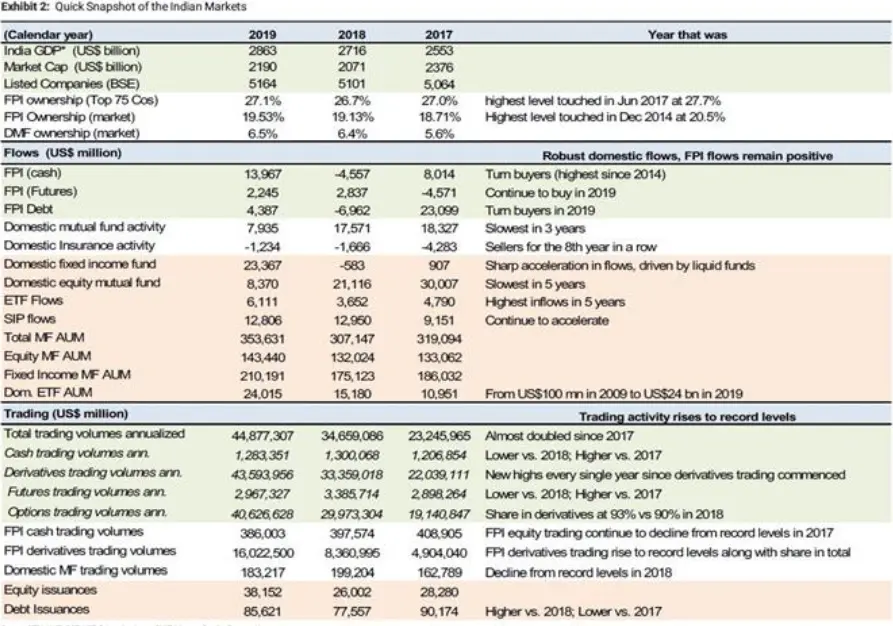

The below report provides a quick snapshot of how the funds have come into capital markets and how the ownership has changed. FPIs continue to be the second largest owner of Indian equities after promoters. Hence, the confidence (or lack of it) of FPI continues to have an outsized impact on the Indian markets.

What do we expect in 2020?

- We expect selected small and mid-cap in India to start performing. This will be driven by:

- Compelling valuations in selected small and mid-cap.

- Easing liquidity with RBI loosens monetary policy and provides excess liquidity in the system.

- The government announced substantial measures including infrastructure spending, a new fund for stressed real estate, and many others.

- Better flow of credit through guaranteeing buyout of the portfolio from NBFC, providing mudra loans, and encouraging banks to lend.

- Lowering of corporate tax which will translate into better y-o-y earnings

- We expect the Indian economy to start picking pace in 2020 vs 2019 based on the above measures. Besides, some of the previous reform measures like GST, IBC, RERA, and formalization of the economy, after being a headwind to the economy in 2019, will start being a tailwind in 2020.

- Liquidity in the system will impact the broader markets. We expect RBI to maintain an accommodative stance as RBI focuses on getting the economy back into shape. We also expect FPI to continue to favor India as much of the world is awash in liquidity with very low returns.

- The credit crunch in the Indian economy had brought economic activity into low gear in 2019. We expect the credit crunch to abate in 2020 and economic activity to once again move into higher gear. This will aid many of the NBFCs who have been struggling to raise money from the markets at reasonable rates.

- We expect higher volatility from international markets which can worsen the very favorable expectations that we have for India. These include trade wars, geopolitical tensions, upcoming elections, slowing world growth, high overall valuations, and many more. We will be watchful as these issues play out and adjust our stance as thing evolves.

How does it impact the portfolio?

Given our expectations for 2020, we are positioning the portfolios accordingly:

- We are putting more of the money to work as we expect the company’s earnings power in 2020 will improve translating into better returns.

- We are overweight financials given the value in this sector. We also expect that the government will keep pushing for more liquidity and higher economic activity. These efforts should reduce credit crunch, improve demand for credit, and hence help the financials.

- We continue to find businesses with compelling valuations, good return on capital, good management, and good runway. Hence, we have added them and will continue to add them to the portfolio.

- We are currently finding bargains we have not seen since 2013 and early 2014. Hence, we continue to be bullish going into 2020 and deploying incremental capital.

Conclusion

We are thankful for the CY 2018-2019 bear market. While it inflicted pain on the portfolio, it provided us with wonderful insights. It has helped us discover our blind spots, fine-tune our approach across multiple dimensions, and become more resilient:

- Concentration vs diversification in the portfolio

- Short-term vs long-term holding and the need for sell discipline

- Importance of management

- Appreciation for the resiliency of business models

- And above all, need to work with the right investors/partners who:

- Understand our approach

- Have a long-term orientation

- Recognize that risk and volatility are different concepts (though most of the investing world conflates them)

- Appreciate that our interests are aligned

- Have high integrity and are a pleasure to work with

Our gratitude

We talked about our investors and how they behaved in 2019. We are very thankful to our investors. It reinforces the virtuous loop – good investors lead to better staying power which leads to better returns which in turn leads to other good investors – which we are keen to create as we build out DoorDarshi.

We, at DoorDarshi, are more than happy to sacrifice short-term gains for long-term benefits. We demonstrated this in 2019. Our investors reciprocated with a higher level of trust and higher allocation. When we behave in a way that is consistent with our values, we are reinforcing those values. Our investors have our gratitude for continuing to help us live our values. We subscribe to Benjamin Franklin’s quote, “Honesty is the best policy.”

The last word

The risk that we need to guard against, as Ben Graham put it is “The investor’s chief problem—and even his worst enemy—is likely to be himself.” Through these annual letters, we intend to guard our partners from being their own worst enemies. In the process, we hope to continue our learning and become better investors. May the force be with us!

Appendix

How to know if you are making a mistake with your investments?

Alexander Green wrote an interesting article Are You an Asinine Investor? I have taken the gist of that article and mentioned it here. The purpose of providing this summary is to identify some of the pithy sayings which lead us astray. You can read the full article at the link mentioned.

Charlie Munger is famous for his oft-quoted maxim, “Invert, always invert.” This section takes a cue from this maxim and tries to understand if we are likely to end up making a mistake with our investments. As a basic starting point, make sure you cannot truthfully check any of the boxes in “The Dangerous Dozen”:

- I’m completely out of the market because I’m scared about the future (or I am all in into the market because I’m excited about the future).

- My incentives and my financial advisor’s incentives are not in alignment.

- I turned all my assets over to a commission-based stockbroker since I’m not qualified to manage my own money.

- I’m paying my mutual fund managers a ton of fees because they have promised serious outperformance.

- I’m buying stocks because the economic forecast is good. (Or I’m selling my stocks because the economic forecast is poor.)

- I’m selling stocks because the market is in a correction. (Or I’m buying stocks because the market is in an uptrend.)

- I’m loading up on one stock because I feel really good about it.

- I’m selling this stock because “you never get hurt taking a profit.”

- I’m selling this stock because it hit my broker’s price target.

- I’m holding this stock because it’s worth less than what I paid for it.

- I’m moving out of stocks and onto the sidelines until the investment outlook improves.

- I’m buying hundreds of stocks because I don’t want to be under-diversified.