There’s an adage on Wall Street: “The market takes the stairs up and the elevator down.” Q1 of 2020 has provided ample evidence of the same. Indian markets are down 25%+ in the quarter and most of the world markets have similar magnitude of drawdown. What was a problem initially localized to China has become “the problem” for the whole world. Of course, we are talking about Covid-19.

Equity markets – so far?

We all can lay the blame for the sharp fall in the equity markets at the altar of Covid-19. However, it is the intensity of the fall in the last month that has surprised most participants. The intensity of falls is no doubt driven by the geometric growth of the virus across the world and the extreme measures various countries have adopted to contain it. This has been exacerbated by the trillions of dollars that are sitting in passive funds and trillions more investing using computer algorithms.

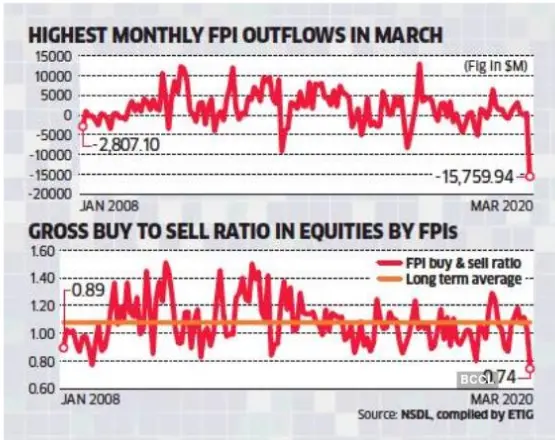

Indian equity markets have an additional factor to deal with – FPI (Foreign Portfolio Investors). FPIs have pulled out a record $15.9 Billion (1.2 lakh crore) out of Indian debt and equity markets in March. They have sold equities worth $9.5 billion (Rs 71,000 crore) in the past 22 days.

This selling by FPIs in March 2020 exceeds the selling that took place in all of 2008! Since FPIs account for a fifth of the total market capitalization of Indian equities, their actions have a dramatic impact on the equity markets. The chart below shows the extent of selling.

Markets hate uncertainty and Covid-19 has created uncertainty for companies as well as investors. In such uncertain times, many participants would first act and then think! Cash in a portfolio that was being looked upon as a mistake is now being looked upon as one of the brilliant moves in the portfolio.

Read moreHow bad will Covid-19 get?

The short answer is we don’t know and we think nobody knows. People are putting out their best guesses and through that get more clarity for themselves. Here are our thoughts.

COVID-19 differs from some of the other recent pandemics like H1N1 Swine flu and Asian flu in material ways:

- The period during which an infected person may remain asymptomatic

- Multiplier effect – number of people that one person infects

The above attributes make it more difficult to track COVID-19 and hence increase the likelihood of contagion. Countries are using some combination of social distancing (voluntary or enforced), COVID-19 testing, and the use of masks to handle the crisis. The trajectory of COVID-19 will depend significantly on how successful these countries are with the measures that they have adopted and how strictly they enforce them.

Equity markets – what can we expect?

Equity markets will remain weak till there is better visibility on the end game of COVID-19. We can say the following about the economy and equity markets (by extension) so far:

- GDP will shrink significantly in Q2 for most countries given the significant slowdown in economic activity. The subsequent quarter’s impact will depend on how COVID-19 develops.

- Shrinkage in Q2 may lead to second and third-order effects in terms of job losses, corporate bankruptcies, and weak demand which can further feed on each other.

- Central banks and governments in various countries have initiated various monetary and fiscal matters to reduce interest rates, put money in the pockets of consumers, and defer interest payments to delay the above.

- We think the above measures could be effective in the short term. However, a medium-term solution has to be a medical solution. Damage to the world economies and equity markets could be quite significant if COVID-19 continues beyond 2020.

- Measures taken by the Indian government and central banks look tame as compared to the measures taken by some other countries like the USA, Germany, and others. We believe that the Indian government will have to take additional measures to prevent the negative feedback loop that we have talked about earlier.

- Significant compression in multiples in equity markets is discounting a pessimistic scenario for COVID-19. This pessimism may be overcome if a medical solution is found for COVID-19. In the interim, the damage to the economy and equity markets could be significant.

Hence, till a medical solution for COVID-19 is found, markets may remain volatile. However, once a solution is found the bounce back could be swift. At that point the narrative will change from “how bad things can get” to “how quickly we can recover given the solution.”

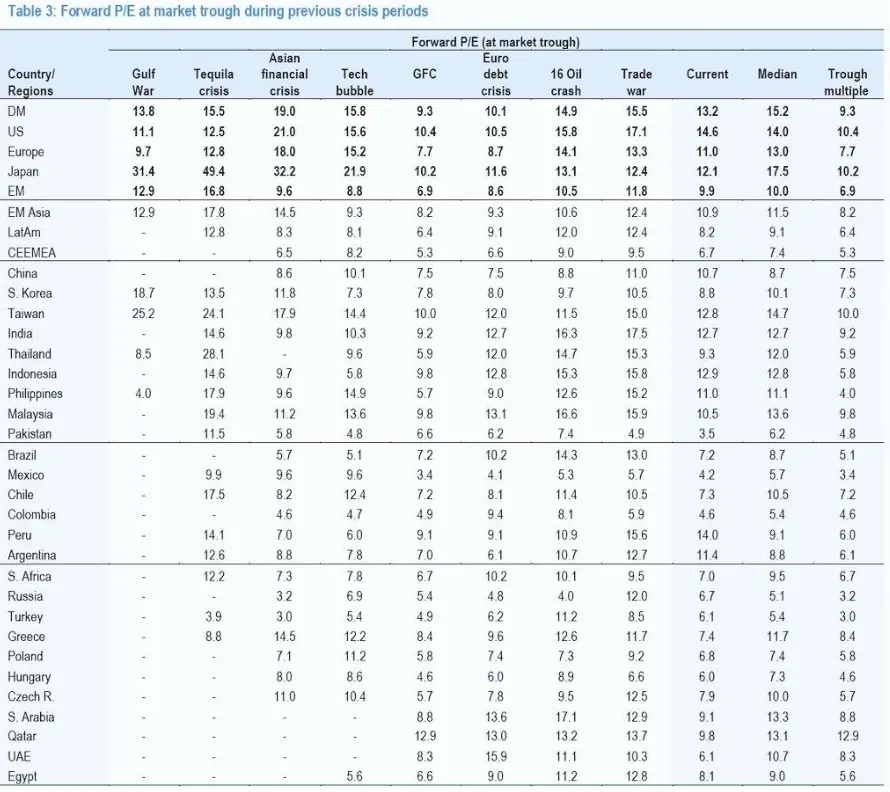

Another factor that we should keep in mind is that equity markets are trading at very reasonable levels as compared to the past crisis. Below table covers crisis over the last 30 years. Most markets are trading at around the median crisis multiple. Yet the interest rate in most economies is the lowest they have been in those 30 years. Hence, a persuasive case can be made that markets have shot themselves on the downside.

I mentioned about FPI selling in an earlier section in the context of the Indian equity market. FPI selling is a big reason for the significant drawdown in the Indian market. A quick solution to COVID-19 could reverse this selling and instead may result in a deluge of buying by FPI. Such a change would cause Indian equity markets to move upwards swiftly.

We saw a trailer of something similar in 2009 when it looked as if the FPI selling would never end. Instead, not only did the selling end but FPIs invested into Indian equity markets with gusto driving up the overall markets.

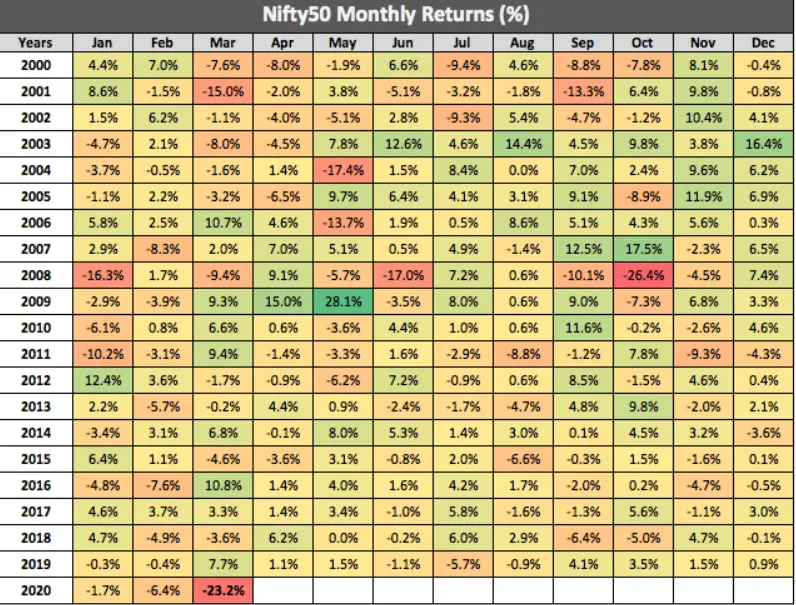

Lastly, the below table shows how Nifty has performed every month over the last 20 years. March 2020 is the second worst month since Oct 2008. As subsequent month return shows, in 2009 some months gave the best returns of these 20 years.

Credit: Stable Investor

What should an investor do?

This is a classic case in which the outcomes of COVID-19 are broad and uncertain. We recommend that an investor looks inward and ask a few questions of them:

- “When do I need the money that I have invested in equity markets?” If the answer is in the next year or two then this money shouldn’t have been invested in the equity markets in the first place. If on the other hand, the investor doesn’t need the money in the next few years, then the losses are only notional and should be treated as such.

- “How do I feel about the significant losses in my portfolio?” Most people overestimate their capability to bear risk in good times. However, they get unnerved when their portfolio has a significant drawdown. Charlie Munger has an instructional quote on this matter which I am paraphrasing, “….If you cannot bear having 50% losses in your portfolio a few times in your life, you are not fit to be an equity investor. You deserve the mediocre results that you will get investing in other options.”

- “Do I have the right advisor/investment vehicle to invest?” Most people overestimate their ability to invest on their own rather than seek out the right advisor/investment vehicle. We recommend that the right advisor/investment vehicle would have the following attributes:

- An investment approach that resonates with the investor.

- An incentive structure that is aligned with that of the investor. This would mean that fees to the “helpers” would have some relation to how the portfolio is doing.

- Time horizon that is consistent with that of the investor.

An investor should also be aware that no advisor/investment vehicle will beat other options all the time. If an advisor/investment vehicle claims such an achievement, run away from them as fast as possible. More likely than not there is a fraud lurking somewhere. Remember Bernie Sanders!

- “Do I need to make any changes now?” Most of the time best decisions are made calmly. When the portfolio has gone down a lot, emotions can interfere with rational decision-making. Time horizons shrink. There is an urge to act and save the remainder of the portfolio. Don’t! This is the time to step back, review the situation from a long-term perspective, and then decide.

The purpose of these questions is for an investor is to better understand who they are. Benjamin Graham said it best, “For indeed, the investor’s chief problem – and even his worst enemy – is likely to be himself. (The fault, dear investor, is not in our stars – and not in our stocks – but in our selves)”

Conclusion

I read a great quote recently, “All bear markets look like an opportunity in hindsight but in the moment it feels like the pain will never end.” This quote captures what many investors are going through currently. Nobody knows if we are close to the end of the bear market or close to the beginning.

Given that we cannot control the bear market or its length, it is best to focus on what we can control. We are doing the following with our portfolios:

- Checking and re-checking our portfolio holdings and how they are performing given the evolving economic situation.

- Moving the portfolio to holdings that can deliver better returns and away from holding which will provide meagre returns.

- Ongoing discussion with our peers and our clients to understand the evolving situation.

- Keeping a positive mindset and remembering that every crisis has in it the seed of a glorious future.

- Learning from our mistakes and yet not being afraid to make new ones.

I will encourage all the investors to focus on what they can control and leave the rest in god hands. I will wrap up this missive by reminding you of the following, “To finish first, you must first finish.” Stay the course, stay safe, and stay healthy.

show less