Summary

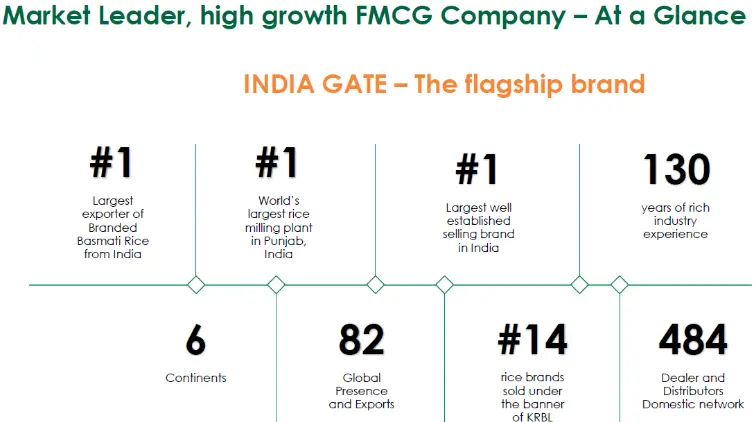

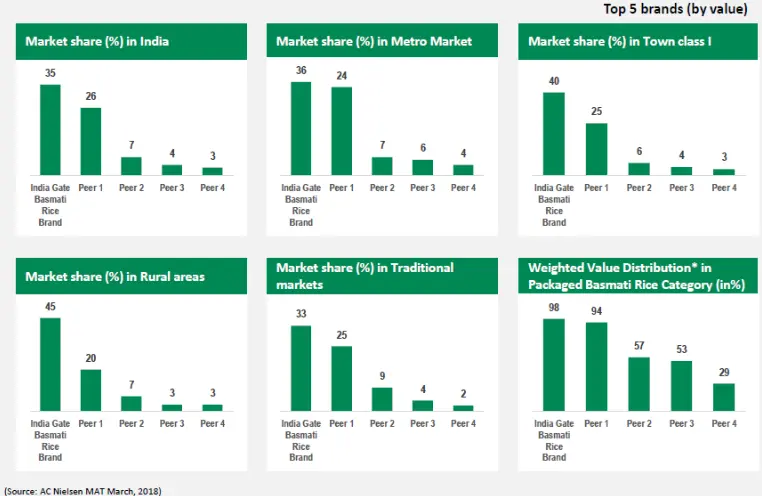

KRBL is India’s largest branded Basmati rice player. Its leading brand “India Gate” is the dominant brand in the Indian Basmati market with a 35% market share. KRBL is also the leader in many of its export markets.

At the current price of 150/sh, the company’s market value is 3,531 Crs. This translates into trailing twelve months PE of 6.4x, and EVEBIT of 5.4x. This is for a company that has delivered:

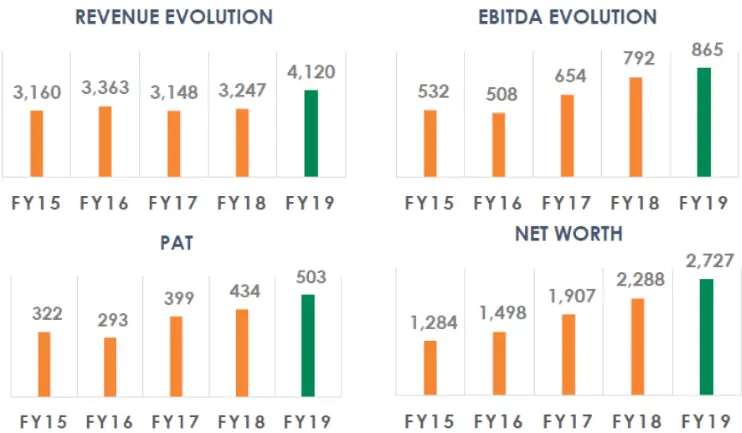

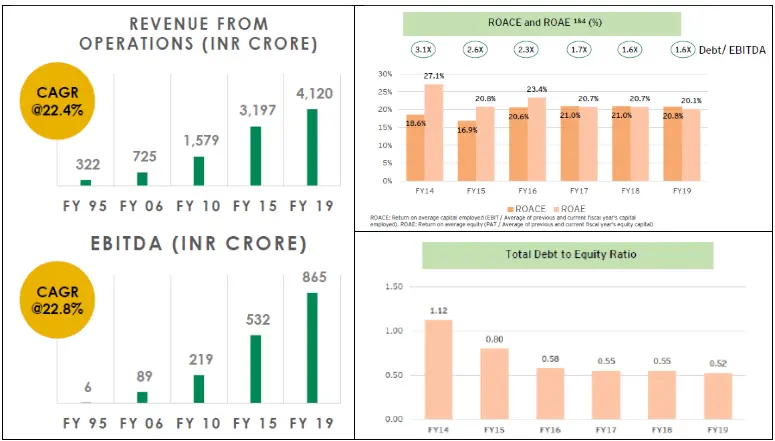

- 3 times increase in revenues in the last 10 years.

- 7 times increase in profitability in the last 10 years.

- ROE of 20%+ over the last 5 years and ROCE of 20%+ over a similar period.

- All of the above growth has been achieved without any dilution of equity.

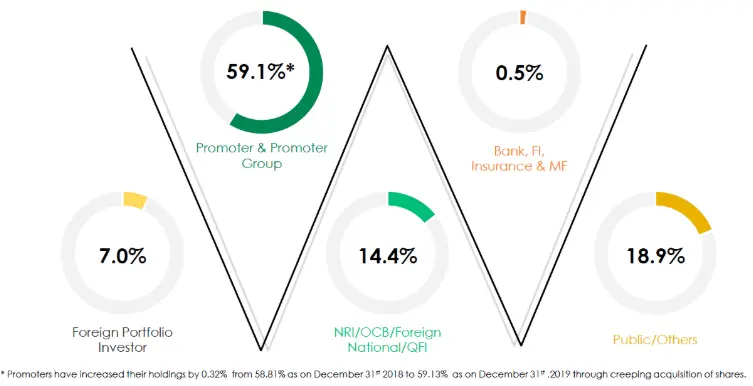

- Management is also the largest owner of the company at 59% and hence is in the same boat as that of the shareholders.

Background

KRBL was established in 1889. Since then it has been guided across three generations of the family to bring its business to its current state.

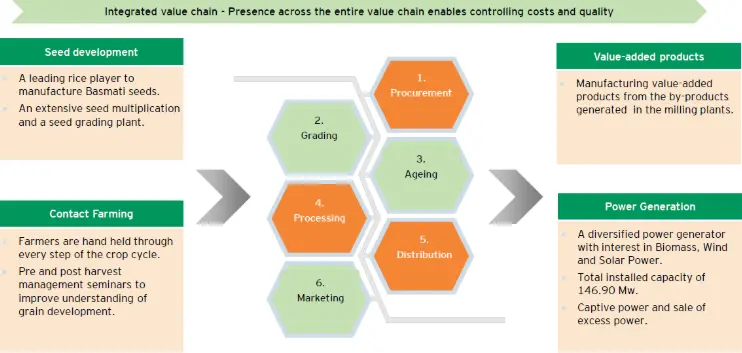

KRBL is India’s first integrated rice company. They participate in the entire value chain of Basmati rice from:

- Growing and multiplying Basmati seeds to be provided to farmers

- Guiding farmers on which seeds to grow, what pesticide to use, and conducting various seminars

- Buying the harvest from the farmers

- Grading and aging the rice based on the quality of the harvest

- Market and sell its product both domestically and internationally.

Having an integrated supply chain offers multiple advantages to the company:

Read more- Ability to influence farmers on the right varieties of basmati to plant during the season.

- Providing seed to farmers

- Builds connection and trust

- Gives an early indication of the crop size for the season. This insight is used to scale the buying of basmati during the harvesting season as well as how to price their products in the market.

- Ongoing guidance to the farmers

- Address issues like overuse of pesticides

- Helps during procurement of crop

- Use byproducts from milling to improve margin.

KRBL Businesses

KRBL derives 97% of its revenues from agricultural products. The remaining 3% of its revenue comes from supplying power from its renewable plants 146MW.

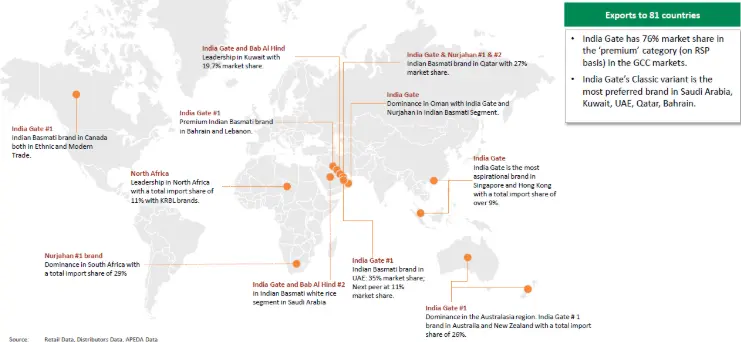

Approximately 50% of its agricultural revenue comes from selling products in the domestic market and the remaining 50% comes from exporting its products to the world. The company exports its products to 6 continents and 82 countries.

KRBL has 14 brands in its stable. Of this “India Gate” is the predominant brand of KRBL and contributes 65% of the total revenue. Other prominent brands include “Unity” and “Nur Jahan.”

Companies dominate the domestic Basmati rice segment with its largest brand “India Gate.” India Gate is not only the largest basmati-selling brand in India. It is also the largest-selling brand in many Middle Eastern countries.

The company has strong distribution strengths and works with most of the big retail chains in India and in the world.

The company is also innovating and moving up the value chain. The company is launching new products like Flax seeds, Chia seeds, Brown rice, and other “health products” to cater to the evolving tastes of the consumer.

Headwinds

Basmati rice industry has struggled in the recent past due to multiple concerns:

- Uncertainty due to Covid 19 and its impact on the supply and demand of Basmati rice.

- Sanctions on Iran and how that will impact the export of Basmati rice from India.

- Lower oil prices and their impact on demand for Basmati rice from Middle-Eastern countries.

- Impact of clampdown on exports to Europe due to high residue of pesticide.

Besides the above, KRBL also had company-specific issues. The tax department of India had served an additional tax demand of 2,200Cr on KRBL for previous years.

Mitigants

On the tax demand issue, the Indian appellate court has reversed the tax demand by the Indian tax department. This corroborates the position of management that tax demand notice doesn’t have merit and will be reversed. However, there may be further litigation on this matter.

The macroeconomic impact of Covid 19 is a big unknown. Our working hypothesis is that one way or the other a cure will be found in the year 2020 and the pandemic will recede beyond 2020.

Lower oil prices are unlikely to have much impact on the demand for Basmati rice from Middle-Eastern countries. This is because Basmati is a staple food in many of these countries and consumers will first cut on their other luxuries before changing their eating habits.

Management and Ownership

We tend to look for companies where management and owners are closely aligned (ideally they are the same people). In this case management owns 59% of the company and has similar interests as that of the shareholders.

Management has increased its ownership by 6% over the last 10 years. This has been achieved by buying shares from the equity markets rather than showering options on themselves. The company doesn’t have an ESOP plan.

Management has bought 38 Crs of shares from the open market between December 2019 and March 2020 at an average cost of 252/sh.

KRBL is guided by an experienced management team:

- Anil Kumar Mittal, Chairman & Managing Director (CMD), has been in the rice industry for the last 44 years and has guided KRBL to its current state.

- Arun Kumar Gupta, Joint MD, is an expert in the Basmati paddy supply chain and has been in the rice industry for the last 36 years.

- Anoop Kumar Gupta, Joint MD, oversees strategy and financial operations and has been in the rice industry for the last 34 years.

Anil, Arun, and Anoop are brothers and they focus on different aspects of the business.

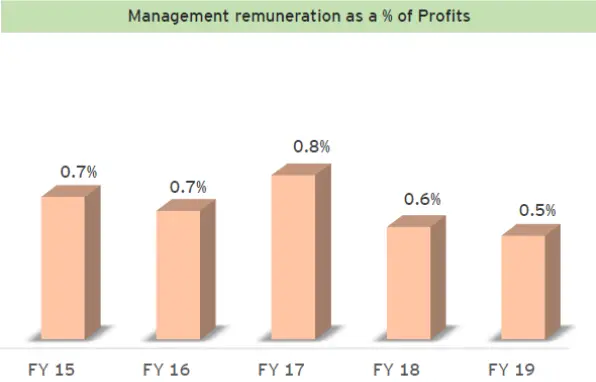

Management takes <1% of profit as their compensation. This ensures that management does well when the stock does well and hence management is in the same boat as that of the shareholders.

Valuation

KRBL currently trades at:

- 6.4x Price to Earnings

- 5.4x EV to EBIT

These multiples are for a business which is:

- Market leader in its segment (basmati rice)

- High growth rates

- 3 times increase in revenues in the last 10 years.

- 7 times increase in profitability in the last 10 years.

- High return on capital upwards of 20%

- Low leverage

We think that a company with such characteristics deserves a multiple of at least 12x. This multiple along with an expected growth rate of 10% over the next few years gets us to a market cap of 8,500Cr or 350+/share.

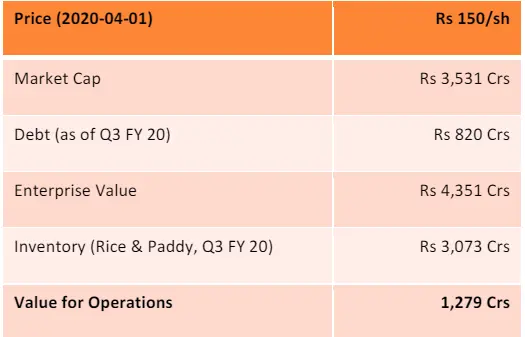

An alternative way to look at this company is from the lens of Enterprise value.

Accounting for inventory on its balance sheet, the company is only being valued at 1,279 Crs. If we assume that EBIDTA in FY 20 will be the same as in FY 19, we are currently buying this company at 1.5x EV/EBIDTA. We think such a company should trade at 5-6x of the EBIDTA. Hence, we once again easily get to 350+/share as our expected value.

Note on Inventory: Half of this inventory was bought in Q3 as the basmati harvest came to the market. When we compare the price at which inventory has been marked on its book as compared to the price at which they are selling rice, it is quite obvious to us that this inventory is understated. Hence, there is a significant profit that is available in the future as the company packs its inventory and sells it.

Expected Return

If the stock were to move from 150/sh currently to 350/sh by June 2022 it would provide us an expected return of 45%.

Risks with the thesis

Apart from competition, which is always present in any industry, some of the key risks in the thesis include:

Export to Middle-Eastern countries

50% of KRBL revenue comes from exports. 76% of its exports are to Middle Eastern countries. Most of the Middle Eastern countries are heavily dependent on oil. As the oil prices have come down these economies may face headwinds thus impacting the demand of Basmati.

Most of these Middle Eastern countries use Basmati as their staple food. Hence, we think it is unlikely that they will cut back on product that is so much a part of their habit. They are likely to cut back on other luxuries.

Income tax demand

KRBL was served an income tax demand notice of 2,200Cr by the Indian Income Tax Department in early 2019. Over the last year, the company has appealed against this demand in the appellate courts.

Appellate courts recently gave a judgment in favor of KRBL and nullified 2,000Cr of demand of the income tax department. There may be further litigation on this matter but we feel comfortable that the risks of this case going against the company are relatively low.

Covid 19

COVID-19 has impacted most economies of the world and will likely impact India and Middle Eastern countries quite negatively. India is currently under lockdown which means that the supply of basmati has been impacted.

Management of the company has indicated that the impact of lockdown is fading and the company will be able to gear up its output from next week. They also feel that the demand remains intact in the Indian market.

Overall, we think there is a risk that demand may move around from one quarter to another as people hoard some of the essentials. However, it is quite unlikely that the demand will vanish

because of Covid 19.

Overall

KRBL offers a compelling case of:

- Heads we win with an expected CAGR of 45% over the next 2.5 years.

- Tails we don’t lose much. Accounting for inventory company is only valued at 1,279Crs. This is for a company generating 850 Crs of EBIDTA in FY 19 and likely to have similar EBIDTA in FY 20.

- Management has bought 38Crs of stock from the stock market between December 2019 and March 2020 at 252/sh. Hence, we can buy this stock at a significantly lower price to the management.

Trade Feasibility / Idea Practicality

The company’s current market capitalization is 3,531Cr or $471Million. KRBL is listed on both the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). On average 579 lakhs or $770,000 worth of shares are traded daily.

Thus there is enough liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi Advisors (DDA) and its employees/partners/clients may have a position in the stock discussed.

- The stock discussed was for illustration purpose only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one percent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the research report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed a public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.

- None of the employees/partners of DDA have ever served as an officer, director, or employee of the subject company.

- Neither DDA nor its employees/partners have ever been engaged in the market-making activity for the subject company.