Executive Summary

Manappuram is India’s second-largest gold loan company. They have been lending for more than two decades and have earned the trust of their borrowers.

Gold loan business is a highly lucrative business as demonstrated by the following:

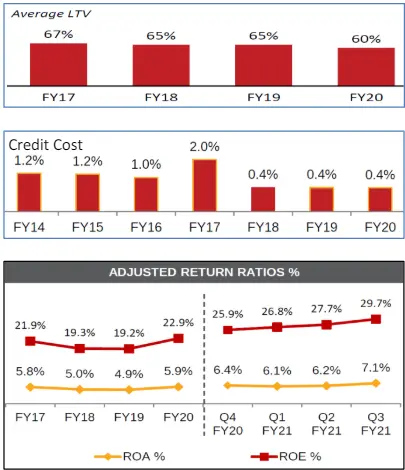

- Major gold loan companies enjoy high margins – NIM (Net Interest Margin) of 10%+

- Major gold loan companies enjoy high returns on capital as well as a high return on overall assets – they have an average ROA (Return on Assets) of 5%+ and ROE (Return on Equity) of 20%+.

Headwinds

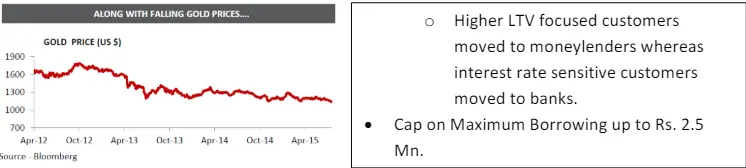

The two big Gold loan companies grew very well till FY 2012. A series of regulatory changes in CY 2012, distress in the rural economy, and a drop in gold prices impacted their growth between FY 2012 and FY 2015. Since then setbacks have been episodic, demonetization in CY 2016 and Covid-19 in CY 2020.

The road ahead

It is estimated that the organized (tax-paying) gold loan segment is only 30-40% of the total gold loan business. The remaining segment is dominated by local moneylenders and pawnbrokers who charge much higher interest rates. With digitization, better information availability, and broader coverage, we expect that organized players will continue to take away the market share from unorganized players.

New growth engines

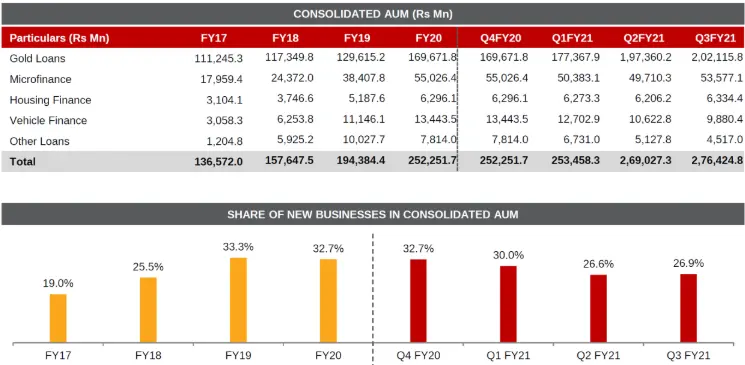

In FY 15 Manappuram started its journey of identifying additional businesses which can enable it to better leverage and expand its customer segment. The company has focused on the following additional businesses:

- Housing finance for customers in the mid-to-low-income group

- Vehicle Financing

- Microfinance using a collateral-free, joint liability model

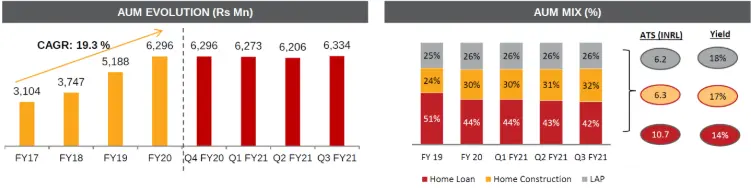

These new businesses have scaled up well and now (9M FY 21) contribute as much as 26.9% of its total AUM.

Covid-19 pandemic has made the company realize that Gold loan is one of the safest and the most lucrative business in its stable. Hence, the company has reduced the growth rate of the new businesses. However, even with the reduction in the growth rates, we expect Manappuram to be able to grow its overall AUM and profitability at a CAGR of 15% over the foreseeable future.

Management

Manappuram is headed by V P Nandakumar – MD & CEO of the company. Mr Nandakumar started the company in 1992 and the company was listed on the stock exchange in 1995. Over the last 25 years (since the company has been listed), it has delivered a CAGR of 27% to its investor v/s 11% provided by Sensex.

V P Nandakumar owns 35.00% of the company.

Valuation

Manappuram trades at 8x expected FY 21 earnings and at 2.0x book value (Q3 FY 21). This is for a business that has a good return on capital (average ROE of 20%+ and ROA of 5.0%+ over the last 4 years) and is expected to grow at a CAGR of 15% over the foreseeable future.

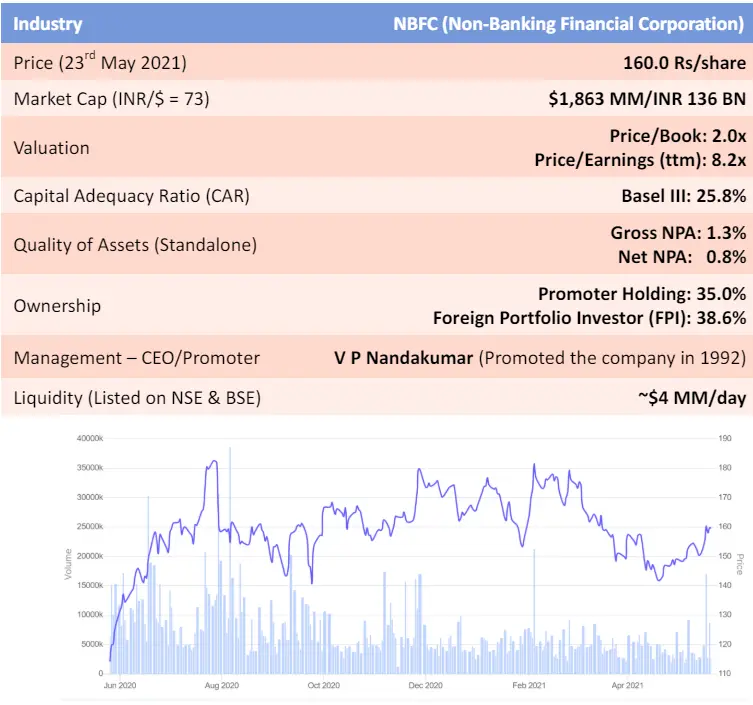

Basic Facts

Company Background

Manappuram’s origins go back to 1949 when it was founded by the late V.C. Padmanabhan, father of Mr Nandakumar. In those days its money lending activity was carried out on a modest scale at Valapad. Mr Nandakumar took over the reins of this one branch business in 1986 after his father expired.

Read moreSubsequently, V P Nandakumar promoted Manappuram in 1992. Today it is a publicly-listed entity headquartered in Thrissur, Kerala, India. It now has a Pan India presence with branches across 28 states and 4 Union Territories of India.

The best way to understand Manappuram’s evolution is to break down its recent history into multiple phases.

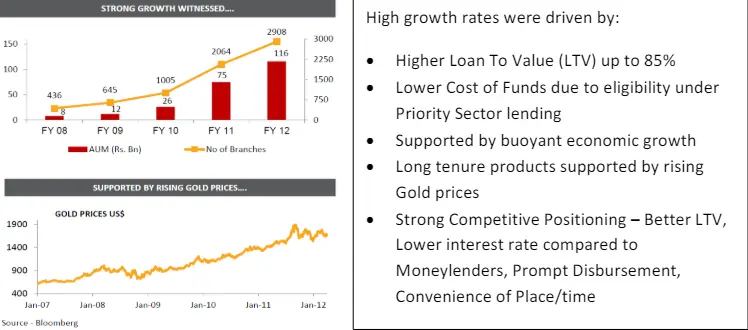

Phase 1: FY 2008 – 2012

The company’s financial and operational metrics were completely transformed with:

- AUM CAGR of ~95% over FY08 – FY12.

- Branch Network grew by 7x over FY08 – FY12.

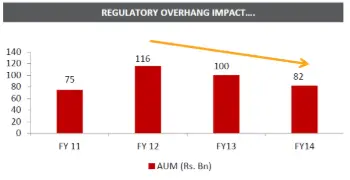

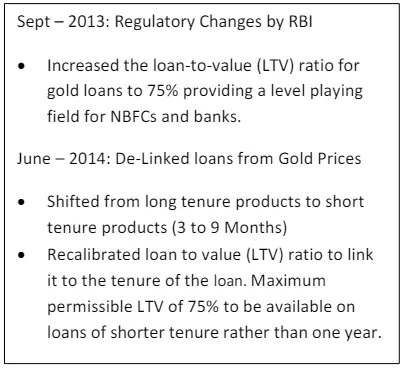

Phase 2: FY 2012 – 2015

The company’s financial and operational metrics were hurt with:

- Fall in Gold prices and peak LTV of 85% limiting the ability to lend to borrowers.

- Negative operating leverage resulted in a fall in return ratios and profitability

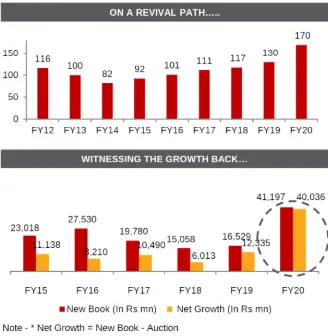

Phase 3: FY 2015 onwards

In this phase the company’s financial and operational metrics have improved with:

- The risk of loss from gold price fluctuation has come down to close to nil.

- Operational efficiency and digitization initiatives have helped with the margins.

- Higher AUM has allowed the company to share its fixed cost over a bigger pool of assets.

Business Segments

The company started entering new businesses in FY 15-16 to enhance its offering to the existing customer segment and grow into new segments. Faster growth in alternative businesses has allowed the company to reduce dependence on Gold loan business to 73.1% of the total AUM in Q3 FY 21. The company has moderated the growth of new businesses in the recent past as they tend to have higher delinquency. However, management is confident of 15%+ CAGR in total AUM over the foreseeable future.

Let us now look at each of these segments to better understand the company’s operations.

Gold Loan

Gold loan is the mainstay of the company. The company has been able to scale itself of the back of robust offering in this segment.

As one of the oldest forms of secured lending, gold pawning has been prevalent in India for centuries. Given the liquidity it offers, gold helps both the borrower and lender to complete transactions faster than any other form of financing.

Gold lending business has some unique characteristics:

- Unlike traditional lending, in the gold loan business, it is the borrower who needs to trust the lender. Thus brand (and trust) plays a big part in where the borrowers go for the loan.

- Most of the borrowers who use gold loan can’t borrow through formal channels because they don’t have a regular income, proof of income and credit history.

- It is a highly secure business. The company has estimated that in case a customer defaults, LGD (Loss Given Default) is only 0.63%.

- Gold loans have a quick turnaround time. A borrower gets a loan within 10 mins of the time they walk into one of their branches.

There are two main categories of gold loan lenders in India:

- Formal (Organized) sector (banks, NBFCs, cooperatives) – regulated by RBI.

- Informal sector (pawnbrokers, local moneylenders) – unregulated.

manappuram’s Gold Loan Business

Gold loans is at the core of Manappuram’s operations. Manappuram identified this niche and has been able to ride it to scale up its operations.

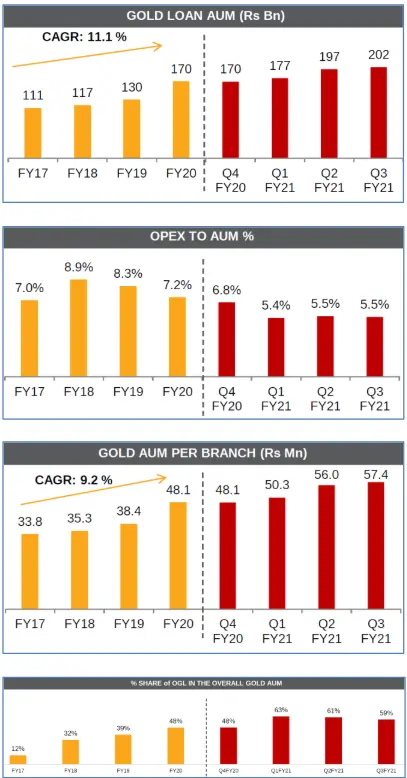

Company Gold loan AUM growth picked up over the last few years. This is driven by the increase in the gold prices (though gold loan companies don’t agree with this) and the reduction in alternative options for the borrowers (pandemic reduced earning power).

An increase in AUM has also reduced Operating expense as a % of AUM. This improvement is driven by the reduction in security cost as management introduced cellular vault. The company has also benefited from the operating leverage embedded in the business model.

AUM/branch has grown by more than 50% in the last 4 years which is one of the operating leverage we were talking about earlier. Management believes that the company should be able to continue to grow the AUM/branch in the future.

An additional area of operating leverage is the growth of OGL (Online Gold Loan). This allows customers to deposit gold with Manappuram and borrow money when they need it through the app. Thus there is no need for the customer to come to the branch making the whole process much more efficient.

The company moved to a 90-day tenure Gold loan a few years back. This coupled with conservative LTV (Loan to Value) has enabled the company to have a low credit cost as can be seen in the next chart.

Gold loans have been a great business for Manappuram with high returns on capital and translating into no need for capital raise over the last 7 years.

After the COVID-19 pandemic, RBI gave a regulatory advantage to the banks by allowing them to lend at an LTV of 90% till March 31, 2021. This disadvantage will reduce the growth rate of gold loan companies like Manappuram in the short term. However, it is unlikely to have any impact over the long term.

The company has multiple initiatives to grow the Gold loan business including:

- Providing loans directly to customer bank accounts.

- Mobile apps to enable withdrawal/payment of loans.

- Growing the OGL (Online Gold Loan) which is convenient for all involved.

- Providing gold loans at customer’s doorstep.

We expect that the company can grow the Gold loan business at around 10%+ CAGR over the next many years (though the company has promised a higher growth rate).

Microfinance (MFI) – Asirvad

The company entered the MFI business by acquiring Asirvad Microfinance in Feb 2015 with an AUM of 322 Crs. As an established gold loan NBFC, the company had long dealt with the segment just above the bottom of the pyramid, i.e. those who possess some amount of gold. With this acquisition, they entered an adjacent segment.

MFI caters to those at the bottom of the social pyramid by providing loans through the collateral-free, joint liability group (JLG) model. Thus, unlike gold loans, these are unsecured loans and hence have a significantly higher risk.

In MFI segment, the company gives a loan with a tenor of up to 24 months for the following purposes:

- Income-generating program (IGP) loan

- Product loan

- Small and Medium enterprise (SME) loan

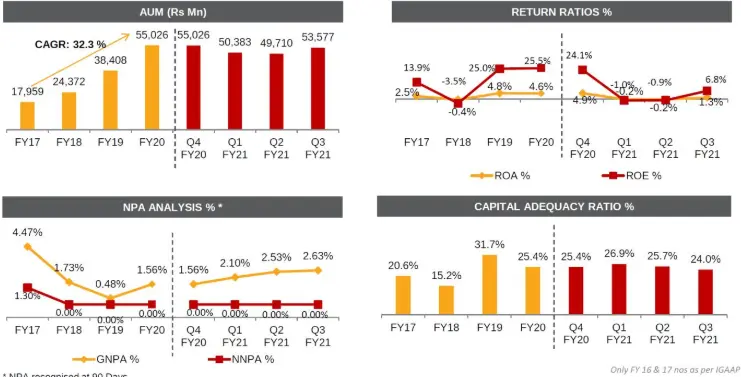

In reviewing the above charts we can conclude that:

- Asirvad has grown its AUM at a very fast pace since its acquisition by Manappuram.

- In FY 21, Asirvad kept its AUM stable and focused more on addressing the credit challenges posed by the Covid-19 pandemic.

- Asirvad return ratios go through a lot of variabilities over the years as the customer segment is impacted by the macroeconomic situation.

- The company follows a very conservative provision policy. Over the last 3 years company has fully provided for NPA (Non-Performing Assets). Hence NNPA has been consistently 0%.

- Lastly, Asirvad is well-capitalized. This high capitalization has enabled it to be rated AA-/Stable by Crisil – among the highest-rated MFI in the country.

Asirvad continues to be run by its founding Managing Director, SV Raja Vaidyanathan. As a subsidiary of Manappuram, Asirvad has benefited by accessing lower-cost funds and has been adequately capitalized.

MFI is a fast-growing industry with a long runway given the weak penetration of organized players. Asirvad is already at a critical size and it has withstood the recent headwind of the pandemic quite well. In the medium term (1-2 years), it is expected that Asirvad will get outside funding either from PE player or through an IPO. This will also provide a value unlocking for Manappuram shareholders.

Additional businesses

Besides MFI, the company initiated a few additional businesses in FY 15.

Vehicle Finance

The company had ventured into vehicle finance in the 2000s. However, given the fast growth of their gold loan finance, they decided to focus on gold financing. As Gold loan growth came down, the company once again started focusing on vehicle finance in FY 2015.

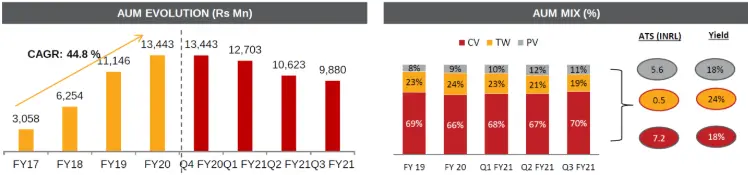

A few things stand out about the vehicle finance business:

- The company scaled up the vehicle finance business aggressively over the last few years. However, as the pandemic hit the world and the bad loans grew, the company scaled down the business.

- The company is focusing on commercial vehicles (CV), Two-wheelers (TW), and Passenger Vehicles (PV).

- Management has indicated that they will continue to be cautious till they see improvement in the delinquency metrics.

Housing Finance

The company provides home loans through its subsidiary – Manappuram Home Finance (MHF). MHF started its operation in January 2015. It focuses on affordable housing loans for mid-income to low-income groups mainly in tier-II, tier-III, and the outskirts of metropolitan cities. The company’s primary focus is on South and West India and 75% of its business is self-sourced. MHF is rated AA-/Stable by Crisil.

A few things stand out about the home finance business:

- The company has been calibrated in its growth of the housing finance business as compared to the MFI and vehicle finance business.

- The slow pace of growth (in a comparative sense) is driven by the poor loan performance in the initial loan book.

- New management was brought in a few years back and the quality of the loan book has improved materially. The new book is now 76% of the total home loan book.

Management

Management is a critical factor in the success of any investment. In an industry like finance, where leverage magnifies management actions, choosing the right management becomes critical.

V P Nandakumar (CEO & MD of Manappuram)

V P Nandakumar (VPN) is the CEO & MD of Manappuram. He promoted Manappuram in 1992. Prior to promoting Manappuram, VPN managed the money lending business that his father started in Valapad.

Manappuram was listed on the stock exchange in 1995. Since then the company has delivered a CAGR of 27% to its investors in IPO. Thus VPN has created enormous wealth for himself and his investors.

VPN currently owns 35.0% of the company. His significant ownership in Manappuram ensures that his incentives are consistent with those of others investors.

S V Raja Vaidyanathan (MD of Asirvad – MFI)

Raja Vaidyanathan (RV) is an electrical engineer from IIT Chennai and MBA from IIM Calcutta. RV has 30 years of experience in financial services. RV setup Asirvad in 2007. It was subsequently acquired by Manappuram in 2015.

RV is the driving force behind Asirvad and has already scaled it to be among the largest MFI in the country.

Overall

Management has been shareholder-friendly, pays a regular dividend, doesn’t reward themselves with options but rather buy shares from markets, and, are well-grounded. They are passionate about their business and have skin in the game.

Valuation

We will value Manappuram using our forward return analysis framework. In this method, we will project earnings a few years out and then apply reasonable multiples to come up with the expected forward return.

PAT projection

- Consolidated ttm (trailing twelve months) PAT is 1,654 Crs. PAT is subdued since the company had to take higher provisions for bad debts in its MFI book. As the pandemic stress reduces, the profitability of MFI will add to the overall profitability.

- We expect that the company should grow PAT by 15% CAGR over the next few years (management has guided for faster growth). This will be driven by:

- Stress in the MFI book has been fully provided. Besides as the collection efficiency improves we may have some reversal of provisions in the MFI book.

- Gold loan business was subdued in Q3 and expected to be subdued in Q4 because RBI allowed banks to have higher LTV during this period. However, this dispensation won’t be applicable in FY 22 and hence banks and gold loan companies will be at par from a regulatory perspective.

- Assuming PAT grows at 15% CAGR, we expect PAT in FY 23 to be 2,260Cr. Applying a multiple of 12x, we expect the company to be worth 27,180 Cr by June 2023.

- In our mind, 12x multiple is very reasonable for the following reasons:

- The company is expected to have a reasonable earnings CAGR of 15%.

- The company has a good ROE of 20%+.

- The company is owner-operated and management is passionate about the business.

- The company has a long runway ahead of it given the under-penetration of finance in India. Besides, financing businesses will keep moving from an unorganized to an organized sector.

- Lastly, the company won’t need to raise equity to support this fast growth. Hence, the entire growth in PAT will translate into EPS and hence be available for shareholders.

Expected Return

- The company’s current market cap is 13,600 Cr.

- This market cap of 13,600 Cr will grow to 27,180 Cr over the next 2 years which gives us an expected forward return of 37% CAGR.

Risks with the thesis

Apart from the competition, which is always present in any industry, some of the key risks with the thesis include:

Lending business

Manappuram is in the business of lending money. Most of the surprises in lending are negative. New regulations from the regulators, black swan event like economic lockdown and loan waiver by the government are some of the event risks with the thesis.

Manappuram’s lending business relies heavily on collateral. Other than MFI, we expect that the above events may slow down the growth or at worst impact profitability only temporarily.

Unsecured lending – MFI

MFI caters to the low-income group. Loans are given without any collateral. Thus there is a risk that these borrowers are not able to service their loans and lenders will not have any recourse to get their money back.

MFI lending practices have evolved over the last decade to significantly reduce the risk of defaults in this segment. All lending is done through JLG which means that multiple people are responsible for the loan. In addition, no borrower can take more than two loans. Lastly, credit data is now available for the borrower. Hence if a borrower defaults they are cut out from the formal lending channels (with lower interest rates) for a long time. Thus borrower has a strong incentive to service the loan.

Key-man risk

Manappuram has been promoted by VP Nandakumar. He is the face of the company and the force behind the business. While the next layer of management has its niches, there is no obvious successor if something were to happen to VP.

Manappuram has incorporated many new businesses in the last few years. This has brought in key talent into the organization. We expect that some of these new hands will mature and can help address the succession issue.

Overall

Manappuram offers a compelling case of:

- Heads we win with an expected CAGR of 37% over the next two years.

- Tails we don’t lose much. Even, if some of the unexpected events were to materialize, given that the loan book is highly collateralized we don’t expect significant losses.

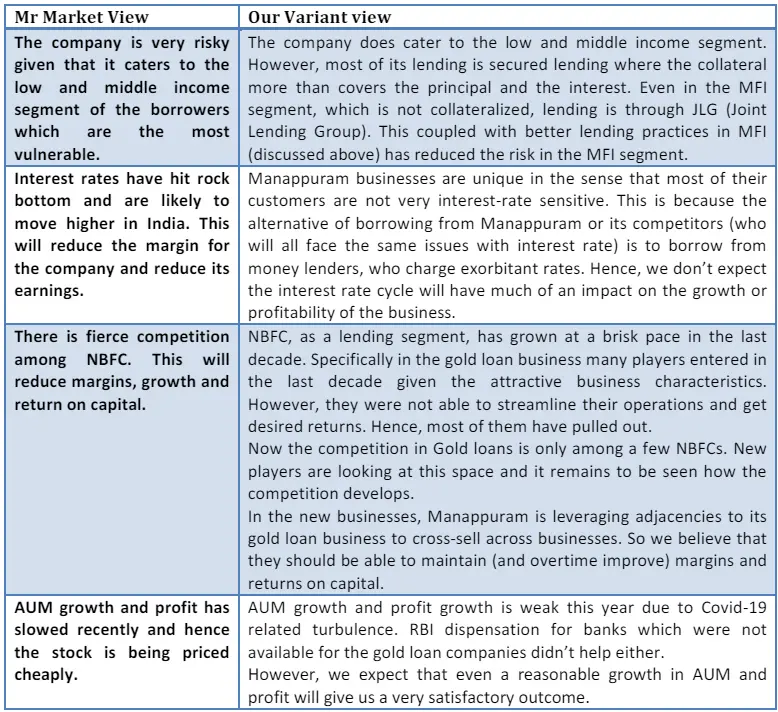

Variant View

In this section, we outline some of the reasons why Mr Market is underpricing this company. We then provide our variant view of the same. This section has been put in the thesis to follow Charlie Munger’s dictum, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

While we don’t claim that we know the other side of the argument better than the next person, we sure as hell do try

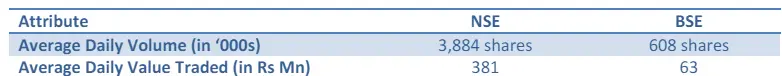

Trade Feasibility / Idea Practicality

The company’s market capitalization is 13,600Cr or $1,863Million. Manappuram is listed on both NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Additional details are provided in the table below:

Thus there is enough liquidity across NSE and BSE to take advantage of this opportunity.

Disclaimer / Disclosure

- It is safe to assume that DoorDarshi Advisors (DDA) and its employees/partners/clients have a position in the stock discussed.

- The stock discussed was for illustration purposes only and not to be construed as investment advice.

- Please do your due diligence and consult your advisor before acting on it.

- Neither DDA nor its employees/partners have had actual/beneficial ownership of one percent or more at any point so far.

- Neither DDA nor its employees/partners have any other material conflict of interest at the time of publication of the research report.

- Neither DDA nor its employees/partners have received any compensation from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have managed or co-managed a public offering of securities for the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation for products or services other than investment banking merchant banking or brokerage services from the subject company in the past twelve months.

- Neither DDA nor its employees/partners have received any compensation from the subject company or any third party in connection with the research report.

- None of the employees/partners of DDA have ever served as an officer, director, or employee of the subject company.

- Neither DDA nor its employees/partners have ever been engaged in a market-making activity for the subject company.