2021 brings for all of us a new beginning. Here is wishing all the readers a very Happy New Year. At DoorDarshi it is a special year. After multiple requests from our investor friends, we are delighted to launch our US fund in 2021 – DoorDarshi India Fund. The fund – as the name implies – will focus on investing in Indian equities. Through the new fund, we hope to demonstrate the opportunities that exist in Indian equities to a new geography of investors.

What does it take to succeed in investing?

Since many new investors will be joining us this year, it is important to summarize our approach to investing (more details will follow in subsequent sections). It is also useful to reinforce the same for our existing investors. Success in investing comes down to:

- Well-defined investment approach and investment process

- Discipline to stick to our approach, especially when it is not working

- Investing in lesser-picked opportunities

- Partnering with “right” investors

- Long-term orientation

- Continuous learning

We hope to navigate the ups and downs of the stock market together with our investors. While we cannot guarantee returns, we can always promise our investors that we will make money with them rather than from them. We judge our success not by how big the AUM is, but by:

- Absolute performance over multiple years.

- Out-performance versus other standard benchmarks over multiple years.

So let us see how we have performed.

Portfolio Performance

A few caveats (from last year) are in order, before we present the performance numbers:

- The performance provided below is what we have experienced in our portfolio. Partners will have different results based on when they started investing and what stocks they held in their portfolio.

- The performance below is not a good predictor of future returns. It only tells us what we have done so far.

- We don’t present any risk-adjusted returns. The reason for the same is that we don’t like the traditional definition of risk – standard deviation, beta, etc. Hence we don’t like some of the corresponding alpha measures like Sharpe Ratio, Treynor Ratio, etc.

To us, risk is the permanent loss of capital. We feel that risk can only be assessed over long periods by how the portfolio does. So, stay tuned for future results.

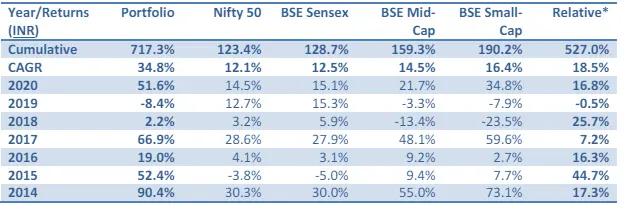

Read morePerformance in INR (₹)

2020 was a phenomenal year for us with total returns of more than 50%! We handily beat all the standard indices that most investors use for comparison including Nifty and Sensex by more than 35%.

While Q1 of 2020 gave us jitters and left the portfolio in shambles, the subsequent recovery has been breath-taking. It has been the wildest ride of our career and is reflected in the wide moves in the portfolio value during the year.

*Relative is the difference between the Portfolio return and the BSE Small-Cap index return. We use the BSE Small-Cap index for comparison as its correlation with the portfolio is highest at 88% over the last 7 years.

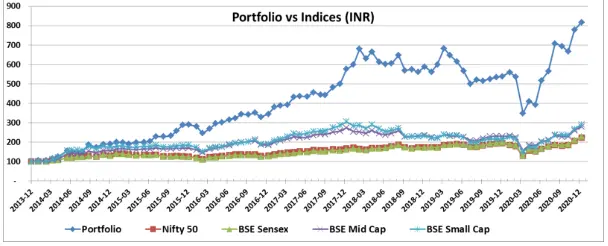

The last 7-year journey, and the corresponding outcome, is easier to understand through the below graph. The portfolio has delivered 8x in the last 7 years while indices have delivered 2-3x.

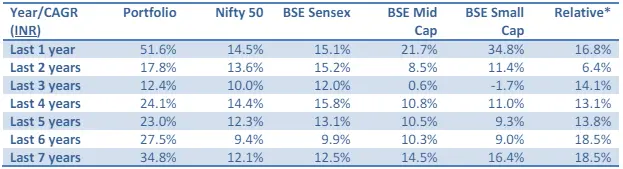

We are also adding another table that provides the return looking back from the end of 2020.

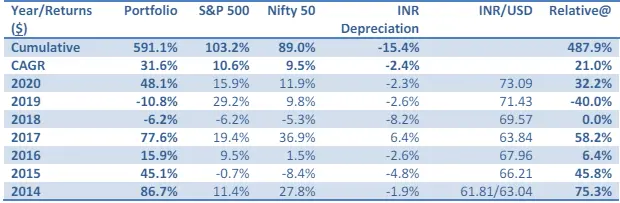

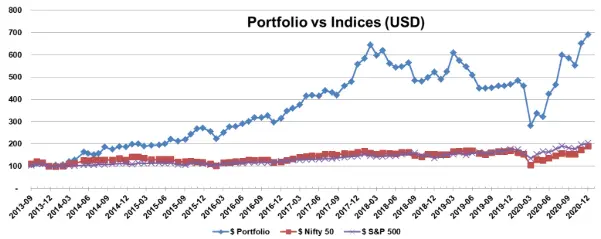

Performance in USD ($)

Since many new investors will be joining our US fund offering this year, we also present our returns in USD. These returns account for USD-INR fluctuations which impact the $ returns.

In $ terms we delivered 48% in 2020 in our portfolio, outperforming the S&P 500 by a handy 32%. Over the last 7 years, we have outperformed S&P by 21% annually!

@ Relative is the difference between the Portfolio return and the S&P 500 index return.

In $ terms, the portfolio has delivered 7x in 7 years while S&P has done 2x!

What drove the performance?

A 50%+ return in any year is a fantastic achievement. Achieving it in 2020, when markets gyrated wildly, was even better. Another interesting data point is that from the end of March, when the portfolio hit the bottom to the end of December, the portfolio is up a massive 134%.

2020 was also the year when we achieved the highest absolute return of our career – higher than the absolute returns in 2017 and 2014. Though the percentage returns were higher in 2014 and 2017, the amount invested was smaller in those years, and hence the absolute returns were lower.

As phenomenal as 2020 was, we are even more thrilled with the 34% CAGR that we have achieved over the last 7 years. In the investment management business, there are too many shooting stars – investment managers who perform well for a year or two and then go for good. Longevity is an understated virtue. We hope to have longevity in this profession through our behavior, our process, our investors, and our long-term orientation. Hopefully, you get a flavor of some of these in this letter.

In investing, as in life, compounding is a big force multiplier. Compounding at 34% over 7 years has multiplied the portfolio 8x (in INR terms). We are still very early in our career. There are still a lot more mountains to climb and pitfalls to guard against. We want to reinforce what has worked for us and what we need to improve. Let us start with what has worked so far.

Investment approach and investment process

The most important determinant of success in investing is whether one has an investment approach and whether that approach is executed through a well-defined investment process. It is very easy to be swayed by the “next shiny” thing. Temptations are everywhere. Hence, we will do well to remember Adam Smith’s quote, “If you don’t know who you are, the stock market is an expensive place to find out.”

We are lucky to have been indoctrinated in the school of Value Investing. At the core of Value Investing is the concept of Margin of Safety – buying a $ for 50 cents. As Warren Buffett has said, “It is extraordinary to me that the idea of buying dollar bills for 40 cents takes immediately with people or it doesn’t take at all. It’s like an inoculation. If it doesn’t grab a person right away, I find you can talk to him for years and show him records, and it doesn’t make any difference.”

However, having an investment approach is not enough. One then needs to bring discipline and focus to execute this approach. This is where our investment process plays a crucial role. By continuously subjecting existing positions and potential ideas to a high level of diligence, we keep a list of ideas that are force-ranked by return expectations. Investments are then made in the most compelling opportunities and money is withdrawn from the least compelling opportunities.

COVID-19-induced recession is the deepest since World War II and over twice the intensity of the Global Financial Crisis (GFC). Given the significant volatility in markets, many more opportunities were available to us to take advantage of. Throughout 2020 we continued to use our investment process to identify compelling opportunities and allocate money to them. In June we also presented our process to IIT Bombay alumni on how we are investing during Covid-19 times.

Discipline to stick to our approach

Nothing in investing works forever. Investing in large-cap equity in India did well in 2018 and 2019. However, it has underperformed in 2020. The performance of emerging markets like India waxes and wanes. Technology is all the rage today but it was decimated in 2001 and 2002.

Since no approach works forever, many participants are always on the lookout to move to the next approach that will catch the fancy of the market! Alas. It is not that easy. By moving from one approach to the next, participants don’t develop conviction in any approach. Hence, when a big shock like Covid-19 comes, they find themselves paralyzed. More often than not, they harm themselves by doing the opposite of what would have been in their best interest.

Many “investment managers” told us that they are going to 50% cash in March 2020. March 2020 was the time to deploy cash rather than hoard cash! Yet the short-term pain of further losses prevented many from taking advantage of compelling opportunities.

We, on the other hand, could assess the opportunities in our “circle of competence” and invest in the best ones. It was very hard psychologically to invest on day one and be down 5% the next day. However, our investment process enabled us to execute on these opportunities.

An example of an opportunity that we took advantage of during March 2020 was KRBL. KRBL is India’s largest Basmati rice player. In March 2020, the market value of the company only accounted for the inventory on its books. The rest of the business including the infrastructure, the brand value, the dominant presence in many global markets, and the strong management team were all valued as nothing. We presented a case study on KRBL at the Asian Investing Summit in April 2020. KRBL was also presented on Sumzero and can also be accessed on our website. From the time of the case study, it is up around 100%.

Investing in lesser-picked opportunities

By definition, value won’t be available in stocks which are the “talk of the town.” If something is well understood and discussed broadly then it is also likely to be priced appropriately. However, humans being social creatures love to be where the herd is.

The reverse is true as well. Stocks that have not done anything or worse, for years, are likely to be discarded by the market. If we can find such opportunities and can gradually build our conviction, they can provide compelling opportunities.

We found one such opportunity with IDFC. IDFC is a special situation where a trigger is expected within the next year. Market participants had suffered in the past because earlier expectations were too rosy. We presented our case study on IDFC to the Sumzero community in June 2020. The thesis is also available on our website. Since our presentation, the stock is up more than 100%.

Unfortunately, not all our theses work out so well and so fast. Luckily, we only need a few to do well in equity markets.

Partnering with the “right” investors

We hold our investors in very high regard. They are very accomplished people in their domain, understand our investment approach, trust us completely with their investments, and, are a pillar of support.

Warren Buffett and Charlie Munger have talked about creating a “Seamless web of deserved trust.” In this web, participants trust each other and hence the cost of doing the business comes down. We continue to build on this “web of deserved trust” with our investors by behaving in a manner that is better than expected.

This “web of deserved trust” was tested quite thoroughly during the March 2020 drawdown. Many of our investors had significant drawdowns in their portfolios. They were shaken by the brutality of drawdowns as were we. However, all but one investor gave us feedback along the following lines, “We understand the portfolio is down. But so is the market. We have complete confidence in your capability. Let us talk in 6 months to a year and see how we are doing.”

Our investors are glad that they kept their faith and investments with us. Not only have they recouped the drawdown, but they have also done much better than the benchmarks. The 2020 pandemic experience has once again reinforced our belief that having “right” investors is one of the key ingredients for success in investing.

Long-term orientation

Investing is a competitive endeavor. A lot of resources are thrown at the problem since the rewards are also significant. The three main sources of advantage in investing are informational, analytical, and behavioral. We believe that the first two sources continue to be mined thoroughly and the opportunities, if any, are fleeting. However, it is the last source – behavioral, where we continue to see opportunities emerge from time to time.

All of the advantages that we have talked about so far are behavioral. We also expect that behavioral advantages will continue to have a long shelf-life. This is because as humans we are emotional and we don’t always act in our best interest. Hence, understanding what leads us astray and designing the investment process to minimize those mistakes will continue to be beneficial.

Keeping a long-term horizon as we look for investment ideas gives us another big advantage. Most of the market participants are trying to decipher what will happen next quarter or the quarter after next. Since almost everybody else is also trying to do the same, participant effort tends to nullify each other.

We, on the other hand, tend to look at opportunities from a few years perspective. By taking a view that is a few years into the future, we can ignore the short-term considerations that occupy most of the participants. As an example, during Covid-19 times most participants were worried about the performance in Financial Year 2021. We were instead thinking of what could happen in FY 2022 and 2023. Hence, we could cut through some of the Covid-19 noise while others were engrossed in it.

Continuous learning

We find that the most successful investors are also very humble. We also have a hypothesis for this observation. The reason successful investors are humble is that markets have taught them how much they don’t know! Having realized their mistakes and paid the tuition fee (in terms of losses for the errors), these successful investors become eager observers of their mistakes and are keen to fix them. This leads them to be humble and willing to listen and learn.

We want to learn from these successful and humble investors and from the market opportunities and continue to improve. Given the importance of learning, we devote the next section to the key learnings in our investment journey.

Key Learnings

Warren Buffett’s animated series “The Secret Millionaires Club” has a catchy tagline, “The more we learn, the more we earn.” We are on a journey to learn and earn!

Another important consideration is that the biggest returns from compounding are all back-ended. Warren Buffett made his first Billion at the age of 56. All the remaining billions he has made, and many more that he has given away, have been accumulated from that first billion at the age of 56. Similarly, what we will do in our future years will have an even bigger impact on what we will achieve.

Hence, we should continue to learn and improve. How do we learn continuously? It pays to listen to Charlie Munger, “I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.” The lessons below are our efforts at rubbing our noses in our mistakes. Hopefully, we will remember them better.

The best time to buy a stock is when there is blood on the street, even if the blood is your own

March of 2020 left most investors bloodied and bruised. There was no place to hide. We were no different. We would wake up, see our holding go down another x% for the day, and go back to bed. The next day was no different. Do look at the chart again (earlier in the letter) to see how swift and deep the fall was!

My wife rightly diagnosed that I wasn’t sleeping well. I knew I was not. However, I told her I was sleeping soundly so as not to spread the panic that I was feeling inside. Everything that we owned was in free fall.

Many investment managers that I spoke to during March told us how they have moved 50% of their portfolio to cash or are in the process of raising cash to a very high proportion. Most investment managers also talked about another down leg in the coming months.

Such market moves, and response from investment managers, left me numb. Yet when we looked at our portfolio holdings, we were seeing something totally different. Expected returns in many of our holdings looked unbelievably good even under pessimistic scenarios.

Our investment approach gave us the courage to be active buyers with the cash that we had. I am glad we did. It helped us do much better than the benchmarks.

Of the various stocks that we bought during the March period, we put out a thesis for a few in the public domain. The thesis on KRBL was presented at the MOI Global Asian Investing Conference as well as submitted on Sumzero in late March and early April. We were already invested in KRBL when March came. However, when the stock tanked we loaded up on it. It has worked out very well so far.

A good business and good management, at a bad price, is not a good stock

The ten-year bull market in technology stocks has fuelled the narrative that investing is all about finding good businesses and good management. Price doesn’t matter.

Trees don’t grow to the sky no matter the soil and the care with which they are looked after. Similarly, a company won’t keep growing, forever, at very high rates and prices do matter.

Resistance can come from unknown quarters including government policies, the company’s bureaucracy, industry development, the business environment, or even a virus!

We had such an experience with a company called Piramal Enterprises in 2018. We liked the management of Ajay Piramal – a good capital allocator. We liked that they are going into business areas where there is a lot of white space and hence a long runway. However, as the business performed, the price ran far ahead of the fundamentals.

We knew that the price didn’t justify the fundamentals. However, we were intoxicated by what could happen a decade out rather than what could happen in the next few years. Mr Market gave us a whacking and a lesson that we will try to remember for the future.

The misplaced craze for compounders

Another narrative which has developed with the bull market is that one needs to find Compounders and hold them for multiple decades. This narrative talks about how FANGAM (Facebook, Amazon, Netflix, Google, Apple, Microsoft) has rewarded its shareholders. However, what the narrative misses is how many such “perceived” compounders have failed in the past as well. Think of Nokia, Yahoo, General Electric, Myspace and many more.

Unfortunately, compounders are only known in hindsight. However, one is managing the portfolio for the future. Thus, buying and selling of a stock should be done based on our assessment of the business prospects and the valuation. It should be done irrespective of tax consequences and frictional costs associated with the activity.

Ian Cassell wrote an interesting article recently where he talked about how portfolio turnover is the price of progress. He mentioned, “Peter Lynch had a 300% turnover per year in the early years of the Magellan Fund. Joel Greenblatt had similar turnover at Gotham Capital. Even Warren Buffett’s public company portfolio ranged between 50-100% turnover per year during his first three decades.”

We had carried low turnover as a “badge of honour” in the past. However, over time we have realized that low turnover is not the goal, good returns are!

Portfolio allocation is key

Unless one actively guards, a lot of trifles get collected in the portfolio which doesn’t add much to the portfolio but take away a lot of time. It is important to get rid of them as soon as one realises that there are trifles in the portfolio.

We realized that while our portfolio grew multi-fold over the last seven years, we had not proportionately increased our buying/selling of the position to account for the increased size of the portfolio. Hence, we were ending up with sub-optimal allocation to positions.

We instituted a simple rule to correct for the above: There will be no position in the portfolio unless it is >1% of the portfolio. The only exception is if the position is being actively sold, being actively bought or if we want to “watch” it closely.

To some 1% may seem too small a position. However, the conviction in a new position comes over time. So we will take baby steps in a new position and gradually build our conviction over time.

Diversification versus Concentration

One of the key questions in investments is the level of concentration in one’s portfolio. When we started we preferred a concentrated approach with having most of our allocation in the top ten positions. While there is no right answer our thoughts continue to evolve here.

We now prefer to have a diversified portfolio for the same expected return-risk profile of securities. This viewpoint reflects our experience that occasionally stocks move wildly without a corresponding change in the business outlook. Having a diversified portfolio allows us to take advantage of these moves.

However, we will not diversify our portfolio for its own sake. New positions have to provide a compelling return-risk profile to get into the portfolio. We need to be comfortable with our

understanding of its business and management. Lastly, we metaphorically ask these positions to justify “why they should be in our portfolio?”

Mistakes are a sign of progress if you are learning from them

While in 2018 we did beat the indices (but not our internal benchmark), in 2019 we underperformed the indices. We are glad that in 2020 we are now out of the woods and beating the industry benchmarks and, more importantly, our internal benchmark.

2018 and 2019 gave us a lot of opportunities to think about and learn from. While many lessons outlined here remind us of the corresponding pain that it caused, we are glad that we went through it. We are even happier that we talk about them with our investors and through that improve ourselves and (possibly) our investors.

If we take the right lessons from life and invest then the inferior part of life is the “earlier part”. Ray Dalio puts it succinctly, “Pain + Reflection = Progress.” Charlie Munger has elaborated further, “Any year that passes in which you don’t destroy one of your best-loved ideas is a wasted year.” By Charlie’s measure, we have been on a fruitful journey!

Dare to be different, and right

Too many investors and too many institutions run towards the positions that have done well recently and, out of positions that have gone down. There is no denying that momentum in stocks is alive and well. Understanding who is buying and selling stock and why can provide important insights.

However, insight on incremental supply and demand of a stock is only a start. It is even more important to have an understanding of the business, the management incentives and, the competitive landscape.

IDFC’s stock price had gone only one way since 2010 – down! Nobody wanted to talk about it. It was a pariah. Most investors were selling it as soon as they were getting even! Due to the fall, the stock had turned compelling which drew our attention to it.

On our investigation, we found that Management was hugely incentivized and management talk and action had been consistent. There was a regulatory trigger point as well. In June 2020, we put out a thesis of why we like IDFC on Sumzero. We also gave a few talks – talk1 and talk2 – in which we discussed IDFC and other ideas in brief.

So far IDFC has worked out well. It is up more than 100% since we put out the thesis 7 months back. Being willing to be different and right can be very rewarding! However, being different also entails the risk of being wrong. We have the scars to show for our audacity. In the words of Lou Brock, one of baseball’s best players of the late 1960s, “Show me a guy who’s afraid to look bad, and I’ll show you a guy you can beat every time.” We don’t want to be that guy!

Observations on the Indian equity market

2020 will be remembered for many things. Below we capture some of the interesting data points that we observed in the Indian equity market.

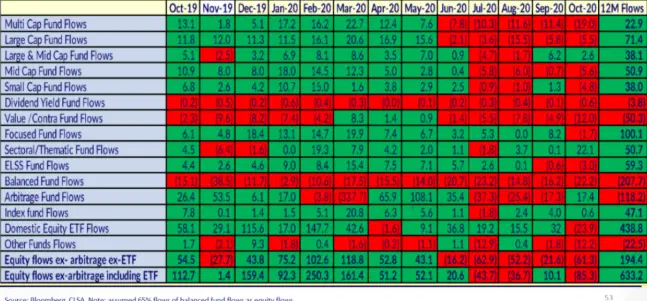

Show me the money

Domestic mutual funds have been pulling money out of equities over the last many months. This is

no doubt driven by individual investors who have had a poor experience with these mutual funds. Yet Nifty 50 has been making all-time highs. Why this disconnect? Many mutual funds are index huggers. They want to have their holdings very similar to the index. Through this behavior, they hope to never get fired. However, because of this behavior, they are likely to underperform (as the costs will eat away some of the returns) and will eventually be fired.

FPI Flows

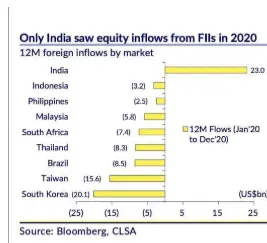

While domestic mutual funds have been pulling money out, FPI rediscovered their love for India in 2020. After tepid flows in the previous 5 years, they returned to the Indian equities in full force in November and December. November inflows have been the highest for a month in a long time.

India received the highest FPI flows among various emerging markets in 2020. Most other emerging markets were on the receiving end and had significant outflows.

There is a high correlation between FPI flows and the performance of equity indices as can be seen from the below chart.

FPI flows have driven returns not just for Nifty 50 but also for Nifty mid-cap and small-cap. This is unlike the rally we saw in 2018 and 2019 which was very narrow and only focused on top 10-15 stocks.

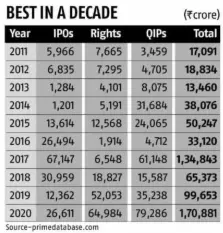

High primary activity

2020 was also the year when companies raised the highest amount of money from the primary markets. A significant amount of money was raised through the Rights issue and QIP. By raising capital, Indian companies have been able to fortify their balance sheet and are better prepared for the headwind from Covid-19.

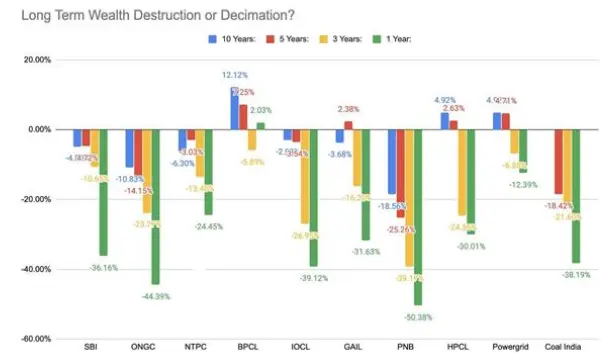

PSU Wealth Destruction

Indian PSUs have been a money-losing proposition for investors. Many of them have given negative nominal returns for over 10 years. One can only imagine the destruction if one accounts for opportunity cost or the cost after inflation. The reasons are not that difficult to see:

- Management incentives are not aligned with those of the shareholders

- Business decisions are taken for non-business considerations

- No/Limited consequences for poor performance

- The culture that propagates bureaucracy rather than competitiveness

Recent government drive to privatise some of the PSU may provide the desired incentive for management to improve the performance.

“Smart money” is not so smart after all…

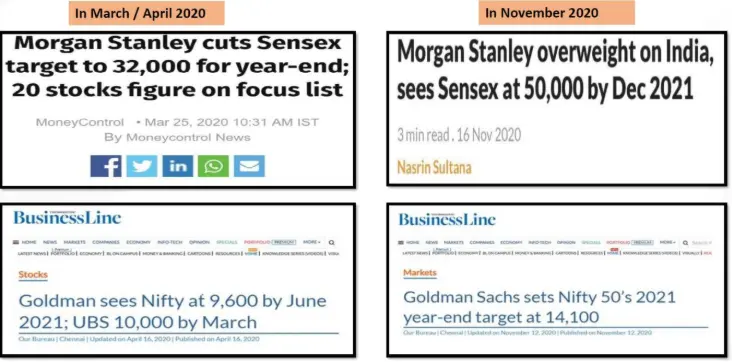

Below images capture just how wrong the forecast for Sensex was in March by two of the prominent investment banks in the world. If they are so wrong, what hope do others have?

We don’t mean to pick on Goldman Sachs (in full disclosure, I worked at Goldman for 5 years and cherished my experience at Goldman) and Morgan Stanley. The above illustrates our message beautifully that smart money is not so smart because of the “institutional imperative.”

Sometimes our investors wonder how are we able to compete with much bigger investment operations and deliver much better performance than them. The answer is simple! We are smaller! We are not beholden to an institutional imperative. We invest in areas where we see opportunities irrespective of what others think. We don’t worry about measures like Beta, Volatility and so on. These measures are not useful in judging how an investment operation is doing.

In short, we compete by finding our niches and focusing on them. We, for example, sidestep the game of forecasting indices that the big institutions play. We think it is impossible to forecast with any certainty. Hence, it is better to not play a game where the odds of success are very low. (I will leave you with a quiz: Why do big institutions play the game of forecasting indexes when the probability of being right is so low? Write to me if you think you know the answer!)

Unfortunately, not playing the market forecasting game makes for a poor party conversation. Most participants are eager to know where the market is going. When we tell them we have no idea, they move on to the more “interesting” folks who are “better” informed.

Passive investing

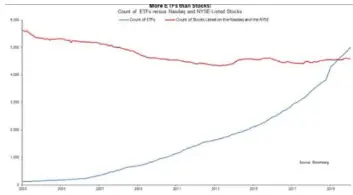

Passive investing has been winning incremental flows in US equity markets. More ETFs are now listed on Nasdaq and NYSE than individual stocks.

Business Standard carried an article recently on passive investing in India. It mentioned that Largecap ETFs have performed better than large-cap mutual funds in India over the last 10 years. However, small and mid-cap mutual funds have beaten their corresponding ETFs. Hence, the article surmised, alpha continues to be available in smaller and mid-cap companies.

We agree with the article’s observation and conclusion. It is unlikely that active investors will have a meaningful insight which is already not reflected in the market price of Sensex or Nifty 50 stocks.

Peering into the future

This section provides our thoughts on the broader Indian equity in the future. Readers are forewarned that we have limited confidence in our forecasting ability. Hence, we are unlikely to

execute on our investing approach based on our prognostication. We will rather, continue to find stocks one at a time and include them in the portfolio. We will counsel the same to the readers of this letter.

With the caveat out of the way, let us elaborate on our current thoughts. We are very bullish about Indian equities for the next many years. A lot of groundwork has been laid which will drive the trajectory of the Indian economy and the Indian equities over many years if not decades. Let us count the reasons:

RBI (Indian Central Bank) has moved to a decidedly dovish stance

RBI had been one of the most hawkish central banks in the world. This stance has deprived the Indian economy of the much-needed capital for growth. Couple that with poor infrastructure – both hard and soft – it is no surprise that the risk-taking and job creation has suffered in India.

However, we believe that the mind-set at the central bank has changed for good. Both the central government and the central bank are now focused on improving the growth rate of the economy. RBI has created significant excess liquidity in 2020 which will allow businesses to handle the stress from the Covid-19 crisis.

Too much of a good thing can also be bad. Hence, we will be on watch if the pendulum swings too much in the other direction.

A slew of reforms by the Indian government

Winston Churchill stated, “Never let a good crisis go to waste.” The Indian government has taken the recent Covid-19 crisis to initiate many reforms. While these reforms have not gotten the attention that they deserve in the media (except one and that too for the wrong reason), we think they will be having a far-reaching impact on the Indian economy. Let us highlight some of the big ones:

- PLI (Performance Linked Incentive) reform: PLI is a ₹2 Trillion scheme by the Indian government to boost the competitiveness of domestic manufacturing in 13 sectors. A financial incentive of 4-6% on incremental sales over the next 5 years will be provided to companies, which have incurred incremental investment. Through this initiative, the government aims to make India a critical part of the global supply chain in emerging technologies. Early wins have been seen in the mobile industry where Apple and its partners

have set up factories in India. Similar incentives are being planned in other sectors. - Agriculture reform: 40% of the Indian population depends on agriculture and yet the value addition in agriculture has been limited. By encouraging corporates to come into agriculture there is a hope that value addition and hence value creation will go up. There are still many teething issues that need to be resolved. How the government handles them will determine the success of agriculture reforms.

- Labour reform: There are multiple reforms initiated by the government in this area. 29 labour laws have been amalgamated into 4 labour codes – Wages, Social Security, Industrial Relations and Occupation Safety. Government has now allowed companies with up to 300 workers to lay off workers without requiring government permissions. This is an increase from 100 workers and had been a major demand from the industry. There are also tighter restrictions on when trade unions can be recognised.

- Land reform: Government is creating land banks and speeding up the process to assign land for industrial projects. Acquiring land in India has been a perennial problem. These reforms

coupled with moving land purchase online will improve transparency in the system.

More than the above reforms, it is the intent that the government has shown over the last few quarters which gives us hope. We believe that a seminal event happened in 2020 which caused the Indian government to focus on the economy. If we are right, we expect that the pace of reforms should continue, if not accelerate. The upcoming national budget will be the next opportunity for us to assess government eagerness with reforms and how well it executes on it.

Land of Entrepreneurs

India is a land of entrepreneurs. While some of them are forced to become an entrepreneur because jobs are not readily available, others are driven by their passion. This passion is reflected in the fact that many of the Indian listed companies are owner-operated. The largest company in India by market cap – Reliance Industries – is also owner-operated. This leads to a natural alignment of incentive between the management and the shareholder and the typical principal-agent problem is mitigated.

Recent Covid-19 pandemic has tested the resiliency of all businesses. The businesses that survive this test are likely to be efficient, hungrier and battle-ready. They will also have a better runway for growth as many of the competitors would disappear.

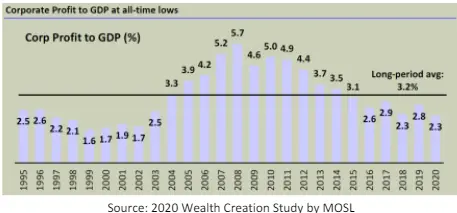

Combine the above with the fact that corporate profit to GDP in India is touching all-time lows in two decades and we have a potent brew for equity out-performance.

Compelling global destination for investments

India is increasingly seen as a must-invest market for global investment houses. India’s domestic market, demographics, democracy and rule of law are all well known. The emerging paradigm of “China + 1”, new trade and geo-political alignment among nations and the positive role India has played in Covid-19 through its pharmacy diplomacy are all factors that are burnishing the case for India. Lastly, significant global liquidity is struggling to find avenues to invest in. India, a capital deficit nation, not only has many avenues for investments but also provides compelling returns on these investments.

We believe that inflows in the last quarter of 2020 could be a prelude of what is to come over the next many years. If India executes well on some its initiatives, there is every reason to believe that capital flows into India could rival that of China and even surpass those.

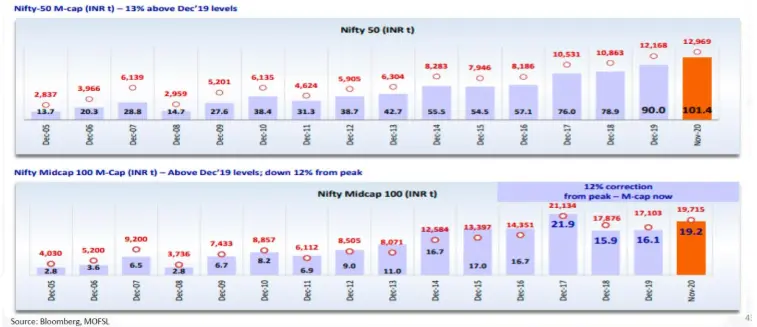

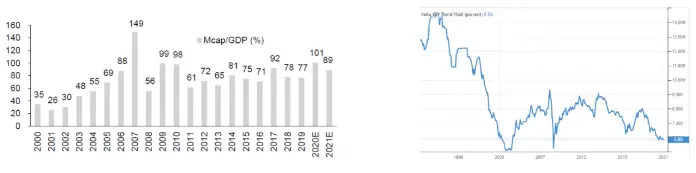

Indian equity markets are not too expensive

While Indian equity markets have had a stellar ride in the last 9 months, they are still reasonably priced as shown by the Market Cap/GDP figure below. When we account for the historically lowinterest rates of Indian 10-year bond, the case becomes even stronger. Lastly, do go back and look at how the Indian equity markets performed in the 2 periods when the interest rates were as low as they are today. Your sense of optimism towards Indian equity markets may also go up.

Conclusion

2020 was a phenomenal year for us in terms of returns of 50%+. Even more important though are the lessons that it taught us, in terms of managing our psychology and our money through a crisis. Covid-19 crisis engulfed economies and the capital markets with a rapidity that was not seen before. Having lived through it, we are better prepared for the next one.

Our gratitude

The Covid-19 crisis once again reinforced to us the importance of partnering with the “right” investors. We are very thankful to our investors for their trust, their guidance and above all their encouragement during difficult times. It reinforces the virtuous loop – good investors lead to betterstaying power which leads to better returns which in turn leads to other good investors which we are keen to create as we build out DoorDarshi.

As we embark on a new journey by launching our fund in the US – DoorDarshi India Fund – we look forward to welcoming many more “right” investors. We continue to learn a lot from our investors and we hope to work together for many decades to come.

The last word

The risk that we need to guard against, as Ben Graham put it is “The investor’s chief problem—and even his worst enemy—is likely to be himself.” Through these annual letters, we intend to guard our partners against being their own worst enemy. In the process, we hope to continue our learning and become better investors. May the force be with us!

show less